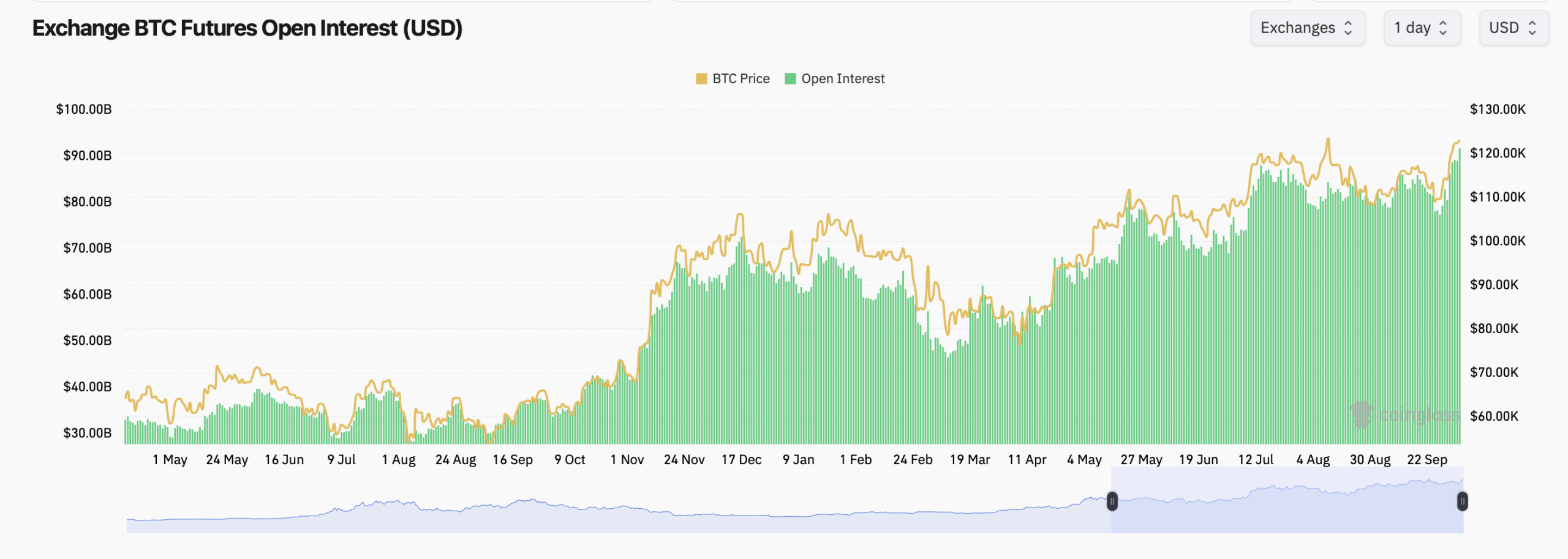

Bitcoin’s derivatives engine just went into overdrive, with futures open interest rising to a record high of $91.59 billion while spot open interest hovered around $123,142 as of 9:30 a.m. Sunday.

Bitcoin’s record futures stack meets call-heavy options frenzy

At the index level, Bitcoin rose to $125,725 this week and then fell to $123,142, without the derivatives crowd blinking. Total futures open interest (OI) collected by Coinglass.com rose 2.04% on the day to a record high of nearly $91.59 billion, indicating that traders added risk in exchange for profit. Translation: The casino lights are on and the chips are stacked high.

CME still wears the crown with an OI of $18.19 billion (about 19.85% of total assets) and exposure worth 147,800 BTC. This was followed by Binance with $16.44 billion (17.94%), Bybit with $10.13 billion (11.06%), and Gate with $9.44 billion (10.3%). OKX shows $4.96 billion (5.41%), while Bitget holds $6.09 billion (6.64%). Rounding out the top 10 are MEXC ($4.04 billion, 4.4%), WhiteBIT ($2.94 billion, 3.21%), BingX ($1.78 billion, 1.94%), and Kucoin ($1.24 billion, 1.35%).

A 24-hour moving company adds even more flavor. Kucoin’s OI jumped an astonishing 65.79%, Bitget added 5.95% and WhiteBIT recorded 4.25%. Binance rose 3.06%, OKX rose 2.83%, and CME Institutional Lane rose 0.89%. On this day, Bybit, Gate, BingX, and MEXC fell slightly. Another thing to note is that CME’s OI-to-volume ratio near 2.47 suggests a more sticky and longer tenor position.

Options traders are optimistic. Calls accounted for 39.74% of puts compared to 60.26% of options OI, and the past 24 hours were similarly skewed, with calls accounting for 58.05% of the volume. The leaderboard is full of upside strikes. Deribit’s December 26th $140,000 call leads with an OI of approximately 9,893.9 BTC, followed by the December 26th $200,000 call at 8,522 BTC and the October 31st $124,000 call at 7,210.9 BTC. December’s $120,000 and $150,000 calls also carry significant interest.

The greatest pain, the level at which buyers and sellers collectively experience the least joy, is concentrated around the six digits. As the expiration date nears, it gravitates toward $115,000, but in the second half of the fourth quarter, the Deribit curve hovers around $120,000 to $125,000. With spot orbiting $123,000, dealer hedging flows around these nodes could add more chop, especially as the end of the month approaches.

In summary, the Bitcoin Futures and Options Committee says that participants are very broad and well-funded. Bulls can point to record futures OI, call-heavy options skew, and a maximum pain band just below the spot price. Bears could argue that the upside calls are crowded and there is room for pressure on the higher OI stack. Either way, derivatives are still setting the stage, and Bitcoin is unlikely to miss the trigger.