Fund inflows turned negative last week due to the “Black Friday” market crash of cryptocurrencies, and cryptocurrency investment products were unable to maintain inflows for the second consecutive week.

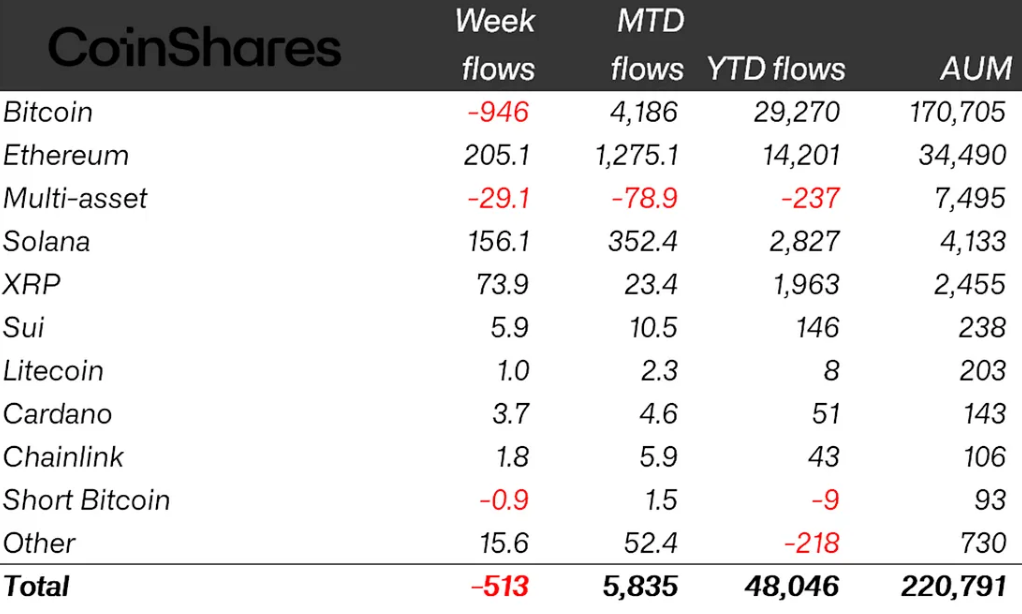

Cryptocurrency Exchange Traded Products (ETPs) experienced $513 million in outflows last week, ending a two-week streak of total outflows of $9.1 billion, CoinShares reported on Monday.

James Butterfill, head of research at CoinShares, said there was less panic in the ETP market than there was in the spot market over the $668 million total outflow following the October 10 “Binance liquidity cascade.”

He said crypto ETP investors were largely “ignoring this event” while on-chain investors were more bearish.

Bitcoin was the only major asset to see outflows

Bitcoin (BTC) was the main cause of ETP’s losses last week, with total outflows reaching $946 million. The outflow reduces year-to-date inflows to $29.3 billion, significantly lower than last year’s total of $41.2 billion, Butterfill added.

Meanwhile, Ether (ETH) continued to gain momentum as investors bought on the spurts, with funds seeing $205 million in inflows. Butterfill noted that the largest inflow was in the 2x Leveraged Ether ETP, totaling $457 million.

Crypto ETP flows by asset (in millions of USD) as of Friday. Source: CoinShares

Amid optimism over the launch of new ETPs, Solana (SOL) and XRP (XRP) continued to see inflows into the funds, with total inflows of $156 million and $74 million, respectively. Particularly notable was Solana ETP, where inflows jumped 67% compared to the previous week.

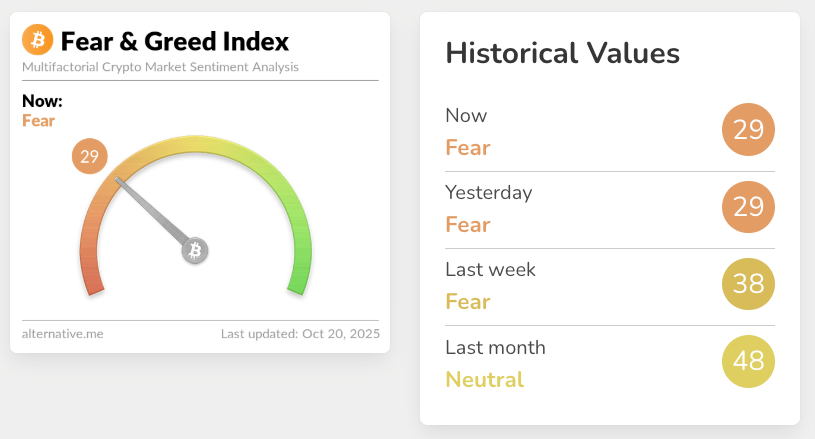

Crypto Fear and Greed Index drops to multi-month low

The new outflows from crypto ETPs come as the Crypto Fear & Greed Index, a measure of overall crypto market sentiment, has fallen to its lowest level since April.

Last Friday, the index fell to a score of 22 as Bitcoin fell below $105,000, reflecting strong “fear” by spot BTC investors, according to data from Alternative.me.

Cryptocurrency fear and greed index. Source: Alternative.me

The “fear” sentiment remained dominant on Monday, with a score of 29. According to data from CoinGecko, the index’s lowest level recorded so far in 2025 was a score of 10 observed in late February, when Bitcoin plummeted from $96,000 to around $84,000.

Related: What is Bitcoin if not a cryptocurrency? Satoshi Nakamoto is rumored to be participating

At the time of publishing, Bitcoin was trading at $111,019, down about 3% over the past seven days and about 4% over the past month.

Ether is trading at $4,035, down about 3% over the past week and 9% over the past 30 days.

magazine: Ether price goes ‘core’, Ripple seeks $1 billion XRP purchase: Hodler’s Digest, October 12-18