Data shows short-selling crypto investors suffered massive liquidations over the past day as Bitcoin and altcoins recover.

Bitcoin and Ethereum soar in the past 24 hours

Bitcoin and other cryptocurrencies have risen over the past day, snapping the market out of the doldrums it was in earlier. At the high point of this rally, Bitcoin topped $116,000 and Ethereum reached $4,250.

Since then, assets have been recovering slightly. The chart below shows how BTC’s latest trajectory has been.

At its current price of $115,400, Bitcoin is up about 4% on a weekly basis. Similarly, Ethereum at $4,160 has gained 3.4%. Most other digital assets have posted positive returns as well, but there are a few outliers like Tron, which has fallen more than 7%. The overall market recovery over the past day has meant that a large amount of short-term liquidations have piled up on derivatives exchanges.

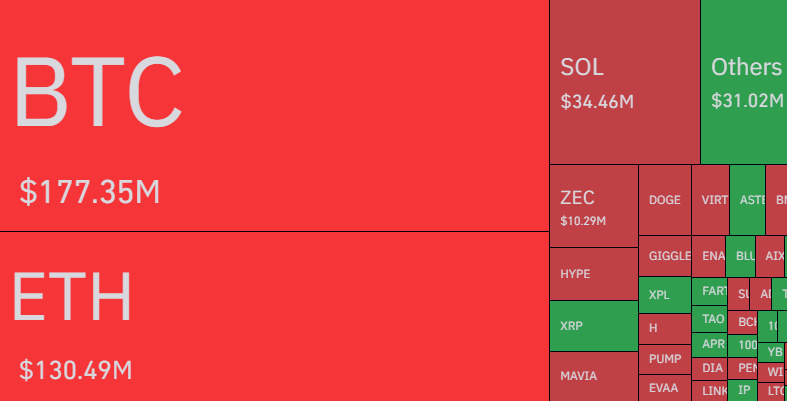

Cryptocurrency market liquidation amount reached a total of $467 million

According to data from CoinGlass, approximately $467 million in crypto-related derivatives contracts were liquidated in the past 24 hours. A contract is said to be “liquidated” when the platform forcibly closes the contract after a certain amount of losses (as defined by the exchange) has accumulated.

Given that the overall coin is rebounding, contracts above this threshold will be primarily short-term contracts. And indeed, the data would support that.

As seen above, the liquidation value related to crypto bearish bets during this window amounted to $358 million, accounting for 76.6% of the sector’s total flash volume. Bitcoin led the liquidations with an associated contract value of $177 million, while Ethereum was the second contributor with a contract value of $130 million. Among the rest, Solana witnessed the biggest flush of $34 million.

