More than 30 National Basketball Association (NBA) officials have been arrested, leaving the sports industry in shock.

The investigation, which FBI Director Kash Patel described as “mind-boggling,” spans 11 states and involves millions of dollars allegedly obtained through illegal gambling and gaming fraud during the 2023-2024 season.

Prosecutors say the scheme involved inside information and organized crime activity and tarnished the league’s reputation in a number of ways.

Given the scope of the problem, the question for investors involved in the sports industry is simple. Which stocks to watch after the NBA gambling scandal?

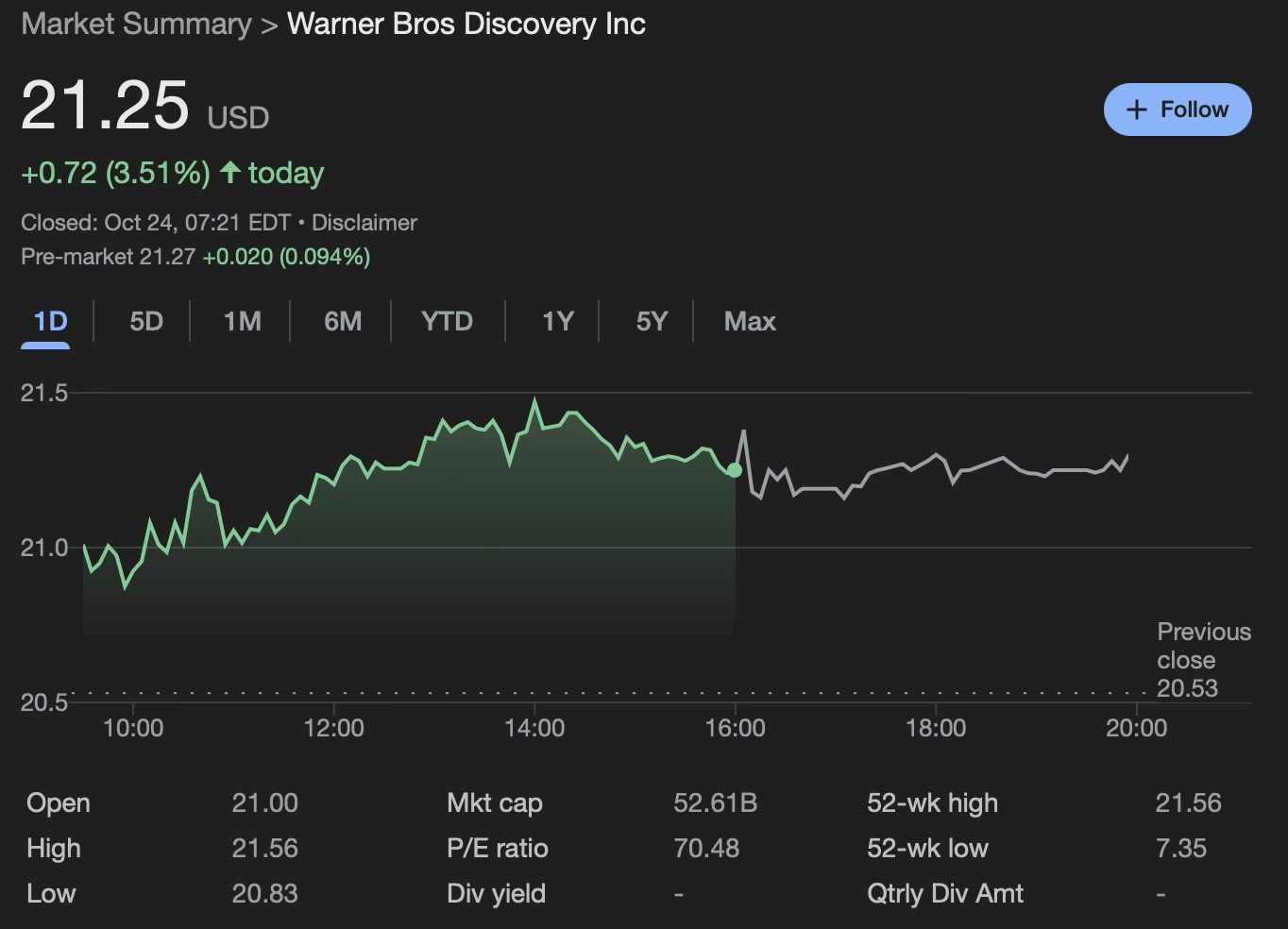

Warner Brothers (WBD)

