Ethereum (ETH) is going through a period of heightened volatility as supply dwindles rapidly, but artificial intelligence (AI) tools argue it could soon recover.

At the time of writing, ETH is trading at around $4,106, up around 3% in the past 24 hours. However, on the weekly chart, the token is still down 8.50%.

AI predicts ETH price

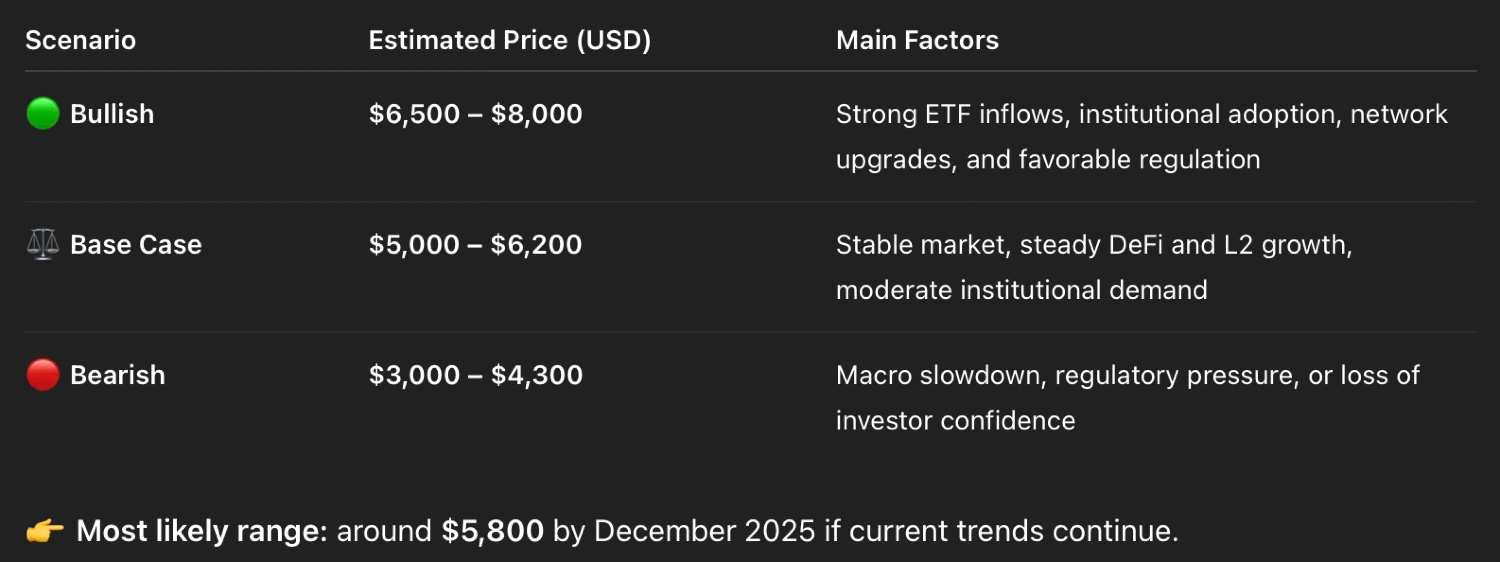

Considering ETH’s recent volatility, Finbold referenced ChatGPT-5 and pointed out several factors that could influence the asset’s momentum in the coming months in his end-2025 Ethereum price prediction.

OpenAI’s model suggests that strong inflows into exchange-traded funds (ETFs) and increased adoption by institutional investors could push the price to $8,000. Conversely, a combination of macroeconomic slowdown, waning investor interest and regulatory pressure could send the stock price down to $3,000.

At the same time, AI suggested that with stable market conditions and stable financial institutions’ investment appetite, the price could reach the $5,000-$6,200 range, with $5,800 being the most likely target if current trends continue.

