Global demographic changes and increasing wealth are likely to drive cryptocurrency adoption and asset demand into the next century.

Demand for global assets, including cryptocurrencies, is expected to be driven by the aging of the world’s population and rising global productivity, resulting in a growing elderly population with more capital available to invest.

According to the Kansas City Federal Reserve, this dynamic will drive demand for assets through 2100. “In terms of asset demand, the aging of the population means that the upward trend of recent decades will continue,” the research report released on August 25 said.

“Extending past analysis using demographic projections, we predict that aging will increase demand for assets by an additional 200% of GDP between 2024 and 2100.”

The report added that this move “suggests a continued decline in real interest rates” and could increase demand for alternative investments such as Bitcoin (BTC).

Source: Kansascityfed.org

Related: Cryptocurrency trader turns $3,000 into $2 million as meme coin soars by CZ Post

Investors will value Bitcoin like gold in the next 75 years

Cryptocurrencies are still considered risky assets, but regulatory clarity could mean that an aging population will value Bitcoin (BTC) as much as gold within the next 75 years, according to Gracie Chen, CEO of cryptocurrency exchange BitGet.

According to a report by crypto payment company Triple A, about one-third, or 34%, of the world’s crypto holders were between the ages of 24 and 35 as of December 2024.

Although cryptocurrencies remain a volatile asset class, regulatory clarity and the rise of institutional products like ETFs could make Bitcoin more attractive to older investors, Chen told Cointelegraph.

“The ongoing maturity of cryptocurrency regulations could play a positive role in driving future demand for this asset class.”

Chen added that with cryptocurrencies’ increasing “government support” and proven role as a store of value, an aging population “will evolve to value Bitcoin as much as they have come to value gold over the course of 75 years.”

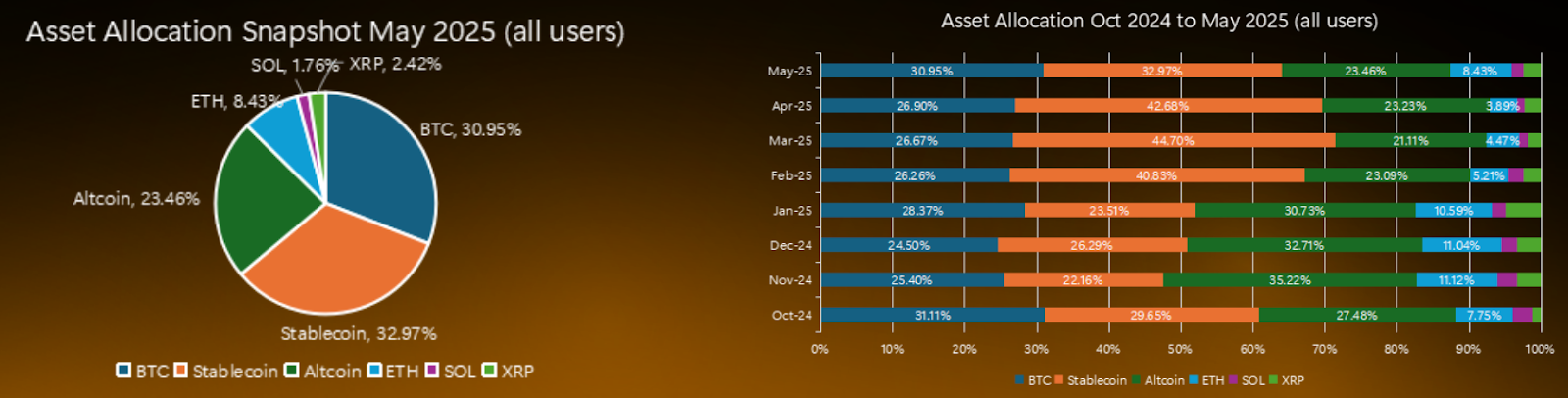

Asset allocation for crypto investors. Source: Bybit Research

As of May, Bitcoin accounted for one-third (30.95%) of total assets in investors’ portfolios, up from 25.4% in November 2024.

Related: Bitcoin ETF launches ‘Uptober’ with $3.2 billion in second-best week in history

Increasing wealth drives crypto diversification

Analysts at crypto exchange Bitfinex said rising global wealth is likely to lead to greater risk appetite and diversification into emerging asset classes such as cryptocurrencies.

Analysts told Cointelegraph that “increasing private wealth drives higher risk appetite and diversification into newer assets.” “While rising asset levels will be reflected in increased demand for cryptocurrencies, we believe investors with longer investment horizons are likely to be more willing to invest in Bitcoin.”

He added that younger, more tech-savvy investors “will look favorably at altcoins and new cryptocurrency projects given their deeper understanding of technology and risk tolerance.”

magazine: Bitcoin is “interesting internet money” in times of crisis: Tezos co-founder