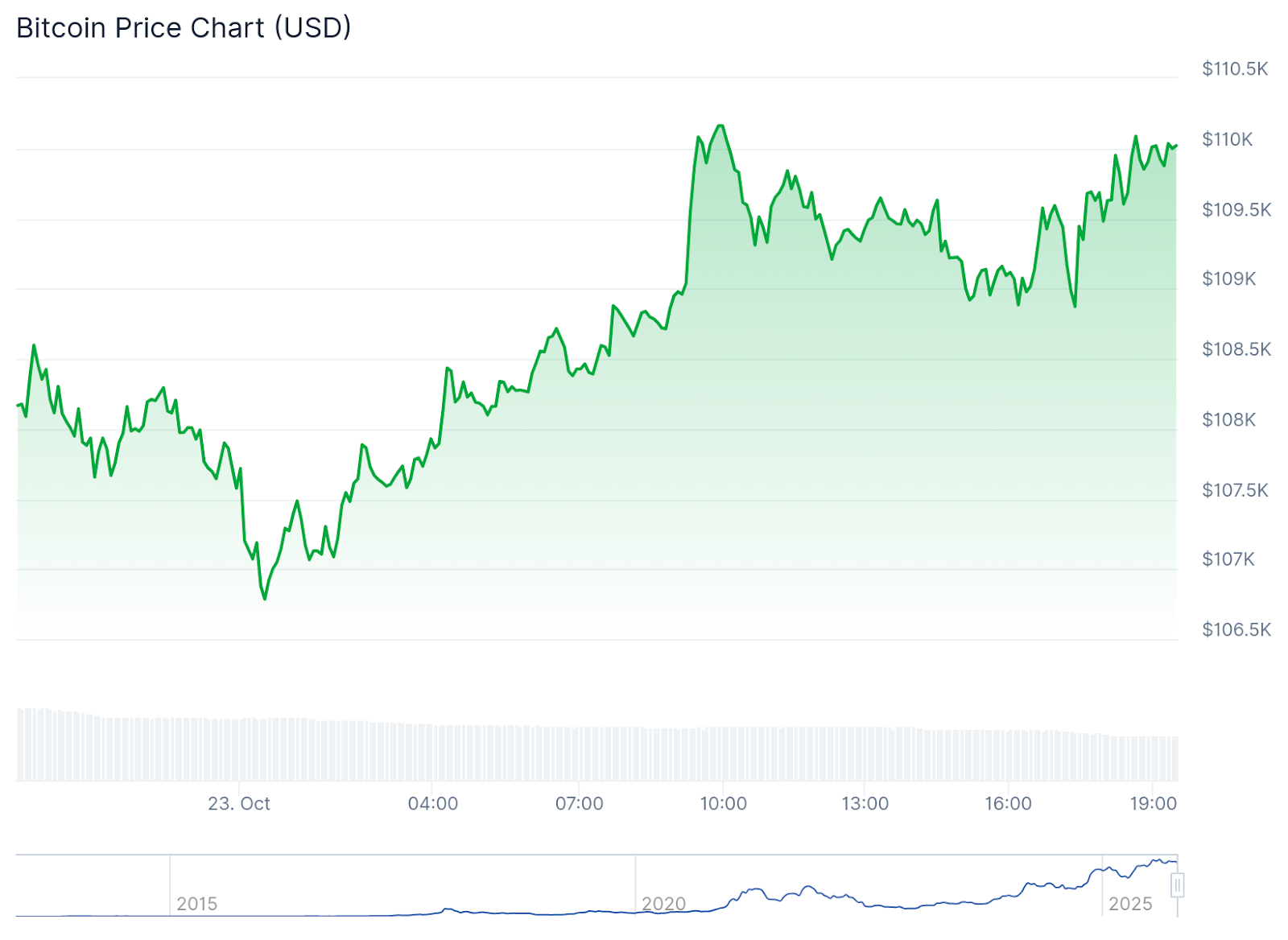

Cryptocurrency markets rose slightly on Thursday morning, with Bitcoin holding steady at around $110,000 and its market cap at $3.78 trillion as the 10-year U.S. Treasury yield rose above 3.98%.

Bitcoin (BTC) rose 1.6%, pushing the price to $110,000, firmly within the $108,000 to $112,000 range.

In a commentary for The Defiant, VALR CEO and co-founder Farzam Ehsani suggested that Bitcoin’s upward trajectory is “not guaranteed” as the same macro volatility that drove gold’s rally due to its general perception as a defensive asset “could cap Bitcoin’s upside if it reignites widespread risk aversion.”

BTC 24 hour price chart. Source: CoinGecko

Ethereum (ETH) also rose 1.5% to around $3,890, with all other tokens in the top 10 by market capitalization slightly up between 1% and 5%. BNB was the group’s biggest winner, surging more than 5% after President Donald Trump pardoned Binance founder Chao Changpeng, who pleaded guilty to enabling money laundering.

