Despite the clear demand for large investments and yields, most Bitcoin holders have never tried BTCFI, as they find the platform complex and unfamiliar. Without simpler products and better communication, BTCFI can stay in an insider’s niche space rather than reaching mainstream adoption.

summary

- Despite investors pouring money into the space and clear demand for yield and liquidity, most Bitcoin holders have yet to touch on BTCFI.

- The problem is that the current platform is built for inter-crypto insiders, and everyday BTC users are not aware that they are confused, discreet, or that these products exist.

- Gomining warns that unless BTCFI is simpler and communicates better, there is a risk of maintaining a niche instead of reaching a wider range of Bitcoin audiences.

Venture funds and media hype may suggest that Bitcoin debt (or simply known as BTCFI) is on the rise, but Bitcoin users are talking about something else. A new survey by Gomining, shared with Crypto.News, found that nearly 80% of BTC holders have never used BTCFI, highlighting the gap between industry ambitions and actual adoption.

Gomining’s BTCFI survey results | Source: Gomining

Similar to Ethereum’s Decentralized Finance (DEFI), BTCFI was intended to provide a set of tools and platforms that would allow BTC to be used economically beyond purchasing and holdings. For example, people can use BTC for lending, access synthetic Bitcoin assets, or provide bridges via cross-chain bridges to access different networks.

It seems that institutional pouring is also growing. Data from enterprise-grade Bitcoin-centric infrastructure provider Maestro shows that BTCFI venture funding surged to $175 million in 32 rounds in the first half of 2025, with 20 of 32 focusing on consumer apps in the BTCFI space.

Code natives only

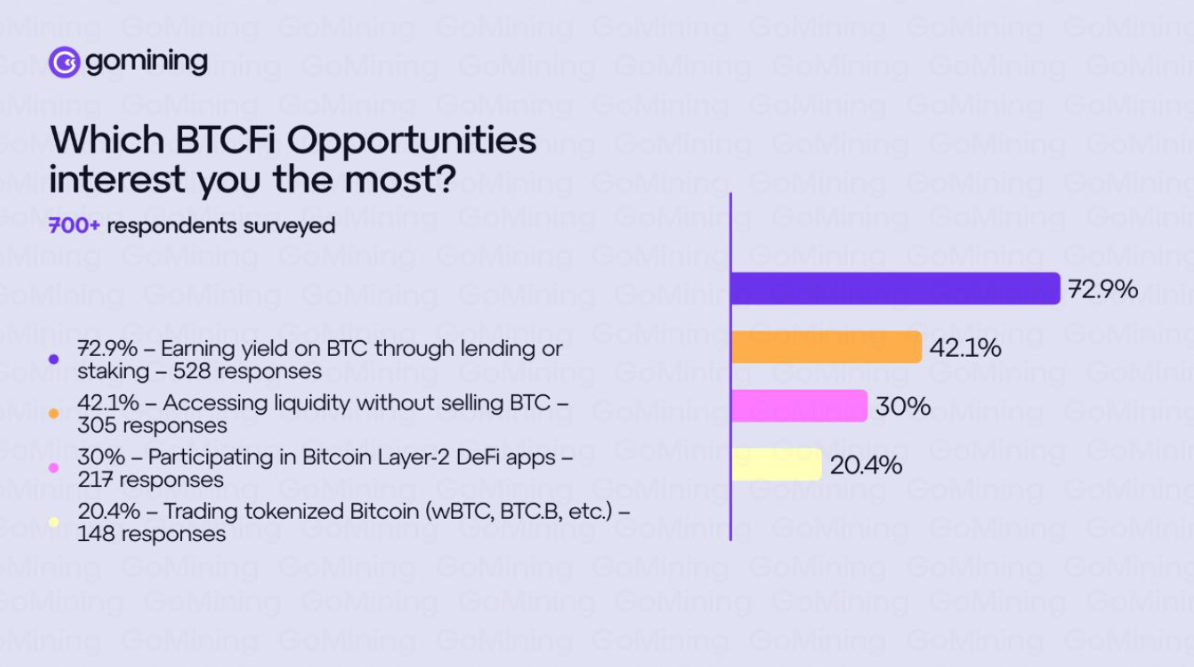

However, a Gomining survey that questioned more than 700 people in North America and Europe shows that around 77% of Bitcoin holders have never tried BTCFI. As the company explains, this issue is not a shortage of demand. The survey shows that 73% of Bitcoin holders want to earn returns on their assets, while 42% are interested in accessing liquidity without selling.

