Important points

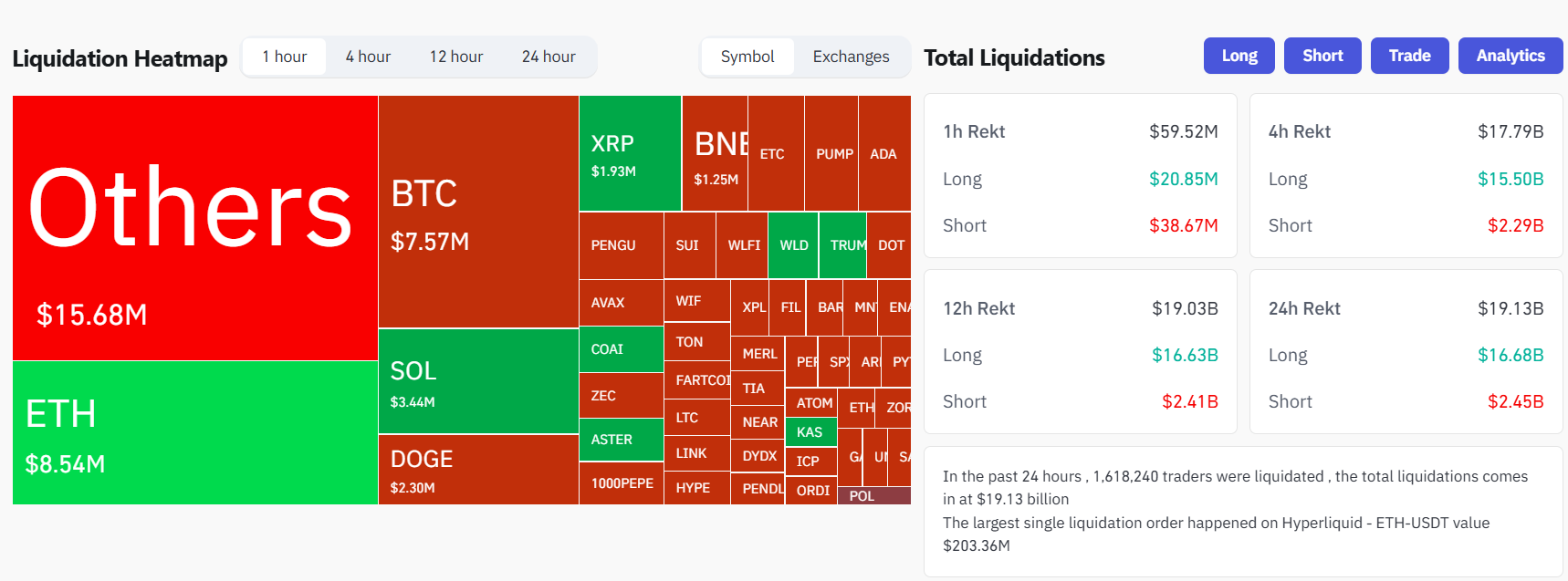

- Over $19 billion in leveraged cryptocurrency positions were liquidated in 24 hours, making it the largest single-day elimination in digital asset history.

- Long positions in Bitcoin and Ethereum were hit the hardest, with more than 1.6 million traders across major exchanges affected.

Approximately $19 billion of leveraged crypto positions have been liquidated following the brutal sell-off that took Bitcoin to $102,000. This is the largest single-day wipeout ever recorded in the digital asset market, according to CoinGlass data.

Most of the liquidations were on long positions, with total losses of $16.6 billion, compared to $2.4 billion on short positions.

More than 1.6 million crypto traders were liquidated across major exchanges, with long positions in Bitcoin and Ethereum severely impacted during Friday’s US trading hours.

The liquidation cascade was triggered after President Donald Trump proposed major tariff hikes on imports from China, and shortly thereafter announced 100% tariffs on Chinese goods in response to China’s planned export restrictions on rare earth minerals.

Following this news, Bitcoin plummeted from over $122,000 to around $102,000. Ethereum fell below $3,500, and small-cap altcoins posted double-digit losses as liquidity evaporated.

At the time of writing, Bitcoin had recovered from its previous lows and was trading above $113,000, but was still below the day’s high of $122,500, according to data from CoinGecko.