Over the years, crypto projects have often launched tokens in the name of governance or network security. In this model, token holders have the right to vote on proposals and guide the future of the project in the spirit of decentralization.

But in many cases, these tokens do little that is meaningful to the value of the project. And the idea of issuing cryptocurrencies in 2025 is probably outdated. It is clear from recent market activity that tokens require some kind of utility and buyback/burn strategy to create value.

Flaws in the spirit of decentralization

A large number of blockchain projects have launched tokens, even if having a cryptocurrency was not necessarily central to their focus.

There is certainly an underlying business reason for this. This includes the fact that tokens can have significant upward value when first listed on an exchange.

Good question, the old model of needing tokens to secure the network has been replaced by the proper use of tokens as a quasi-equity/reward hybrid vehicle to grow audience and revenue. $BNB led the way. $HYPE and $PUMP have improved upon it. Everyone will be doing it soon. https://t.co/wmUT1geBmk

— Jeff Dorman (@jdorman81) September 19, 2025

Many projects are launching tokens in the spirit of a noble effort to strengthen decentralization or give voice to communities related to decentralization, i.e. to increase distribution and participation.

However, this can also lead to community quagmire. One recent example of this comes from the Across protocol. Risk Lab, an affiliate of the project, reportedly manipulated the DAO’s governance to obtain $23 million in tokens to fund its future operations.

Risk Labs CEO Hart Lambur refuted the manipulation claims in a colorfully titled Twitter/X article, claiming the accusations were motivated by competitors.

TLDR: The Across Protocol/Bridge ($ACX) team used secret voting to extract up to $23 million from the Across DAO’s treasury to benefit a private company.

Background: I’ve posted many times about “in name” DAOs, or “organizations that pretend to be run by…”

— Ogle | glue.net (@cryptogle) June 26, 2025

Regardless of who is right or wrong in this matter, this probably highlights the fact that the DAO model may be outdated.

Is Pioneer BNB?

Despite many controversies, Binance’s BNB stands out as a model of utility.

Originally called Binance Coin and launched in 2017 at the height of the Ethereum ICO era, BNB was initially an Ethereum ERC-20 token.

In 2019, BNB was migrated to the Binance Smart Chain platform.

BNB developers originally had practicality in mind. That’s why it performed differently than most cryptocurrencies and was an outlier when it launched in 2017.

From giving exchange users a 25% discount on trading fees on Binance to converting small amounts of non-tradable cryptocurrencies into BNB, this token is in real-world use in its own ecosystem.

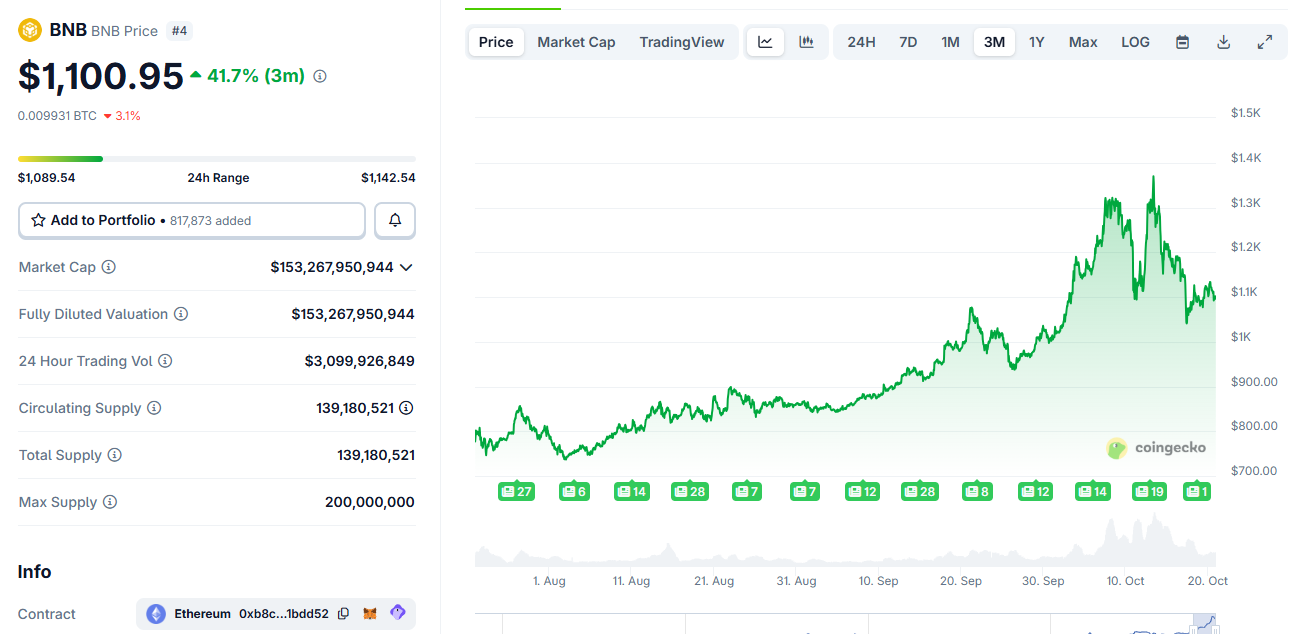

BNB price history since launch. It reached $1,000 for the first time on September 20th. source: CoinGecko

