Ethereum continues to attract investor interest, outperforming Bitcoin in key metrics as the second-largest cryptocurrency by market capitalization continues to compete with the world’s largest cryptocurrencies in the CME derivatives market.

According to recent data shared by CME Group, Ethereum futures significantly outperformed Bitcoin futures in derivatives trading activity.

Ethereum futures set new record for open interest

Since April 2025, Ether futures on a major derivatives exchange have outperformed Bitcoin futures in terms of monthly average daily volume (ADV), according to data provided by sources.

Ethereum has been in the spotlight this year as institutional investors turned from Bitcoin to Ethereum Treasury ownership, and its outstanding performance on the CME derivatives exchange is further evidence of increasing institutional demand for exposure to Ethereum.

Amid growing interest from financial institutions, CME further revealed that the open interest in ETH futures has reached a huge number of contracts, reaching a huge number of contracts of 53,183 contracts, and that of MicroEther futures has increased to a record high of 335,016 contracts as of October 28, both of which are new record highs.

According to the monthly average daily volume (ADV) of Bitcoin and Ether futures disclosed by the exchange, ETH trading volume exceeded BTC trading volume for the first time in April 2025, and has continued to lead the crypto king ever since. Notably, this move shows that the market focus is shifting away from Bitcoin and towards Ethereum.

While Bitcoin futures trading has leveled off after a strong first half, Ethereum momentum remains resilient, driven by growing optimism for DeFi growth, staking yields, and further institutionalization of major altcoins.

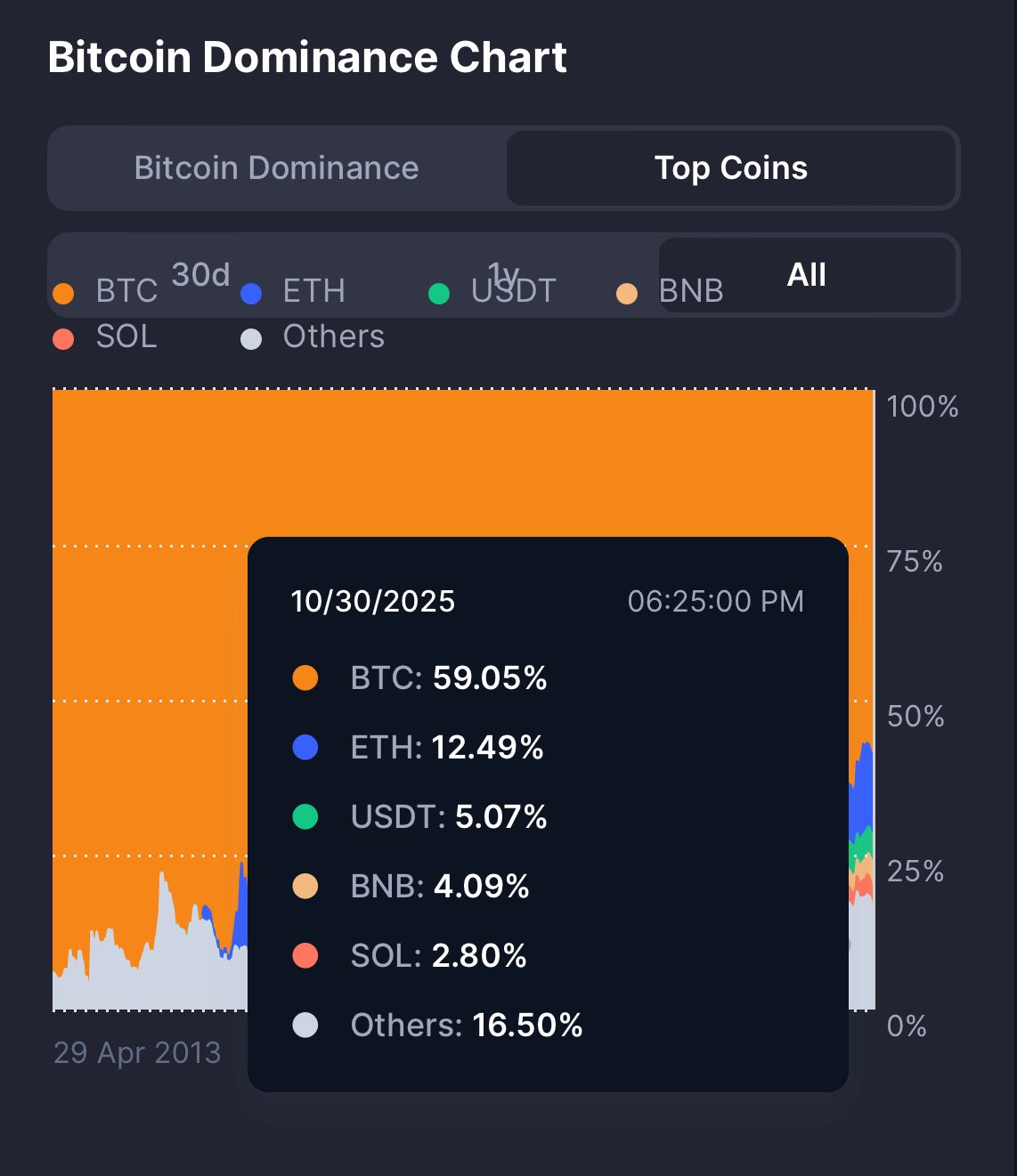

Bitcoin maintains its dominance

Despite the impressive performance seen in Ethereum futures trading, Bitcoin still maintains its dominance across the broader spot trading market.

Data provided by CoinMarketCap shows that Bitcoin still holds the highest market share in the broader cryptocurrency market. As such, Bitcoin’s market capitalization is currently 59.2% higher than the market capitalization of all cryptocurrencies combined.

This shows that despite repeated price corrections, Bitcoin’s dominance has shown a modest increase of 0.87% in the past 24 hours.