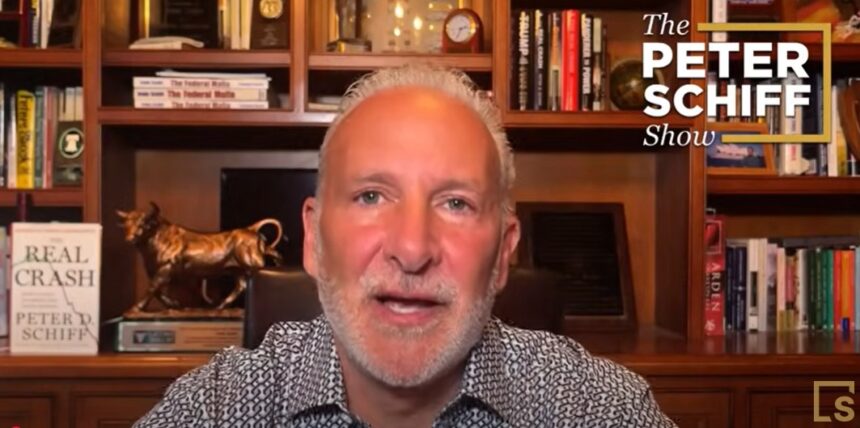

Economist and well-known Bitcoin (BTC) critic Peter Schiff has announced plans to launch his own gold-backed token.

He said the new digital asset seeks to provide “true stability” that only precious metals can provide.

Schiff assured that the system will deliver “everything that Bitcoin promises but will never be able to do” and positions Bitcoin as a direct alternative to the leading digital currencies on the market.

For Schiff, “the only asset that makes sense to put on the blockchain is gold.”because we believe this will “maintain purchasing power.” In their own words, this system allows “tokenized gold to be used as a medium of exchange, a unit of account (…), and a store of value.”

The project is built on the platform of his company SchiffGold.users will be able to purchase precious metals through the application. “The gold is stored in your vault (…) and you can transfer the ownership of that gold to another person through the application,” he explained.

On top of that, Mr. Schiff announced that he would offer a debit card linked to the gold fund.. “If you have US$5,000 of gold and (…) buy something for US$10, US$10 of gold will be sold to cover the transaction,” he explained. With this initiative, the company aims to enable customers to instantly “use gold as the basis for transactions.”

I want to be clear that Mr. Schiff does not have any new ideas. Tokenized versions of gold have been around for yearsTether Gold (XAUT) and Pax Gold (PAXG). Even CriptoNoticias has published a guide on how to buy tokenized gold on the Binance exchange.