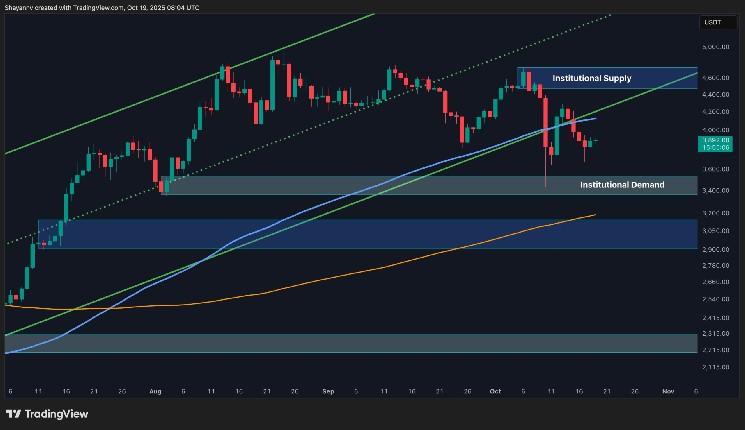

Ethereum remains range-bound following the recent market rally, but remains above the major institutional demand zone. The market is entering a period of consolidation between structural support and resistance, suggesting that the next decisive move is likely to be driven by a liquidity shift out of this range.

technical analysis

Written by Shayan

daily chart

On the daily time frame, Ethereum continues to trade between two major zones. An institutional supply zone around $460 to $470 and an institutional demand zone around $340 to $350. After losing the channel’s lower trendline support earlier this month, the asset is now retesting it from below and confirming that it is resistance.

This structure suggests that Ethereum is currently in an intermediate equilibrium stage where neither buyers nor sellers have clear control. The 100-day moving average, which previously provided dynamic support, has now turned into a resistance zone near $4.1 million to $4.2 million, while the 200-day moving average near $3.1 million remains the last structural line of defense.

Ethereum’s macro trend remains intact as long as the price remains above institutional demand of $3.4 million. However, if this level cannot be sustained, the market could be exposed to a deeper retracement towards the $3.0,000-$29,000 liquidity cluster where the 200-day moving average and previous cumulative base converge.

4 hour chart

The 4-hour structure reveals a descending wedge pattern that formed after a sharp rejection from the $4.2,000 breakdown zone. This repeated rejection at the confluence of the downtrend line and uptrend line reflects the ongoing tug of war between short-term buyers and sellers.

At the same time, the lower bound of the wedge is closely aligned with the broader institutional demand zone, suggesting that Ethereum is approaching a point of compression where increased volatility is imminent.

If the price breaks above the downtrend line and closes above the $4,000-4.1,000 resistance, a reversal could be confirmed with a target of $4.4,000-4.6,000. Conversely, a break below $3.7,000 could trigger a deeper decline towards $3.4,000, the same zone that supports the broader bullish structure. Until confirmation is received, Ethereum will remain range bound, swinging between structural supply and demand.

