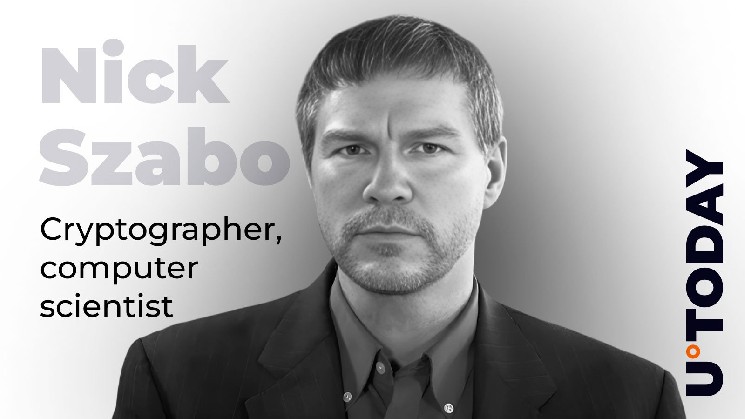

Nick Szabo, one of the first to come up with the idea of digital scarcity, decided to mix things up a bit by suggesting that while AI could work in Bitcoin’s favor, it could end up being gold’s biggest enemy.

In his opinion, once AI begins to take over production, the supply of almost everything will increase, from retail goods to money printing to mining, and robotic miners will extract more of the metals that have been sold as rare for centuries.

AI could increase the supply of almost everything, leading to general retail deflation. Banks, whether run by AI or not, will increase the supply of fiat currency. And we can also imagine robotic mining equipment increasing the gold supply.

Bitcoin is another matter. https://t.co/lGk2ZFEoXF

— Nick Szabo (@NickSzabo4) October 9, 2025

When the supply of gold becomes elastic in the age of tireless machines, its historical appeal as a store of value is diminished, as gold is no longer a scarcity, but a technology that determines its production.

Bitcoin does not follow this logic, Szabo emphasized. The AI may grow and more robots may operate the mine, but the programmed limit of 21 million coins will never change. He hints that this makes Bitcoin the only asset that cannot be uprooted by outside forces, which is why he believes its role is fundamentally different from that of gold or fiat currency.

machine money

Some say Bitcoin is now trading like a tech stock, but for Szabo, this is just a natural learning curve. Early adopters will bring volatility, leveraged bets, and noise, but after a few decades, the true store-of-value nature will emerge.

In fact, AI agents may one day even conduct transactions using BTC or request payments in BTC. Simply put, when the machine selects funds, it runs on non-gamable code rather than hoarding gold bars.