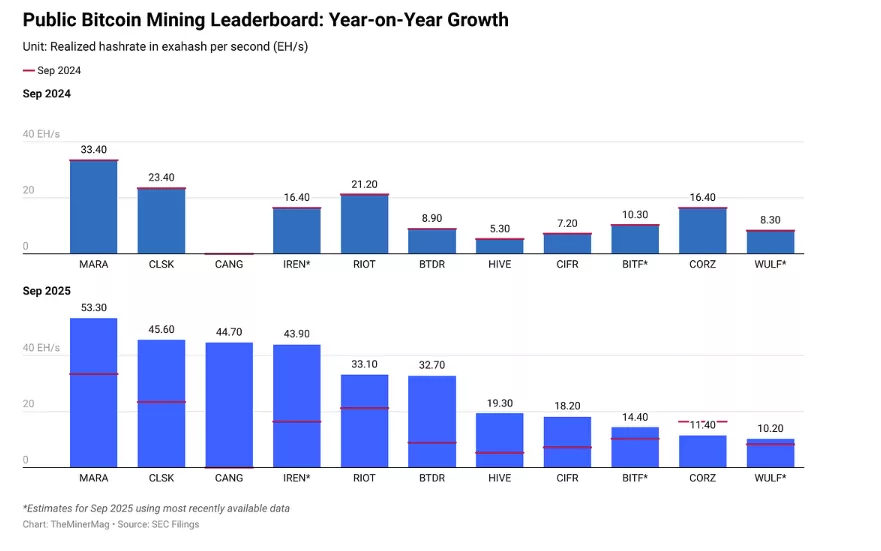

Mid-sized Bitcoin miners are closing the gap with industry leaders in realized hashrate after the 2024 halving.

summary

- After the halving in 2024, mid-tier miners have rapidly expanded and are closing in on top players.

- Public miners doubled their realized hashrate to 326 EH/s, the first record increase in a year.

- Debt in the mining sector has soared to $12.7 billion, driven by heavy investment in rigs and AI ventures.

After years of infrastructure growth, Cipher Mining, Bitdeer, and HIVE Digital have expanded rapidly, bringing them closer to top players such as MARA Holdings, CleanSpark, and Cango.

This change will create a more level playing field in the mining sector. “Their rise highlights how middle-class public miners, once far behind, are rapidly expanding production since the 2024 halving,” Miner Mag wrote in its latest Miner Weekly Newsletter.

You may also like: Crypto VC funding: Coinbase acquires Echo for $375 million, Pave Bank raises $39 million

Top Bitcoin miners double their hashrate

MARA, CleanSpark, and Cango retained their status as the three largest public miners. Rivals such as IREN, Cipher, Bitdeer, and HIVE Digital recorded significant year-over-year increases in realized hashrate.

Top public miners reached a realized hash rate of 326 exahashes per second (EH/s) in September, more than double the level recorded the previous year. These currently account for nearly a third of Bitcoin’s (BTC) total network hash rate.

Public Bitcoin Mining Leaderboard: Source: The Miner Mag

Hashrate measures the computational power of miners, which helps secure the Bitcoin blockchain. The achieved hashrate tracks the actual on-chain performance, i.e. the rate at which valid blocks are successfully mined.

For publicly traded miners, realized hashrate is a closer indicator of operational efficiency and revenue potential. This indicator has become an important indicator ahead of the third quarter earnings season.

You may also like: James Wynn enters XRP with significant investment

Mining debt soars to $12.7 billion

Bitcoin miners are reaching record debt levels and expanding into new mining rigs, artificial intelligence infrastructure, and other capital-intensive ventures. Total debt across the sector jumped to $12.7 billion from $2.1 billion just 12 months ago.

VanEck’s research points out that miners need to continually invest in next-generation hardware to maintain their share of Bitcoin’s total hashrate and keep up with competitors.

Some mining companies are turning to AI and high-performance computing workloads to diversify their revenue streams. This change was made in response to the decrease in margin and block reward to 3.125 BTC due to the Bitcoin halving in 2024.

The increase in debt indicates aggressive expansion plans across the industry. Mining companies face pressure to expand quickly or risk losing market share to better-capitalized rivals.

read more: Cryptocurrency’s $1 trillion blind spot requires a new framework | Opinion