Warner Bros. (NASDAQ: WBD), one of the NBA’s major broadcast partners, appears unfazed by the federal investigation. On the contrary, this year has been all about profits, with the stock nearly doubling since January and trading at $21.25 at the time of writing, up another 3.5% on the daily chart.

However, the company’s future trajectory is currently in the balance, with multiple candidates reportedly considering acquiring part or all of the company. For example, Warner Bros. has already rejected three bids for Paramount Skydance, the last of which was for just under $24 per share.

management said CNBC The company announced on Tuesday, October 21, that it will continue to review all future bids while moving forward with its current plan to split into two separate entities: the streaming and studio business platform and the global network business.

CEO David Zaslav said the approach would allow the media giant to “identify the best path forward” and “maximize the value of our assets.” So whatever the future holds, WBD is definitely worth keeping an eye on.

Madison Square Garden Sports (MSGS)

Madison Square Garden Sports (NYSE: MSGS) is a leading sports holding company that manages the New York Knicks. Although not as strong as Warner Bros., MSGS has also been trending higher, with shares up nearly 18% in the past six months and trading at $226.16 at press time, up 0.29% on the day and 0.24% pre-market.

MSGS is a particularly interesting case as it approaches its third quarter earnings report, scheduled for November 7th. While the Knicks do not appear to be directly involved in the betting controversy, a perceived decline in confidence in the league as a whole could theoretically put pressure on the stock price, and any new potentially damaging findings by law enforcement authorities could theoretically put pressure on the stock price.

However, it is also worth noting that the team’s performance this season has not had much of an impact on the manager’s stock. So even though the Knicks made it to the Eastern Conference Finals for the first time in 25 years, and the 2026 title is on the line, Madison Square Garden Sports stock has only risen 3.4% over the past year.

Additionally, operating margins remain low. Despite the playoff revenue, the company reported a total loss of $22.6 million at the end of its last fiscal year. Additionally, the combined value of both teams is approximately $13.5 billion, while MSGS’ enterprise value is only $6.6 billion.

In short, MSGS offers exposure to the NBA at a deep discount, and if the gap between public and private valuations somehow narrows, the stock could rise, especially if the dream of a new title comes true, but there are so many factors at play at the moment that it’s difficult to predict how the situation will play out. Nevertheless, this stock is worth watching in the coming weeks.

