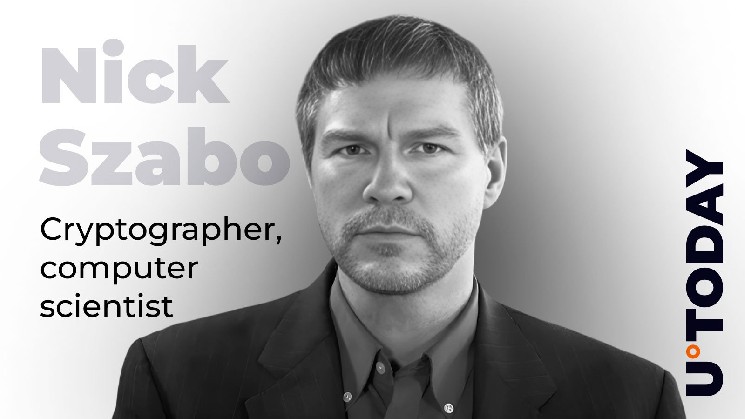

Nick Szabo, a prominent computer scientist known for introducing the concept of smart contracts, argues that the “fundamental problem” with Ethereum’s valuation is that its use case is “way out of sync” with the market value of the popular cryptocurrency.

As Szabo explains, Ethereum apps can earn big returns while the ETH price remains relatively low (or vice versa).

In fact, cryptographers are convinced that there is actually little connection between the price of Ethereum (ETH) and its utility.

Bitcoin’s main use case, on the other hand, is as a store of value (SOV), which is “strongly tied” to the price of major cryptocurrencies, among others.

Since ETH cannot properly mimic Bitcoin’s SOV use case, it must rely on other use cases that are not directly related to price.

story-driven rally

Szabo’s comments came after Thinkocracy Capital co-founder Ryan Watkins pointed out that Tom Lee’s Bitmine was the main factor that was able to push the price of ETH from $1,400 to $5,000 in a few months.

At the beginning of this year, Ethereum was considered to be a “dying” platform, but the story has changed dramatically.

“Until the party is over, it’s a game of flow and storytelling,” Watkins added.

ethereum gathering

On Monday, the price of ETH once again crossed the $4,700 level.

The cryptocurrency recently posted its best performance ever in Q3 and is set to post an even stronger performance in Q4.