On Friday, President Trump threatened to significantly increase tariffs on Chinese goods, unleashing carnage on the crypto market as US-China trade tensions escalate.

Ethereum’s native token Ether was the hardest hit among crypto benchmark CoinDesk 20 Index constituents. Ethereum$4032,20plummeting 7% from Friday’s trading high and hitting its lowest since late September, below $4,100. Its decline far exceeded that of Bitcoin. BTC$116.722,43 A drop below $118,000 resulted in a 3.5% decline, and the index fell 5%.

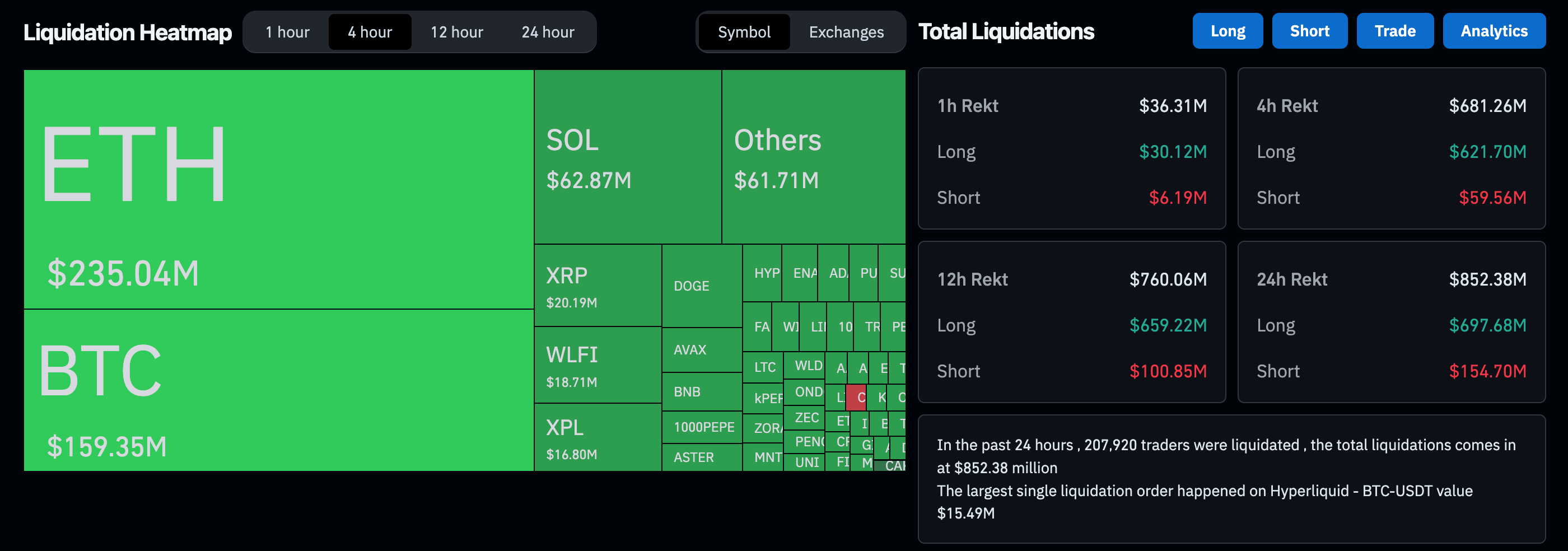

According to CoinGlass data, the market-wide downturn triggered a liquidation cascade across the crypto derivatives market, wiping out over $600 million in leveraged trading positions among all assets.

ETH also led the way in liquidations, with over $235 million of long positions extinguished throughout the session. Going long is a leveraged bet that seeks to profit from an asset’s rising price.

Cryptocurrency liquidation on October 10th (CoinGlass)

Technical breakdown

CoinDesk Research’s technical analysis model suggests that behind the liquidation cascade was a breakdown of ETH’s key support levels.

• Sales pressure appeared around 14:00 UTC, with sales volume at 372,211 units, nearly double the 24-hour average of 190,747 units.

• Volume-based resistance was identified near $4,287.

• Major resistance was identified at $4,141 when recovery attempts failed.

• Potential support forms just below $4,100, where buyers appear.