Binance burns BNB based on the trading volume of the exchange. According to BNBBurn.info, more than 62 million BNBs were burned out of the original 202 million in circulation, reducing the overall supply by 31%.

Utility and burn likely pushed the BNB token price to an all-time high, reaching $1,000 in September.

HYPE and PUMP follow the BNB model

There are other crypto projects that are clearly taking notice of BNB’s success.

Hyperliquid is a perpetual spot decentralized exchange built on a proprietary blockchain and an EVM-compliant smart contract system called HyperEVM, which also burns tokens.

HYPE cryptocurrency is the only way to pay platform fees and is automatically burned.

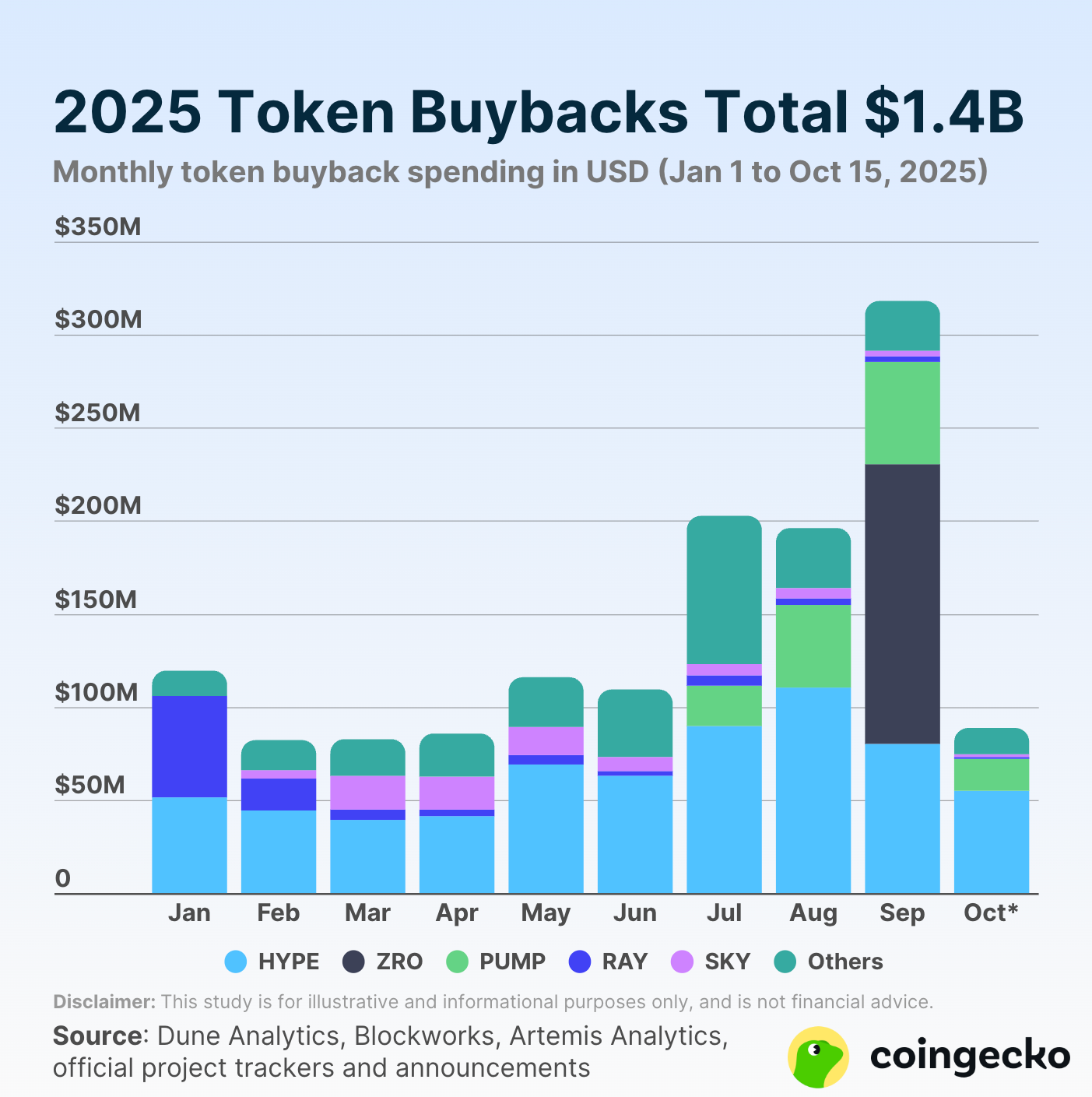

Major token buybacks in 2025. Source: CoinGecko

Although Hyperliquid faces competition from the likes of Binance-backed Aster DEX, its token continues to perform well, rising more than 500% since its launch.