Gomining’s BTCFI survey results | Source: Gomining

You might like it too: After years of foundation, Bitcoin defi is ready to surge | Opinion

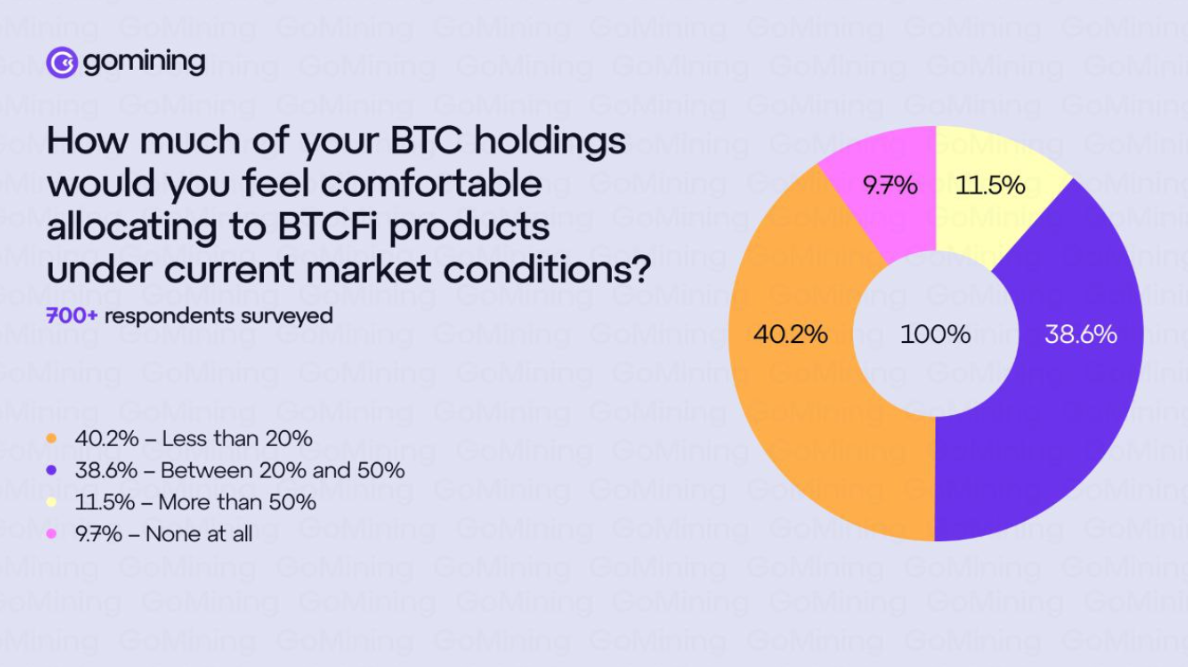

Adoption seems slower due to trust and complexity. Over 40% of respondents said they committed less than 20% of Bitcoin to their BTCFI products.

Gomining CEO Mark Zalan said the results matched what the company saw in its own work, adding, “There is a huge appetite for these opportunities, but the industry is building products from crypto, not everyday Bitcoin holders.”

Lack of consciousness

Perhaps the clearest challenge for BTCFI is recognition. Almost two-thirds of the surveyed participants (approximately 65%) were unable to name a single BTCFI project. For Zaran, this refers to a failure in communication.

“This is not to say that Bitcoin holders can’t keep up. The BTCFI industry needs to communicate more effectively with their target market. If two-thirds of potential users can’t name a single project in the space, they face adoption challenges that education can solve.”

Mark Hank

Gomining’s findings suggest that so far, BTCFI is primarily talking to insiders, rather than the broader foundation of Bitcoin owners.

It’s not like defi

One reason for the disconnection was that BTCFI borrowed heavily from the Defi model of Ethereum. However, Bitcoin users tend to have different preferences. They often support custody wallets and funds traded on regulated exchanges rather than independent property and complex protocols.

As Zalan explained, Bitcoin holders were “not Ethereum users,” and Coinbase and Bitcoin ETFs were successful “as they prioritized accessibility.” In other words, appetite exists, but the platform needs to be simpler, safer and easier to use.

This study paints a picture of a sector with both potential barriers and barriers. Bitcoin holders obviously want yield and liquidity options, but are not rushing to the BTCFI platform due to trust issues, complexity and low brand awareness.

And that contradiction creates both challenges and possibilities. If the BTCFI platform invests more with clear communication and simple onboarding, it may be able to beat a wider Bitcoin audience. But if not, BTCFI is at risk that it remains a niche space for crypto insiders rather than the millions of Bitcoin holders it aims to serve.

read more: It’s finally paid to be on defi, it’s great | opinion