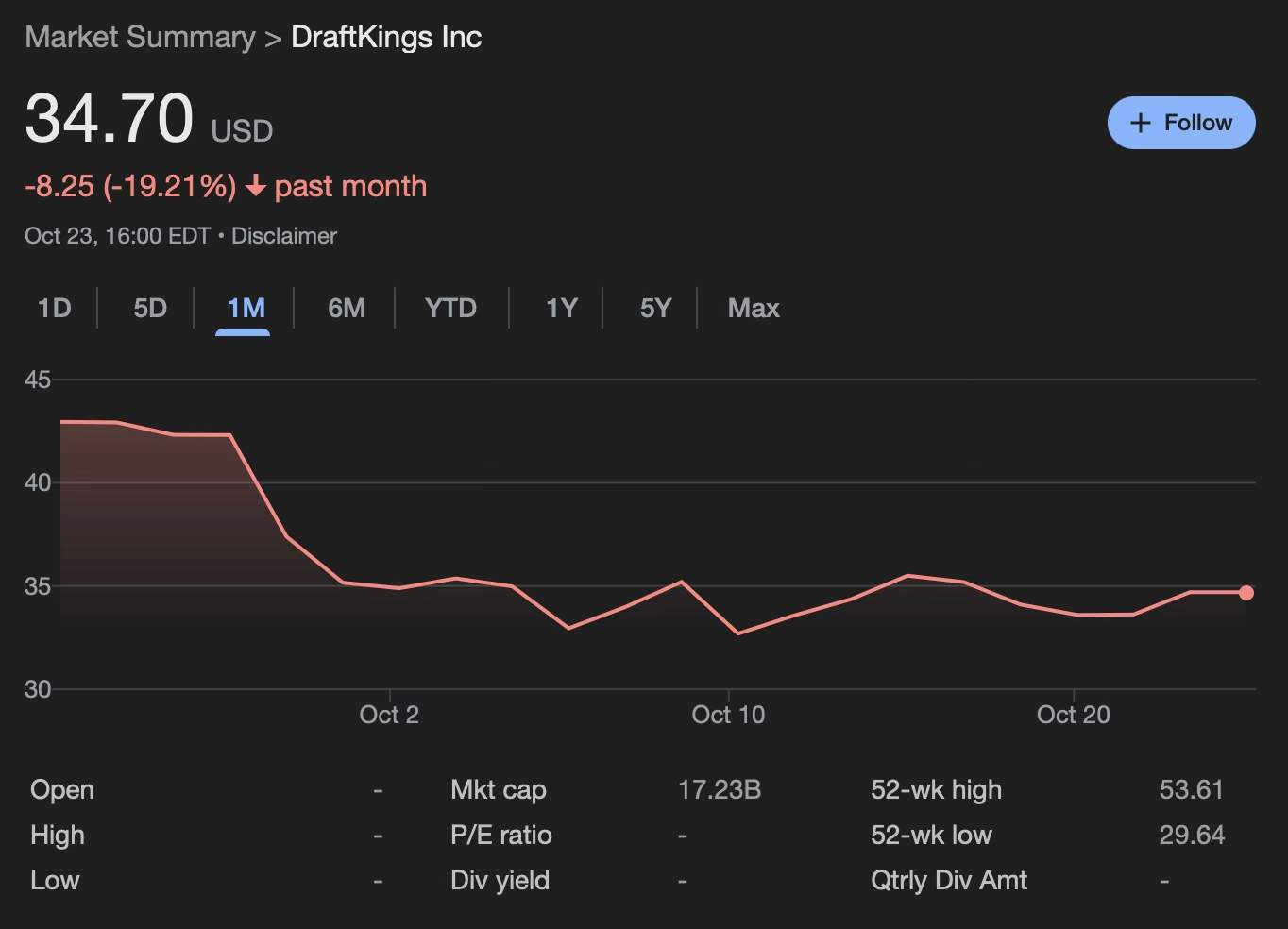

DraftKings (DKNG)

DraftKings (NASDAQ: DKNG), a popular Boston-based betting company that covers the NBA and other major American sports leagues, has been struggling in recent weeks, with its stock plummeting nearly 20% on the monthly chart and trading at $34.70 at press time.

Now, with the health of sports betting severely affected, DraftKings is in an even more precarious position, with its stock at risk of further losses. Nevertheless, several recent developments have once again captured the attention of investors, most notably: Polymarket.

Congratulations to @DraftKings on their acquisition of @RailbirdHQ.

We are proud that Polymarket Clearing is the designated clearing house for entry into the prediction markets space.

— Shayne Coplan🦅 (@shayne_coplan) October 22, 2025

More precisely, DraftKings plans to release its new DraftKings Predictions mobile app in the coming months, covering markets across finance, culture, and entertainment. Polymarket itself is currently in initial negotiations to raise capital at a valuation of $12 billion to $15 billion, a significant increase from its June 2025 valuation of $1 billion. As can be expected, existing backers and potential new investors alike will be paying close attention to betting platforms.

Featured image via Shutterstock