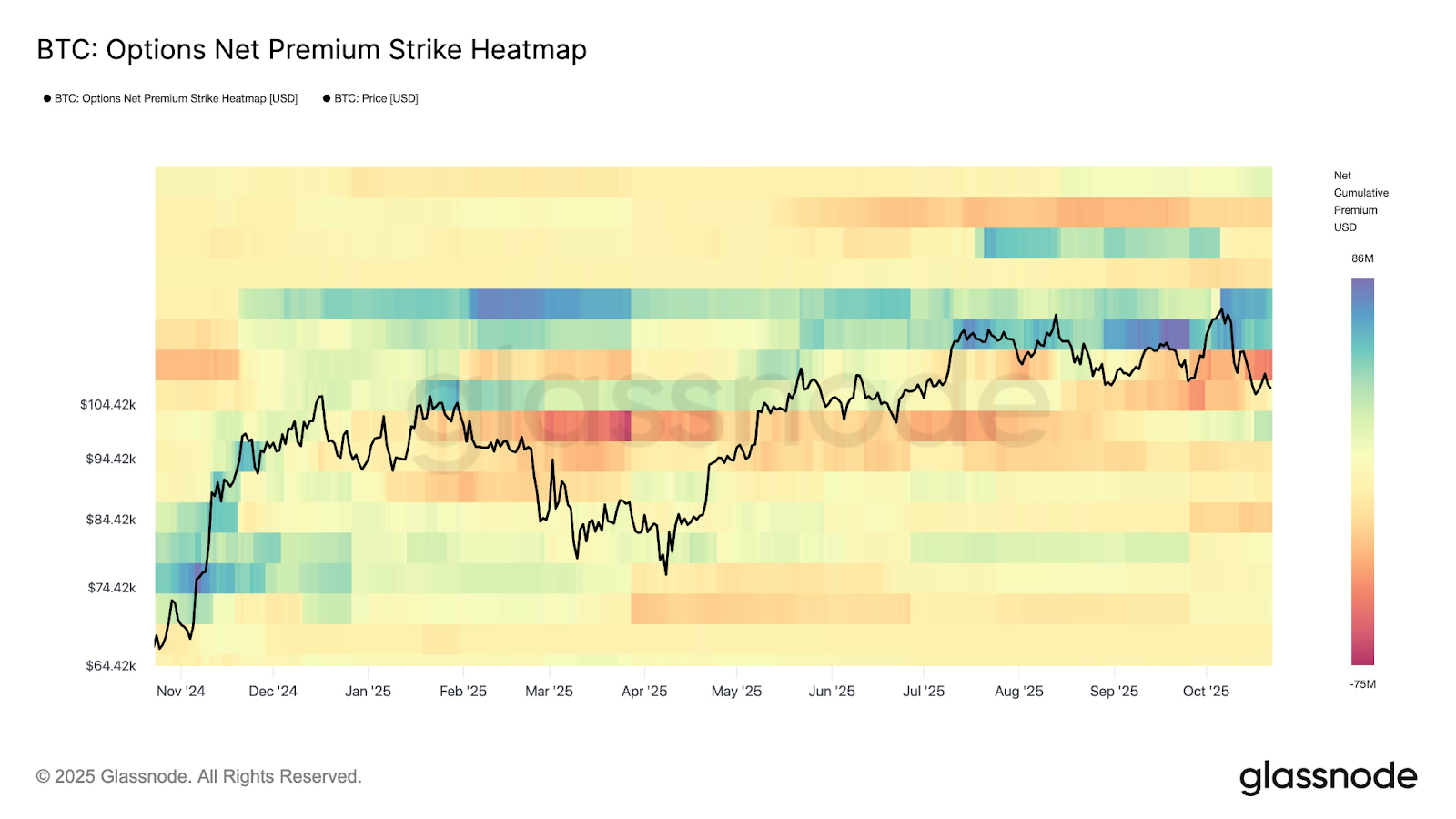

BTC Options Heatmap

In an Oct. 23 X post, Glassnode analysts noted that net premium trends reveal “concentrated selling in the $109,000 to $115,000 range,” indicating that the recent price rally is “being used as a hedge.” Analysts said this suggests traders are “taking a defensive stance on strength as the market consolidates.”

As The Defiant pointed out in a recent newsletter, long-term BTC holders have offloaded large amounts of psychologically significant funds, in excess of $100,000, with Glassnode reporting that over 28,000 BTC ($3 billion) have been sold in the past seven days alone.

big moves and liquidations

Among the top 100 crypto assets by market capitalization, ChainOpera AI (COAI) and Kinetiq Staked (KHYPE) were the biggest gainers, rising 39% and 9.8%, respectively.

As previously reported by The Defiant, the Kinetiq Foundation recently announced KNTQ, the official governance token for the Kinetiq protocol, the largest liquid staking platform on HyperEVM, Layer 1 of Hyperliquid.

Meanwhile, the biggest losers today were Zcash (ZEC) and Hedera (HBAR), down 8.4% and 3.4%, respectively.

According to Coinglass data, $345 million in leveraged positions were liquidated in the past 24 hours, eliminating $213 million long and $130 million short. The single largest liquidation took place on Hyperliquid on the ETH/USD pair, with a value of $6.55 million.

In terms of total liquidations, Bitcoin accounted for the largest amount at $59.95 million, followed by Ethereum at $108.47 million, and other altcoins at $41.43 million.

ETFs and the macro environment

More than $18.7 million was outflowed from the Spot Ethereum ETF on Wednesday, October 22nd, according to SoSoValue. Meanwhile, the Spot Bitcoin ETF recorded net outflows of over $101 million.

On the macro front, US Treasury yields rose on Thursday as investors focused on China trade news and focused on Friday’s inflation report. According to a report from CNBC, the 10-year bond yield reached 3.98%, the 2-year bond yield reached 3.465%, and the 30-year bond yield reached 4.563%.

Rising borrowing costs also led JPMorgan and Bank of America to bring forward their expectations for the end of the Fed’s $6.6 trillion balance sheet outflow, or quantitative tightening, from later this year to possibly this month, Bloomberg reported.