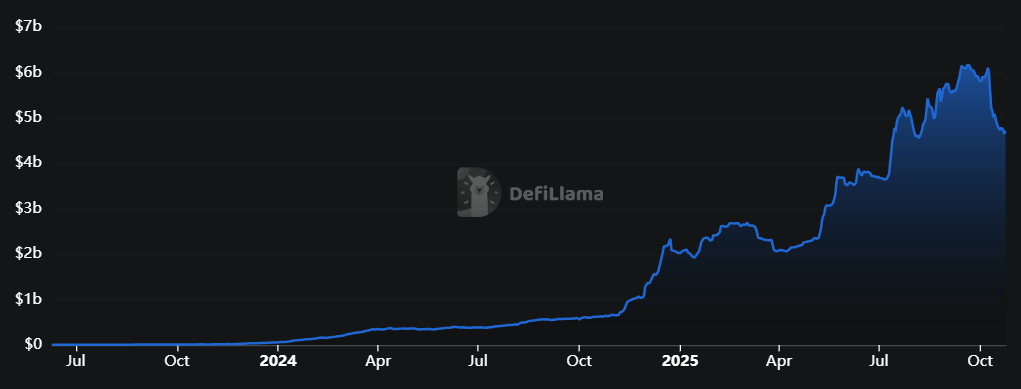

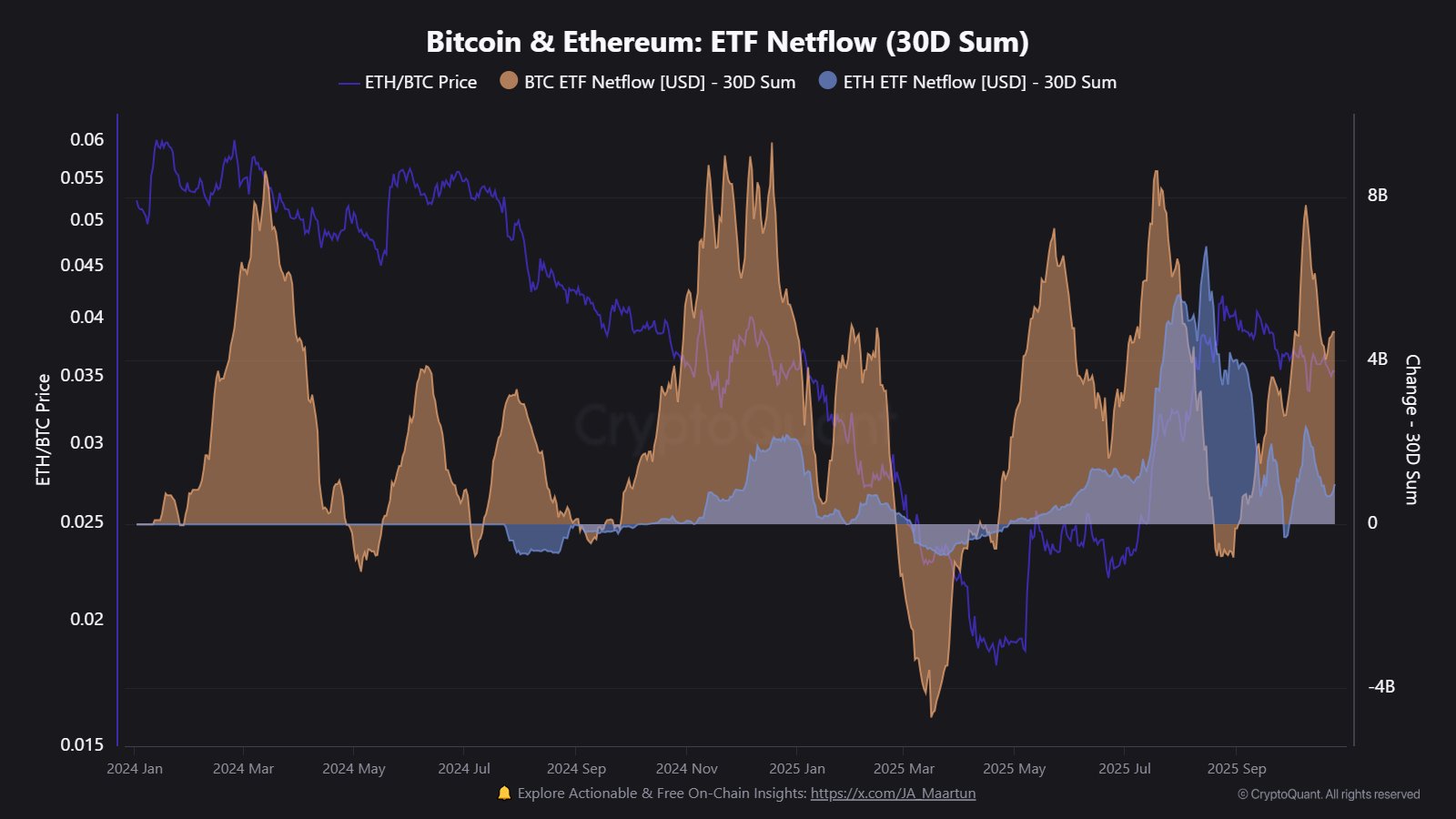

In other news, CryptoQuant community analyst Maartunn noted in an X post that Bitcoin spot exchange-traded funds (ETFs) have seen significant inflows over the past month.

Spot ETFs refer to investment vehicles that allow investors to gain exposure to assets without directly owning them. The US SEC approved the BTC Spot ETF in January 2024. This is a chart shared by an analyst that shows how the 30-day net flow for these vehicles has changed since then.

As shown in the chart above, the Bitcoin Spot ETF saw $4.7 billion in inflows over the past month. The Ethereum Spot ETF, which received approval in mid-2024, also enjoyed inflows during this period, but its value was significantly lower than BTC at $983 million.

Featured images from Dall-E, CoinGlass.com, CryptoQuant.com, charts from TradingView.com