Precious metals and Bitcoin (BTC) are rising to new all-time highs, along with risk assets such as stocks, as the U.S. dollar (USD) is on track for its worst year since 1973, according to market analysts on Kobeissi’s letter.

The S&P 500 stock market index has increased over 40% in the past six months, BTC reached a new all-time high of over $125,000 on Saturday, and gold is trading at $3,880 as of this writing.

“The correlation coefficient between gold and the S&P 500 reached a record 0.91 in 2024,” the analysts wrote, adding that this unusual correlation between safe-haven and risk assets shows the market is pricing in “the new monetary policy.”

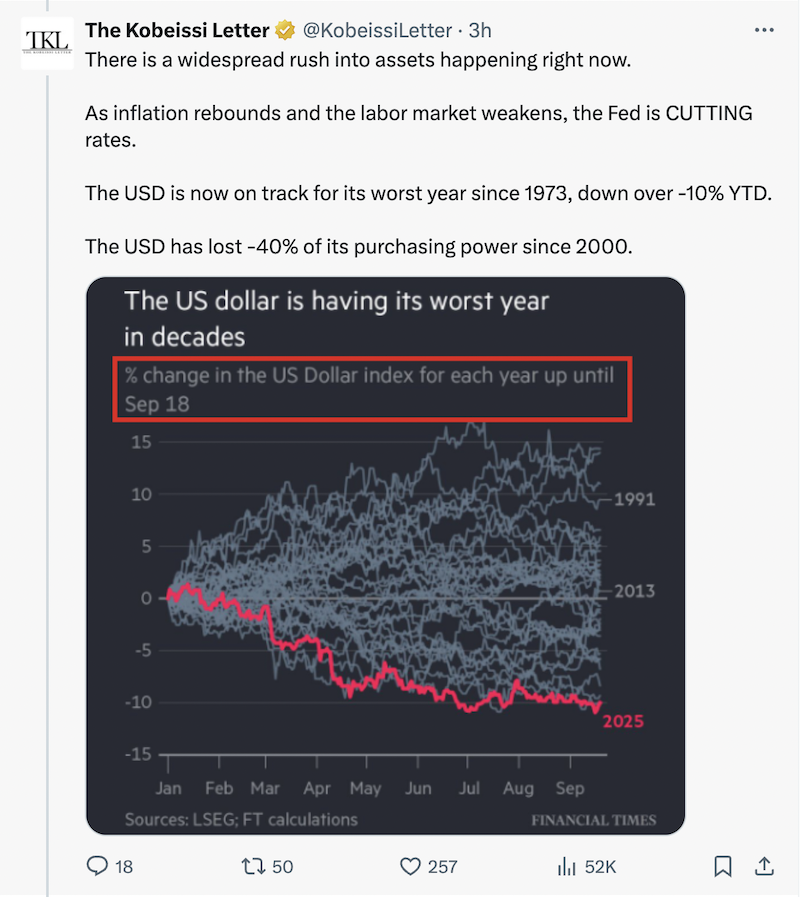

“There is a widespread rush to assets that is occurring now. As inflation rebounds and the labor market weakens, the Federal Reserve is being cut. Since 1973, the U.S. dollar has declined more than 10% annually.

sauce: cobessy’s letter

This analysis comes amid growing concerns about a weakening labor market, interest rate cuts, and the eroding value of the dollar, amid a U.S. government shutdown, a major downward revision of U.S. employment numbers.

Related: Bitcoin corrects from all-time high to $125,000: Where is BTC?

Analysts agree new BTC will be fueled by all-time high macroeconomic factors

According to Fabian Dori, Chief Investment Officer at Global Digital Asset Bank Sygnum, BTC’s rally to new all-time highs was driven by macroeconomic factors, including the recent US government shutdown.

The U.S. government shutdown that began Wednesday has forced regulatory agencies and bureaucracies to shut down operations completely or operate with bare-bones budgets and skeleton staff.

Bitcoin has hit all-time highs and is in a bull market. sauce: TradingView

The “political dysfunction” caused by the shutdown has renewed investor interest in BTC as a valuable financial technology as faith in traditional institutions wanes, Dori told Cointelegraph.

magazine: Scottie Pippen says Michael Saylor warned him about Satoshi’s chatter