Ethereum prices It’s not just blockchain upgrades and activities on the chain. It also leads to the same macroeconomic style that shakes stocks and bonds. As US government closures slow down critical economic data, the Federal Reserve is facing blind spots ahead of its policy meeting in October. That uncertainty is directly fed to risk assets. Includes ETHthe price. The chart shows the price of Ethereum in recovery mode, but the shutdown throws it at a new layer of volatility.

Why is shutdown important for ETH prices?

Shutdown will shut down the Bureau of Labor Statistics. This means there is no official employment reports or inflation data. For the Fed, this is like a steering wheel without instruments. Typically, such data facilitates interest rate decisions, which form liquidity across the market. If the Fed hesitates to cut without a reliable number, risky assets like ETH prices can lose momentum. Conversely, if private data (such as ADP pay) appears weak, the Fed may tilt towards more cuts, increase liquidity and support ciphers that support indirectly.

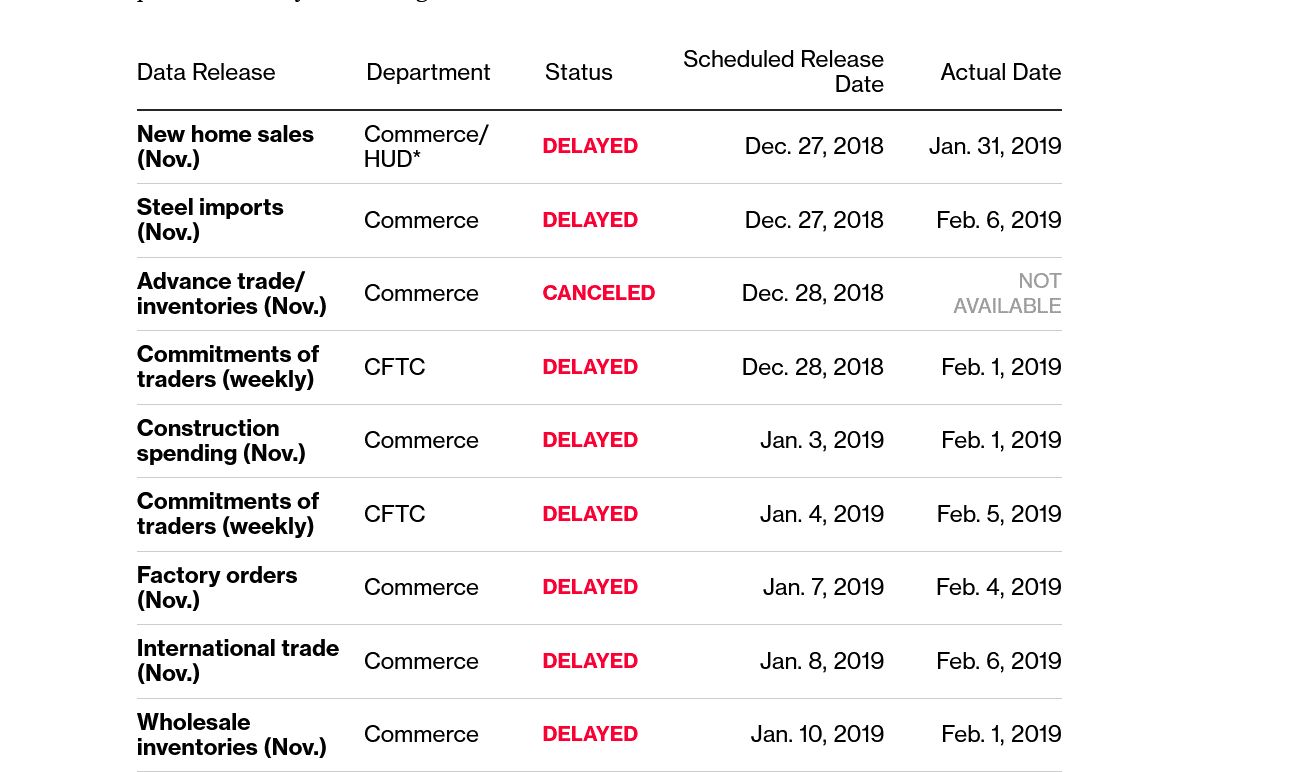

Image source: Bloomberg

This is more than just a theory. During the 2018-2019 shutdown, delays in reporting have led the Fed to pause hikes rates and highlight how missing data will influence policies. If the current shutdown is dragged, ETH prices could swing by shifting Fed policy expectations rather than their own basics. The 17-day closure in October 2013, when BLS was last closed, bringing back reports for both September and October.

