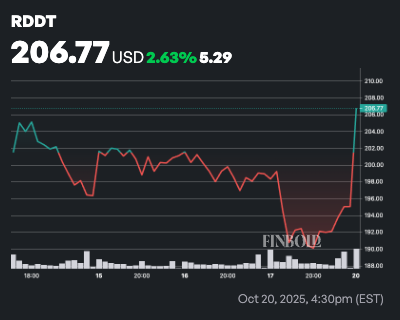

Reddit (NYSE: RDDT) is soaring, rising 6% to $206 in early trading on October 20th.

In fact, this surge comes at a time when RDDT stock has been facing volatility, falling 20% over the past month. But year-to-date, the social media giant is still up 24%.

The increase comes after investment firm Raymond James raised its price target on Reddit from $225 to $250, while maintaining a “strong buy” rating.

Notably, Raymond James analyst Josh Beck highlighted a stronger outlook for Reddit’s ad revenue due to improved monetization metrics and the company’s potential for growth in AI-powered search.

Beck’s updated bottom-up average revenue per user (ARPU) model outlines a $100 log-in ARPU bull case, driven by modest increases in ad load, significant increases in CPM (cost per impression), and a boost from AI search capabilities that are expected to increase query volume on the platform.

Beck said the agency’s recent research shows CPMs for e-commerce campaigns are above $6, representing triple-digit growth year-over-year.

Even under a more conservative scenario, Reddit’s typical campaign CPM estimate has been raised to $4 from $2 in our previous analysis, indicating that advertisers are paying much more to reach users on the platform.

Analyst models assume that Reddit’s home feed ad load could rise from 13% to 17%, which is still below peers such as Meta and Snap, which operate in the 25% to 50% range.

Reddit stock fundamentals

Additionally, the company predicts that Reddit’s AI search/answer capabilities could increase monthly queries from 1.5 billion to 4 billion, potentially creating an untapped $350 million revenue opportunity.

This bullish call is based on Reddit’s strong fundamentals. The company boasts a gross profit margin of 91.04% and sales grew 70% year-over-year to $1.67 billion over the past 12 months.

Raymond James’ upgrade added to analyst optimism. Citizens Financial recently maintained its “market outperform” rating with a $300 price target, while Trust Securities raised its price target to $260, citing strong third-quarter results and expectations for positive fourth-quarter guidance.