Following Bitcoin, institutional interest in altcoins continues to grow, with Ethereum (ETH) being one of the most popular altcoins.

As institutional investors continue to buy ETH, the amount of Ethereum held by institutions and companies exceeds 10% of the total supply. Experts believe this is a sign that the Ethereum market is rapidly becoming institutionalized.

According to StrategicETHReserve data, Ethereum government bonds hold approximately 5.66 million ETH and Spot Ethereum ETF holds approximately 6.81 million ETH. According to the data, the total holdings of institutional investors increased to 12.48 million ETH, representing 10.31% of the Ethereum supply.

The surge in ETF inflows in recent months has coincided with a surge in companies modeled after the largest institutional investor, Strategic (formerly MicroStrategy), and with public companies like Bitmine and Sharplink adding large amounts of ETH to their balance sheets.

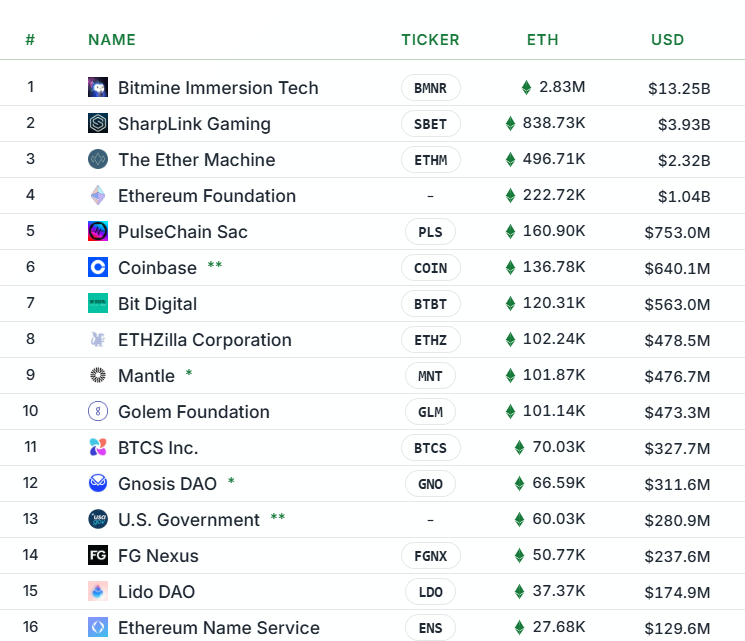

The largest institutional Ethereum company is Bitmine, led by Tom Lee, with 2.83 million ETH (valued at $13.25 billion), according to data from StrategicETHReserve.

Sharplink Gaming took second place with 838.7 thousand ETH worth $3.93 billion, and third place went to The Ether Machine with 496.7 thousand ETH worth $2.3 billion.

*This is not investment advice.