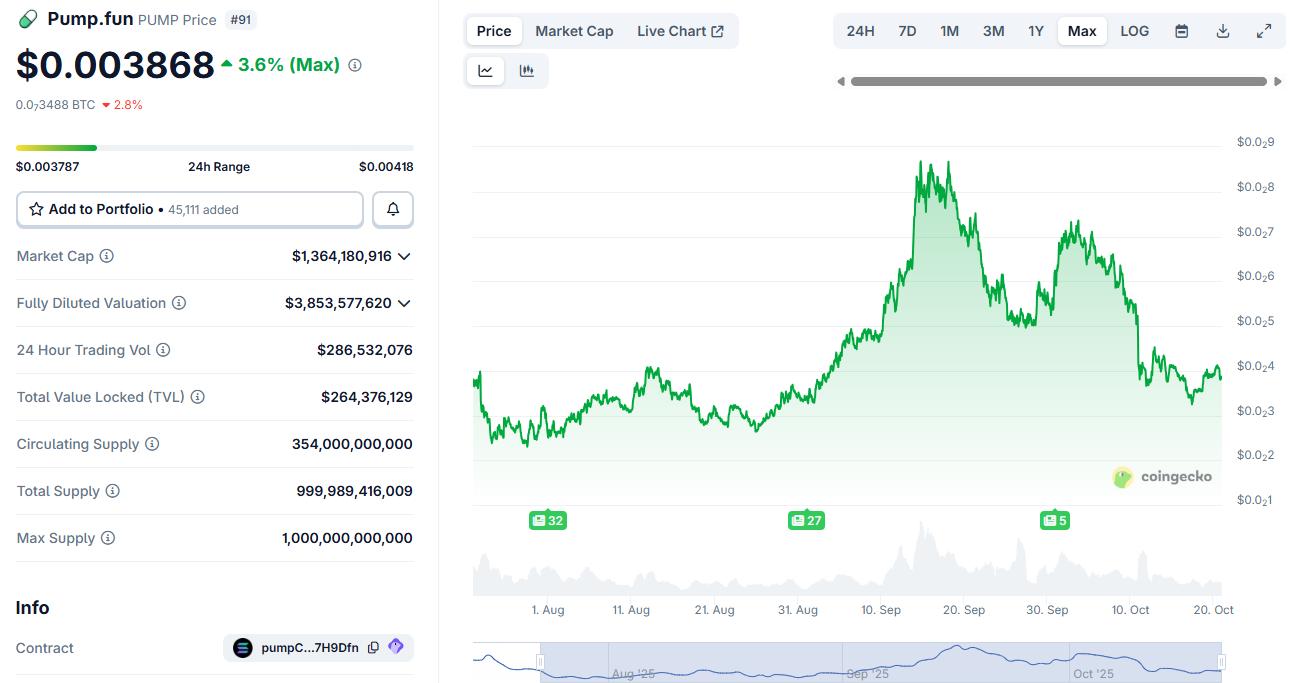

Memecoin launchpad Pump.fun, which raised $500 million in an ICO over the summer, is another example of share buybacks that have had an impact on the project.

PUMP has endured selling pressure since its ICO, likely due to buybacks. sauce: CoinGecko

Pump.fun has made huge profits in the cryptocurrency space, generating over $800 million in fees from traders FOMOing various meme coins on the platform.

Pump also buys back tokens. Since its launch in July, it has already purchased over $114 million in cryptocurrencies.

Selling pressure as a result of the ICO may have brought the price of the PUMP token to a similar level as at launch.

However, this token has only been available on exchanges since July. It may be too early to draw conclusions about PUMP’s immediate performance.

future token

Tokens need to be actually used within the ecosystem, and reducing supply in the form of buybacks/burns overall will reduce selling pressure.

Projects like BNB, HYPE, and PUMP are clear use cases for projects and investors to keep in mind going forward.

Wall Street’s interest in the cryptocurrency market is increasing. And token performance, like stock prices in traditional finance, is a true measure of the merits of many blockchain projects.

As new tokens such as MetaMask, Base, etc. enter the market, the community surrounding them must advocate for utility and buyback/burn models to ensure both sustainability and long-term performance.

This article “Why token buybacks are the best measure of a crypto project’s success” was first published on BeInCrypto.