sentiment analysis

Written by Shayan

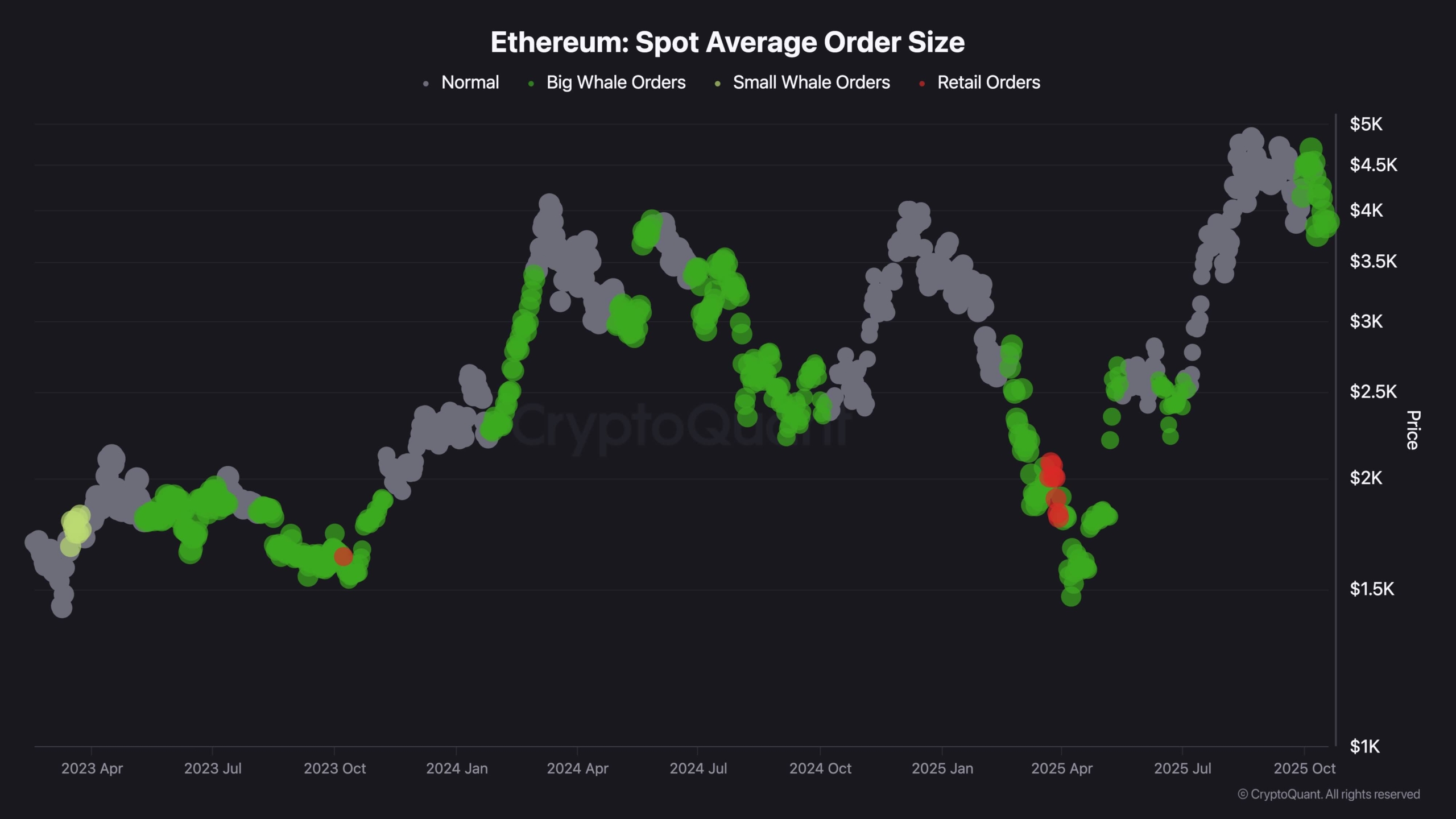

Recent on-chain data shows that Ethereum’s market structure is tightening again. Since mid-October, two important trends have emerged simultaneously. While foreign exchange reserves are declining rapidly, the average size of spot orders is increasingly dominated by large whale trades.

Since October 15th, the price of ETH has remained relatively stable at just below the $4,000 level, but the underlying market composition has changed significantly. Whale-sized spot orders (green clusters) have expanded, indicating new activity by deep-pocketed participants, while the amount of Ethereum held on exchanges (in USD terms) has fallen to one of its lowest levels in 2025.

This combination of shrinking foreign exchange reserves and increasing whale spot activity has historically signaled strategic accumulation by institutional and high-net-worth investors. With liquidity thinning across exchanges, even a modest influx of new demand can amplify price reactions, as reduced sell-side availability magnifies volatility upwards.

Ethereum now appears to be entering a new phase of tight supply, reflecting a quiet but strong period of accumulation in the second half of 2020. During that cycle, there were consistent spot purchases and currency outflows that preceded one of ETH’s strongest multi-month rallies. Once the macro environment stabilizes and ETF-related inflows return, the current structural tightening could provide the foundation for Ethereum’s next big upcycle.