The MetaDAO community today rejected a proposal to mint $6 million worth of META tokens and sell them to two venture capital firms, DBA and Variant, at a discount of approximately 30%.

MetaDAO, the Solana-based governance platform for decentralized autonomous organizations (DAOs), closed its voting today, October 13th, with a volume of over 878,800 USDC, demonstrating clear opposition to the agreement, which would dilute existing holders by approximately 7-8%.

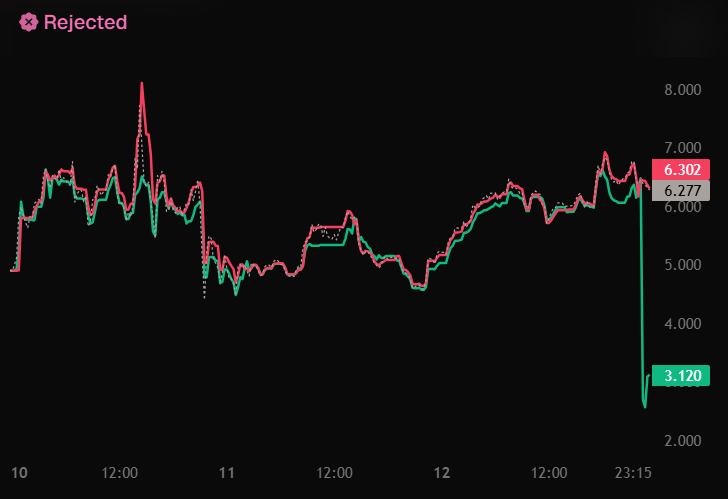

MetaDAO voting results. Source: MetaDAO

If the deal passes, approximately 1.47 million new META tokens will be minted, and the two VC firms will each be able to purchase $3 million worth of META at $4.0795 per token, approximately 30-40% less than the market price during the voting period. The MetaDAO team said in its proposal that the tokens would have been completely unlocked, adding that it “doesn’t believe in locking the supply away from anyone other than the team.”

The small team behind MetaDAO (two founders, one part-time designer, and one X-intern) said the proposal is intended to extend the runway and enable employment possibilities. DAO currently has about $1.8 million in cash, enough to last about 24 months, the voting summary states.

Unlike Snapshot, where voting is done purely based on token weight, MetaDAO uses a Futurkey system that combines prediction markets and governance. Simply put, the community can vote on high-level goals, and the market helps predict which decisions will achieve those goals, allowing the DAO to make more data-driven choices rather than simply counting votes.

In August 2024, MetaDAO raised a total of $2.2 million in a funding round led by Paradigm.

“Wrong proposal structure”

Before voting ended, the deal drew criticism from some community members who argued it gave too large a discount to VCs. After the MetaDAO community rejected the vote, DBA co-founder Jon Charbonneau wrote in the Telegram group:

“(…) I think the two biggest high-level problems with our initial proposal were: 1) It was too much of a discount to the spot price at the time of posting. 2) The process of posting certain OTC trading terms was really just the wrong proposal structure here.”

Charbonneau added that future capital raises could follow a different model, with teams setting price caps and finalizing execution in both directions, similar to how traditional boards handle equity issues.

Gabriel Shapiro, founder of crypto-native legal tech organization MetaLeX Labs, commented on the vote in today’s X Post, saying that MetaDAO is “the only place I see the DAO ethos actually thriving,” adding:

“I can’t imagine something like that happening with today’s Ethereum DAO. They are completely captured by the professional governance class.”

Following today’s vote results, META’s price rose over 16% to over $6.95. This was also driven by MetaDAO’s previous success with UMBRA, Solana’s privacy coin, which was oversubscribed by 50x during the initial coin offering on MetaDAO.

24 hour price chart of META. Source: CoinGecko

Defiant has reached out to MetaDAO for further comment on the now-rejected transaction, but has not received a response as of press time.