According to the co-founder of Multicoin Capital, the Stablecoin-centric genius law enacted in July causes the departure of deposits from traditional bank accounts to high-yield stubcoins.

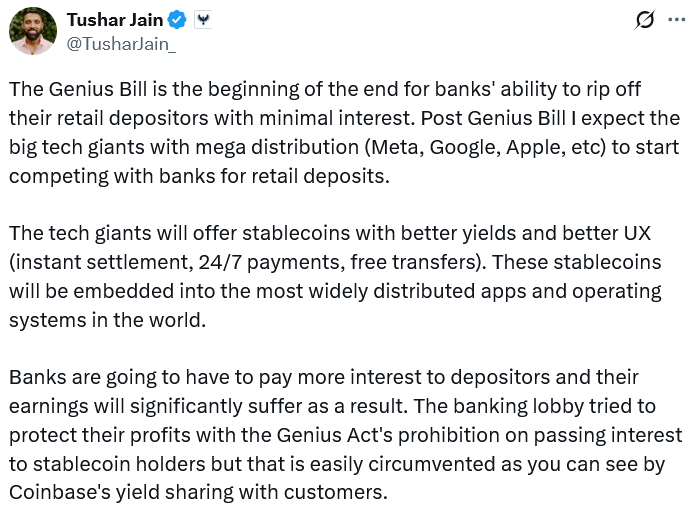

“The Genius Bill is the beginning of the end of the bank’s ability to prey on retail depositors with minimal interest,” Tusha Jain, co-founder and managing partner of Multicoin Capital, posted on X on Saturday.

“We hope that after the genius, big tech giants with mega distribution (meta, Google, Apple, etc.) will start to compete with banks for retail deposits,” Jaina added, claiming that they will offer better stubcoin yields by offering a better user experience for immediate settlements and 24/7 payments than traditional bankers.

He noted that the banking group attempted to “protect profits” in mid-August by calling on regulators to close the so-called loopholes that could allow stubcoin issuers to pay interest or profits on stubcoin through affiliate marketing.

sauce: Tushar Jain

The Genius Act prohibits Stablecoin issuers from providing interest or yields to token holders, but as they do not expressly extend the prohibition to crypto exchanges or affiliated companies, it may be possible that issuers can circumvent the law by providing yields through these partners.

US banking groups are concerned that the widespread adoption of ridiculous stubcoins that support yields could undermine traditional banking systems that rely on banks that attract deposits to fund lending.

$6.6 trillion could leave the banking system

A massive, ridiculous recruitment could result in approximately $6.6 trillion in deposit outflows from the US Treasury’s traditional banking system, estimated in April.

“The outcome is a greater risk of deposit mail that undermines the creation of credit across the economy, especially during stress. A corresponding decline in credit supply means higher interest rates, lower loans and increased costs for businesses and households on Main Street,” the Institute of Banking Policy said in August.

To remain competitive, “banks will have to pay more interest to depositors,” Jain said, adding that “their revenue will suffer a lot as a result.”

Stablecoins offers users up to 10 times more interest

The average interest rate for US savings accounts is 0.40%, while in Europe, the average rate for savings accounts is 0.25%, said Patrick Collison, CEO of online payments platforms last week.

Meanwhile, the fees for borrowing and lending platforms Tether (USDT) and circle USDC (USDC) are currently 4.02% and 3.69%, respectively.

Large tech companies reportedly are investigating Stablecoins

Jain’s bet on Big Tech Giants follows the June Fortune Report, stating that Apple, Google, Airbnb and X are one of the companies exploring to issue Stablecoins to reduce fees and improve cross-border payments. There has been no further development since.

Related: All currencies will become stubcoins by 2030. Tether co-founder

The Stablecoin market is currently located at $308.3 billion with $177 billion and $75.2 billion led by USDT and USDC, Coingecko data shows.

The Treasury forecasts Stablecoin’s market capitalization will rise by another 566% to $2 trillion by 2028.

magazine: Crypto wanted to overthrow the bank, but now they’re becoming them on Stablecoin Fight