The Bitcoin Treasury accumulated $1.2 billion in BTC last week, but analysts suggest that Bitcoin’s new all-time high is likely to be higher due to inflows into Bitcoin exchange sales funds.

Bitcoin continued its spikes over the weekend, reaching its new all-time high of over $125,000 on Saturday.

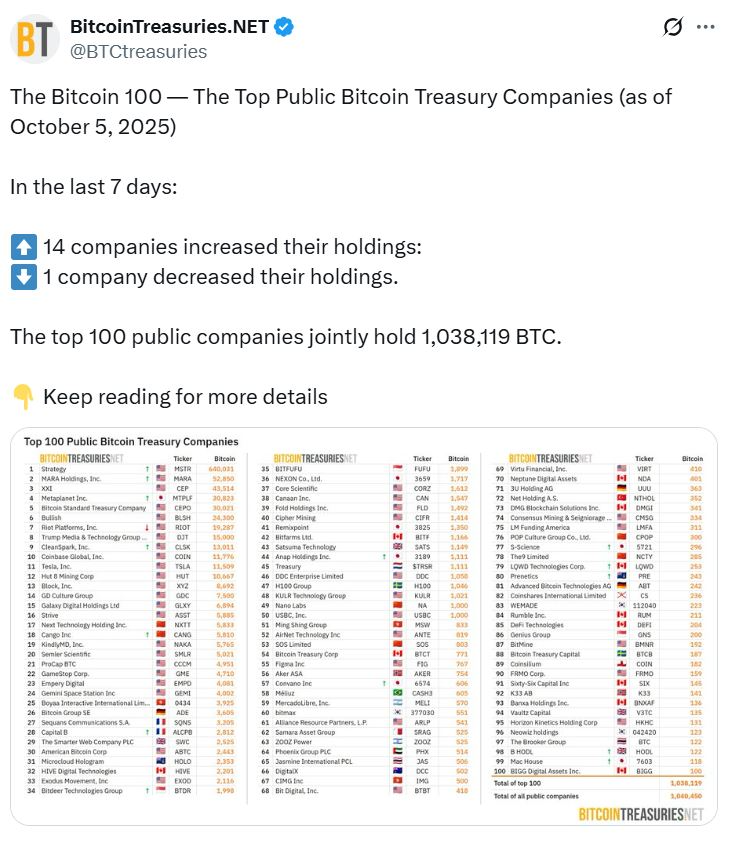

The Bitcoin (BTC) Ministry of Finance purchased more than 6,702 coins over a week, led by Japanese investment company Metaplanet, adding 5,258 Bitcoins on October 1st.

In comparison, the Spot Bitcoin ETF recorded a net inflow of $3.24 billion last week, roughly coinciding with the November 2024 recording week.

sauce: bitcointreasuries.net

ETF influx behind price spikes

Vincent Liu, chief investment officer at quantitative trading company Kronos Research, told Cointelegraph that it was the ETF influx that caused the price rise in Bitcoin.

However, “there were other factors, such as a tight supply of exchange, weak dollars and macro uncertainty. Strong institutional demand over the weekend has strengthened bullish momentum,” he added.

The agency is snapping more bitcoin than miners can supply this year. On average, miners generated around 900 bitcoins per day, with a September report from financial services firm River showing that companies acquired 1,755 bitcoins per day, and ETFs purchased 1,430 bitcoins per day in 2025.

Analysts at Bitfinex Crypto Exchange predicted that a new Altcoin season or rally could be caused by a new Crypto ETF approval in August.

Bitcoin ETF Wild Week

Crypto analyst and trader Will Clemente III also pointed out ETF influx as a catalyst for the recent surge in Bitcoin on the X Post on Sunday.

“We could get one last DIP, but the most bullish thing about this move for Bitcoin is that it wasn’t driven by the boredom of finance companies or Perp, but by the purchase of spot ETFs.

sauce: It will be Clemente

Bloomberg Intelligence analyst Eric Balknath also said Bitcoin’s all-time high came after the ETF became “wild at +$3.3 billion a week, $24 billion a year.”

ETFs may drive more growth

Bitcoin ETF inflows could be a catalyst for further growth towards the end of the year.

Liu said Bitcoin’s fourth quarter outlook will be shaped by “institutional adoption.”

“The future Bitcoin acquisition will likely strengthen supply and a long, long, supportive macro environment with institutional adoption, clarity of regulations and exchanges coming down for the first time in six years.”

Bitcoin’s Executive Chairman, Bitcoin’s Bull Michael Saylor, in September, predicted that Bitcoin will start to gain momentum again towards the end of the year after facing upward pressure from growing corporate and institutional interest.

Related: Crypto Treasuries’ “Easy Money” is over, but that might be good for crypto

According to Bitbo, the ETF holds over 1.5 million Bitcoin worth $188 billion, worth $188 billion.

Meanwhile, the company Bitcoin Treasury currently accounts for 6.6% of its total supply, valued at over $166 billion.

magazine: How do major religions in the world see Bitcoin and cryptocurrency?