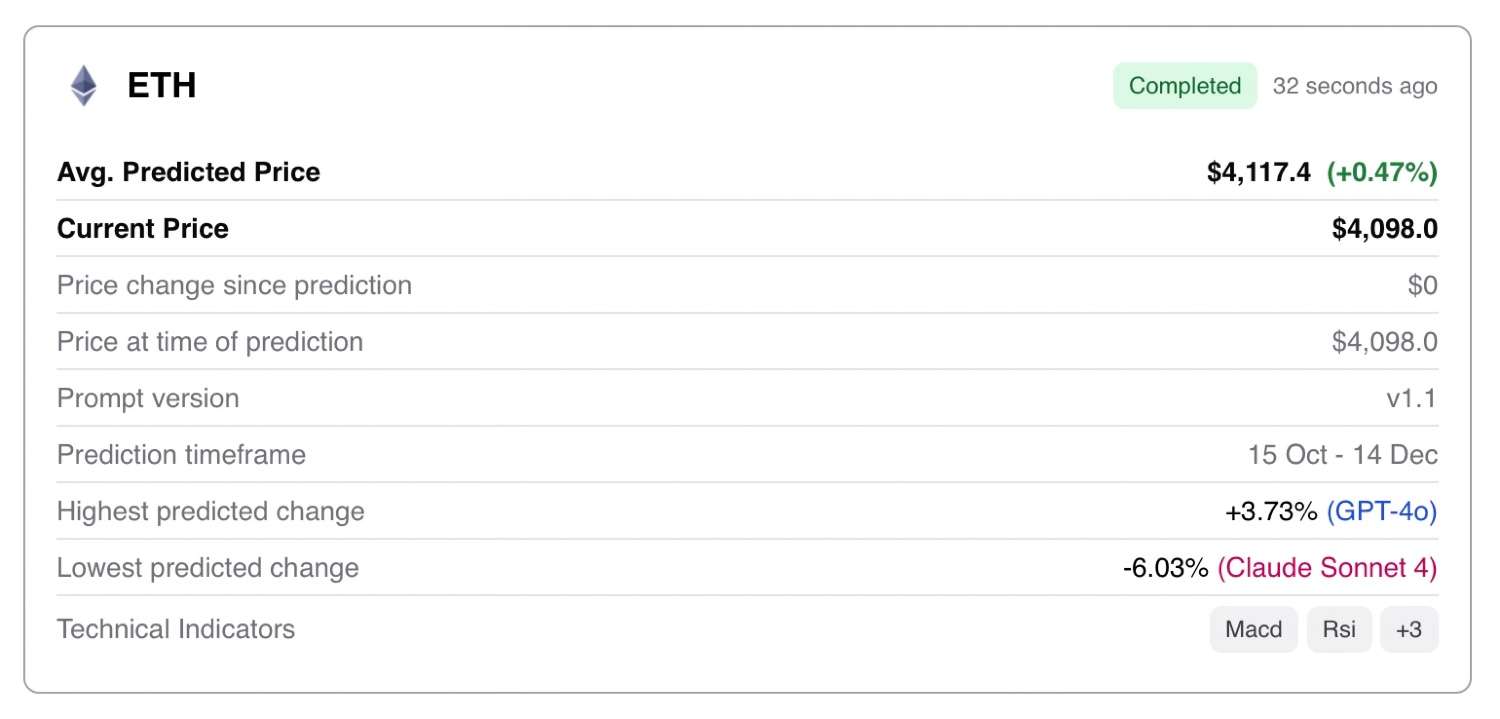

To get a clearer picture of where the second-largest cryptocurrency will be around mid-December, Finbold also turned to its proprietary AI Signals machine learning tool, which integrates several large-scale language models (LLMs) and momentum-based market technical indicators.

Unlike ChatGPT, this algorithm was not very bullish. So, according to our analysis, Ethereum traded at just $4,117 by December 14th, implying a modest gain of 0.47%.

The most notable difference between the two forecasting tools is that the price estimate for GPT-4o LLM leveraged by Signals is $4,250 (+3.73%), well below ChatGPT-5’s year-end outlook of $5,800.

Grok 3 predicted exactly the same numbers as GPT-4o, while Claude Sonnet 4 went in the opposite direction and assumed a -6.03% drop in price to $3,850.

Overall, comparing the two analyses, it appears that ETF inflows may play a key role in driving the asset’s rally, as ChatGPT suggests, while the technical indicators covered in Finbold’s Signals app suggest that the trajectory may not be as steep, at least until the final weeks of 2025.

Featured image via Shutterstock