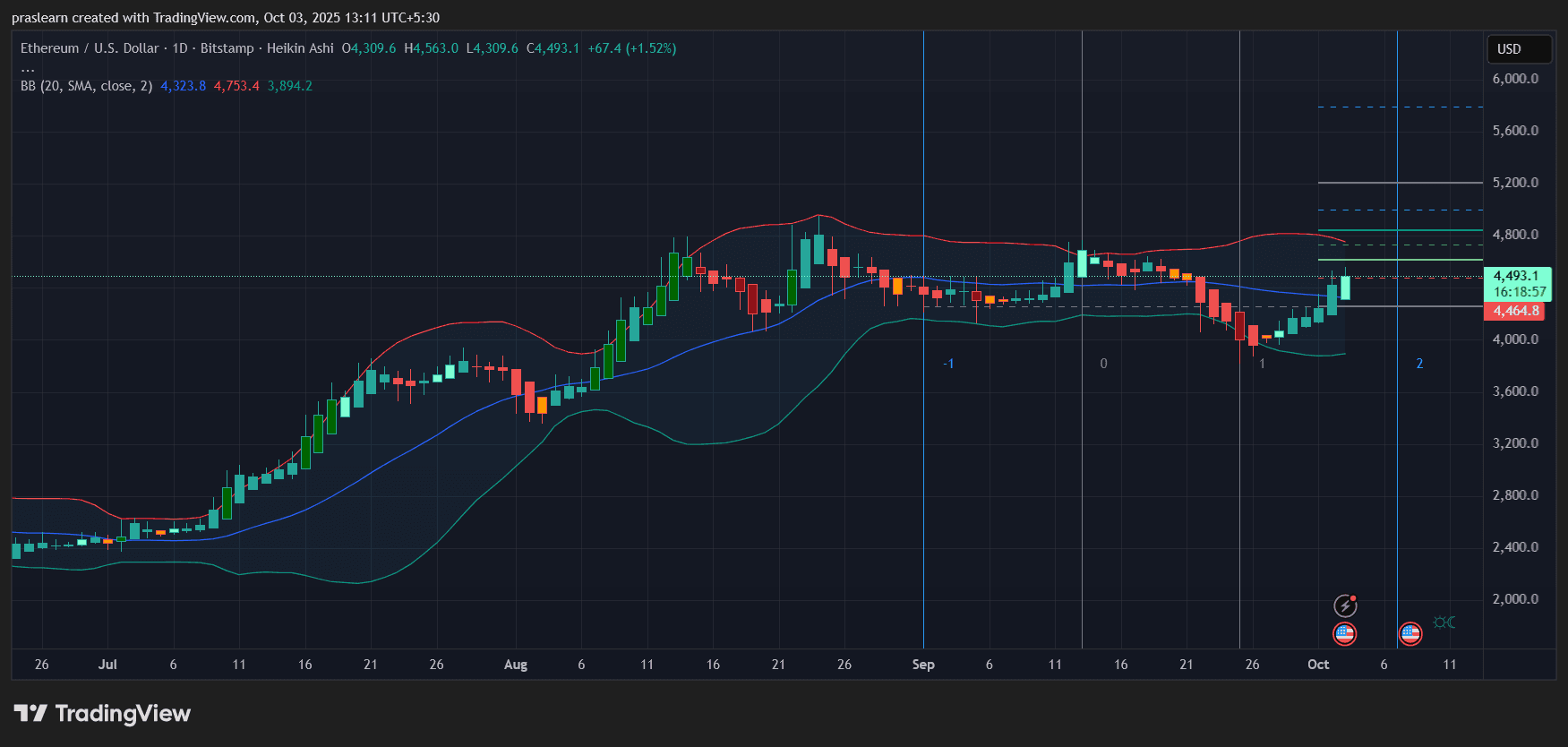

Ethereum price forecast: Read ETH Daily Chart

eth/usd daily charts – TradingView

The chart bouncing strongly from the Ethereum priced $4,300 zone and currently trades around $4,493. Key technical signals:

- A nearly $3,900 Bollinger Band served as support, with buyers actively intervening.

- Price collects the middle band and pushes towards the upper band, which is close to $4,750. This is immediate resistance.

- A break above $4,750 could see $5,600 when momentum accelerates and open the door to $5,200.

On the downside, if US government closure-driven uncertainty puts pressure on the market, ETH prices could be revisited at $4,300 and then $3,900. The hikin reed candle also shows bullish inversion strength, but a volume check is required for a sustained breakout.

Shutdown Impact Scenario for Ethereum Price Prediction

- Short shutdown, weak private data

If ADP and other private indicators show job debilitating and feel forced by the Fed to reduce rates, ETH could break through resistance and benefit from an increased risk. - Long term shutdowns, food stalls are given

The lack of reliable government data could result in the Fed delaying cuts and leaving the market in scope. That indecisiveness allowed him to limit ETH gatherings and continue to stuff it with a consolidation of under $4,750. - Market overreaction to uncertainty

If the stocks fall into data blackouts and policy disruptions, ETH will be pulled lower with the wider risk assets and once again test their $4,300 support.

Investor Psychology and Macro Correlation

Crypto traders often argue that Ethereum prices are detached from traditional markets, but history shows that ETH prices still react to macrocatalysts. Rates reduce fuel fluidity, risk-on behavior, and stubcoin inflows to defi. Conversely, uncertainty is hungry for speculative demand ETH. Currently, shutdowns act as psychological overhangs. Even if Ethereum’s foundations become stronger, the lack of clarity from Washington could amplify volatility in the coming weeks.

Conclusion

$Ethereum is at the intersection. While the daily chart points to a bullish recovery, the shutdown clouds the Fed’s decision-making process. This is important for the next leg of ETH. If the shutdown is resolved quickly or private data pushes the Fed towards mitigation, the $ETH could rise to over $5,200. But if political burglars drag and the Fed stalls, Ethereum risks another dip towards $4,300. For now, traders should expect a rise in volatility and watch both the Bollinger Band level and the FRED signal carefully.