Ethereum continues to show strength, approaching the midline of the ascending channel and is currently trading near $4,670. The market has been steadily recovering since late September, but signs of local depletion have begun to appear, suggesting the possibility of a short-term recession before further rise.

Technical Analysis

By Shayan

Daily Chart

In the daily time frame, ETH is supported by a 100-day moving average around $3,900 and a 200-day moving average around $3,000, and remains firmly within the upward channel structure. Prices are approaching the $4,800 resistance zone, a key level that has been keeping repeated rises over the past few months.

The RSI has also risen to 62, reflecting healthy momentum, although it has not been overheated yet. While breaking above $4,800 could pave the way for psychological levels to test above $5,000, if not maintaining current levels, it could lead to a retry of the lower limit of the upward channel, and even the important $4,000 demand zone, which is crucial for investors to hold to maintain the bull market.

4-hour chart

The 4-hour chart shows an early bearish divergence between prices and RSI, indicating that momentum has faded as ETH tests its main $4,700 to $4,800 resistance zone. However, a small bullish fair value gap (FVG) has formed around $4,600, which could attract short-term retracements and support before continuing.

If buyers keep up with this gap and regain their initiative, their next upside target remains at $4,800. However, losing this level could lead to deeper adjustments towards the $4,200, where the strong demand zone and the recent inverted head and shoulder pattern neckline is located.

On-Chain Analysis

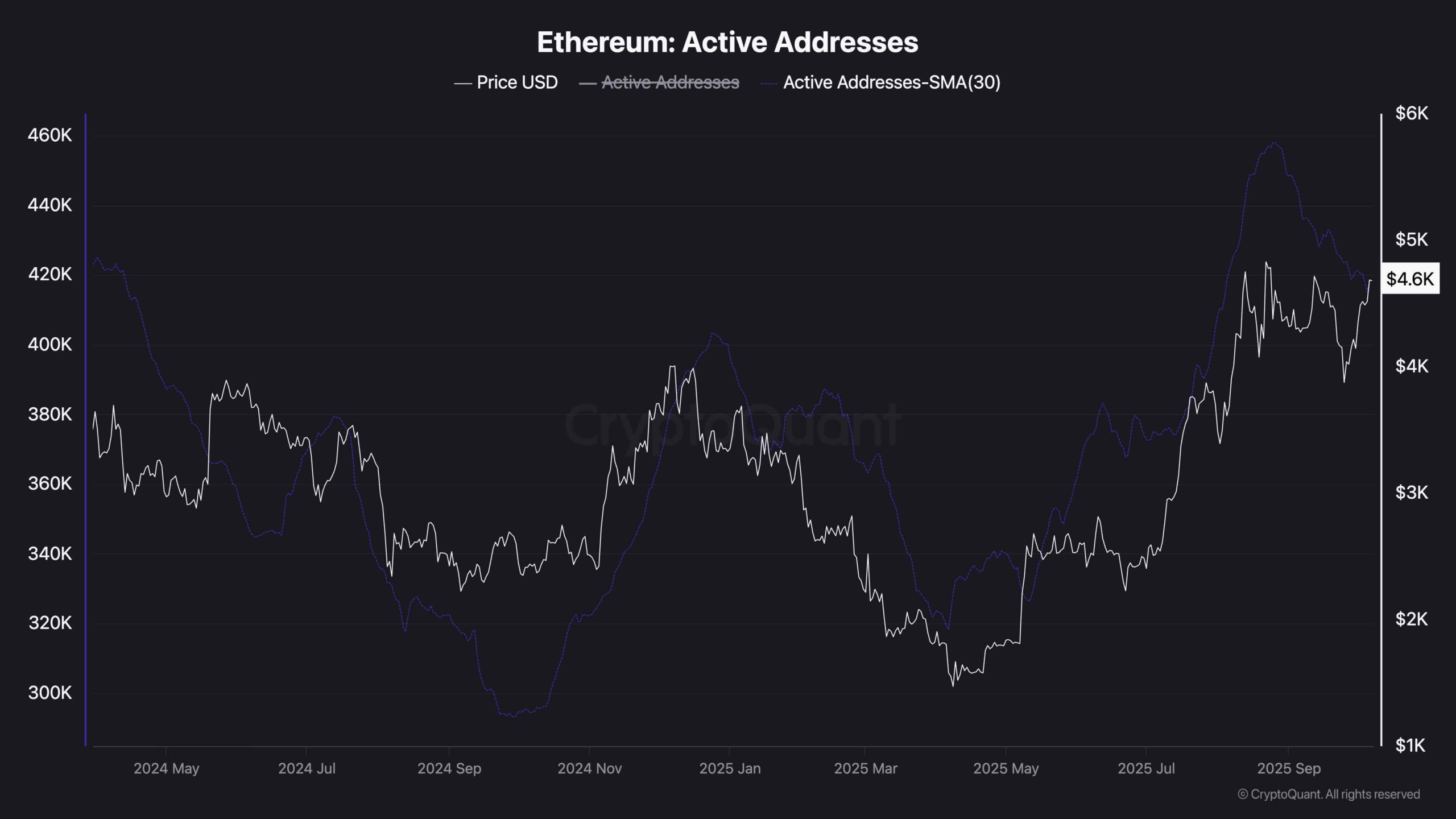

Ethereum prices are bounced strong and seem ready to go up even further, but on-chain activity tells a slightly different story. Despite rising prices, the number of active addresses has recently declined slightly. This indicates that there is a short-term disconnect between network participation and market performance.

To sustain this upward trend, active addresses must rise along with prices, supporting true user engagement and on-chain demand. The continued decline in activity suggests a weakening of fundamentals, which could make it difficult for ETH to maintain momentum beyond the $4,700-$4,800 resistance zone.