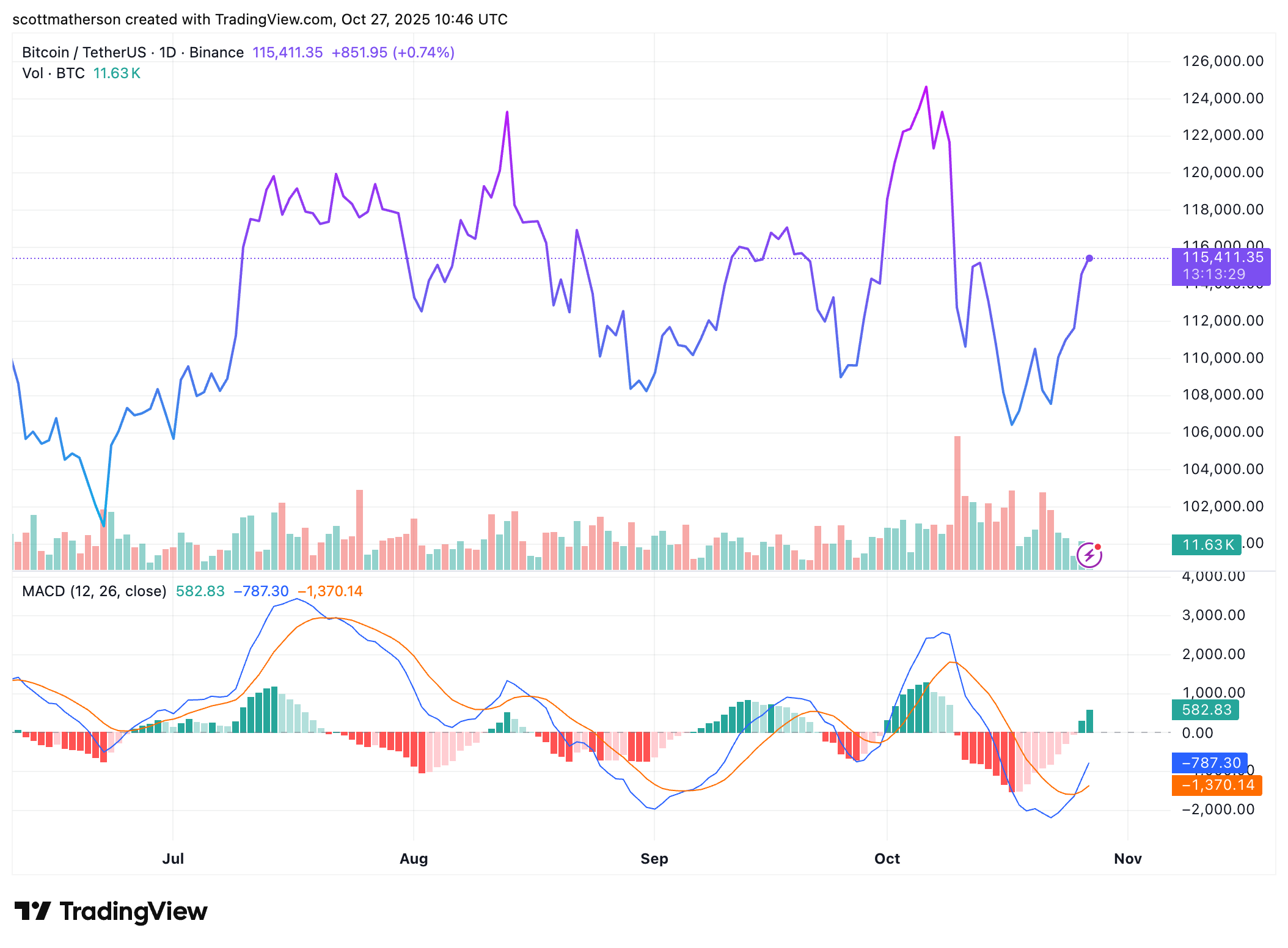

Bitcoin price is positioned for a potentially explosive move and could go well exceeded the all-time high. Analysts are closely monitoring a key resistance level near $116,000 that could be the last hurdle before BTC leaps into uncharted territory above $126,000.

Analysts predict new Bitcoin price to be all-time high

Crypto Analyst Donnie Dicey revealed An X social media post this week states that the $116,000 price level is the definitive zone that Bitcoin must break to confirm a new all-time high. His technical analysis suggests that if BTC breaks out of this resistance area cleanly, it could gain momentum and quickly climb above $126,000.

Notably, Bitcoin set a new ATH on October 6, 2025 after topping its previous record of over $124,000. Rising above $126,000. Since reaching this level, the price of BTC has Significant drop to $115,000. Mr. Dicey’s attached chart shows that after testing support near $108,000, marked as “market rupture” territory, the market has steadily recovered and the bullish price action remains solid above $109,000.

The analyst emphasized that Bitcoin’s daily closing price above $109,000 increases the possibility that the market will rise significantly heading into November. During this period, Federal Open Market Committee (FOMC) At the next meeting, investors are expecting dovish signals such as a rate cut or a formal end to the policy. Quantitative tightening (QT).

Mr. Dicey also points out that he is bullish. S&P500 Increased profits, possible agreement between the two countries to ease global trade tensions US President Donald Trump and comments from Chinese President Xi Jinping, improving ISM manufacturing data points to a supportive macro environment for risk assets. community members commented Whales may be underestimating how long demand for BTC tends to last under these conditions. dangerous answered As Bitcoin’s rally accelerates, the same whales could become “exit liquidity” and miss out on perhaps the strongest phase of this cycle.

The firmness exceeding the January high shows unwavering strength.

In a follow-up analysis, Dicey highlighted Bitcoin has shown remarkable stability above its January highs, describing its price structure as “unbreakable” amid global macroeconomic uncertainty. He noted that several factors are coming together to strengthen BTC’s resilience, including continued fiscal and monetary expansion. weak US dollarand renewed confidence in the global business cycle.

The analyst also noted that geopolitical tensions US-China relations appear to be calming down. at the same time, ETF inflow Rapid growth in the field of artificial intelligence (AI) serves as a tailwind for digital assets. He revealed that despite strong underlying fundamentals, there is still widespread skepticism in the market.

He says many people still believe this. Traditional 4 year cycle storyHowever, retail enthusiasm has not fully returned. moreover, Russell 2000 Index has not yet broken out, and rotation from traditional assets such as the S&P 500 and gold to Bitcoin remains limited. While these developments dampen widespread market participation, Dicey suggests that a decisive shift in sentiment creates the perfect environment for a strong rally in BTC.

Featured image from Pixabay, chart from Tradingview.com