Main highlights

- STBL founder Avtar Sehra announced that STBL will begin share buybacks by October.

- “Stablecoin 2.0” functions as “TCP/IP of money”

- We will introduce: A multi-factor staking (MFS) model that allows investors to increase their returns through staking.

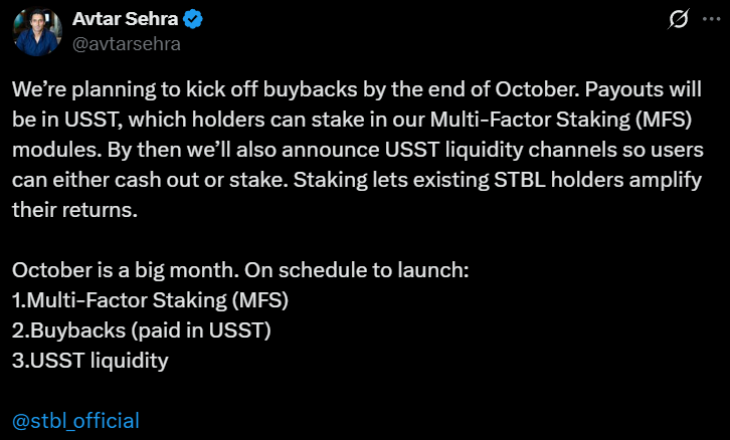

On October 13, Avtar Sehra, British financial engineer and CEO of STBL, shared an update on the company’s plans to begin STBL’s share buybacks by the end of October.

(Source: Avtar Sehra of X)

STBL share buyback details

In a thread posted on X, Avtar Sehra revealed that STBL will begin buying back tokens using STBL’s new stablecoin, USST, which was co-founded by one of the Tether founders.

This program reduces the number of tokens available and may help maintain or increase the value of the tokens. Payments are made in USST, giving holders a clear choice to spend or save their tokens.

Avtar Sehra also announced a system called Multi-Factor Staking that allows users to lock USST tokens and earn rewards. This system is “multi-factor”. Technically speaking, this system uses smart calculations to distribute rewards. This MFS model helps investors increase their revenue simply by staking and supporting the network.

Avtar Sehra spoke about the USST liquidity channel in a tweet. Turn stablecoins into cash. These liquidity channels give the USST more flexibility to spend and trade.

“We are not “another stablecoin.” We are building TCP/IP for money: an open, decentralized, and durable infrastructure. Once we’re done, the peg will hold because the market is making sure it holds. The collateral is clear. Rights are enforceable. Privacy is a feature, not an afterthought. That was the theory then, and this is the product we have now,” Avtar Sehra wrote in a post about X.

“Once completed, STBL will be the base layer on which other stablecoins are built,” he added.

Sehra shares “Stablecoin 2.0” roadmap

In another post, Sehra explained the purpose of STBL and why it is different from other stablecoins like Tether and USDC. He officially called STBL “stablecoin 2.0.” His statement relates to a research paper he wrote in 2017 titled “On Cryptocurrencies, Digital Assets, and Private Money.”

7 years later: From theory to stablecoin 2.0

Nearly eight years ago, I published a paper on cryptocurrencies, digital assets, and private money. Reading it back now, I can see why I designed STBL the way I did. The core proposition still holds true. Our execution has matured. … pic.twitter.com/rYIcB6jhnv

— Avtar Sehra (@avtarsehra) October 13, 2025

Sehra explained that STBL is a real-world version of his earlier vision for a form of digital money that is decentralized, guided by market forces, and built with privacy in mind.

He made the comparison, calling STBL the “TCP/IP of money” and suggesting that STBL could become a fundamental building block of the future of digital finance, just as TCP/IP is the fundamental protocol of the Internet.

He pointed out that the first wave of stablecoins still has major weaknesses. These include dependence on central authorities, extreme price fluctuations, and lack of private trade.

It is built entirely on a public blockchain, meaning that all actions from creating new coins to settling transactions are handled by transparent smart contracts rather than hidden central servers.

This makes the system open and easy to connect to other financial applications.

Every STBL coin in circulation is backed by a larger amount of physical cash assets to keep its value stable. Sehra clearly rejects this unsubstantiated model.

he said:Price stability requires reliable reserves. Fixed/inelastic supplies and speculative flows alone cannot support store of value, medium of exchange, and per-account functionality (SoV/MoE/UoA) without volatility control. Reliable collateral is non-negotiable. Purely algorithmic or synthetic “money” alone does not lead to market stability. ”

The third principle includes an automated system to maintain the value of the coin, which is expected to be pegged to the US dollar. Instead of manual intervention by companies, smart contracts automatically adjust the supply of STBL based on market demand.

STBL also features a unique “three-token model” to enhance compliance and clarity. One token is used for spending, another is used to earn revenue, and the third is used for community governance.

STBL has a composable design that works seamlessly across different blockchain networks with privacy layers.