The $300 million HPC deal for Cipher Mining (CIFR) was supposed to be a catalyst, but inventory lay down as the $1.3 billion convertible raise stole the spotlight. Here’s why the institution hastened and what it means to shareholders:

The next guest post comes from bitcoinminingstock.io, A public market intelligence platform that provides data on companies exposed to Bitcoin mining and cryptocurrency strategies. Originally published by Cindiffen on October 1, 2025.

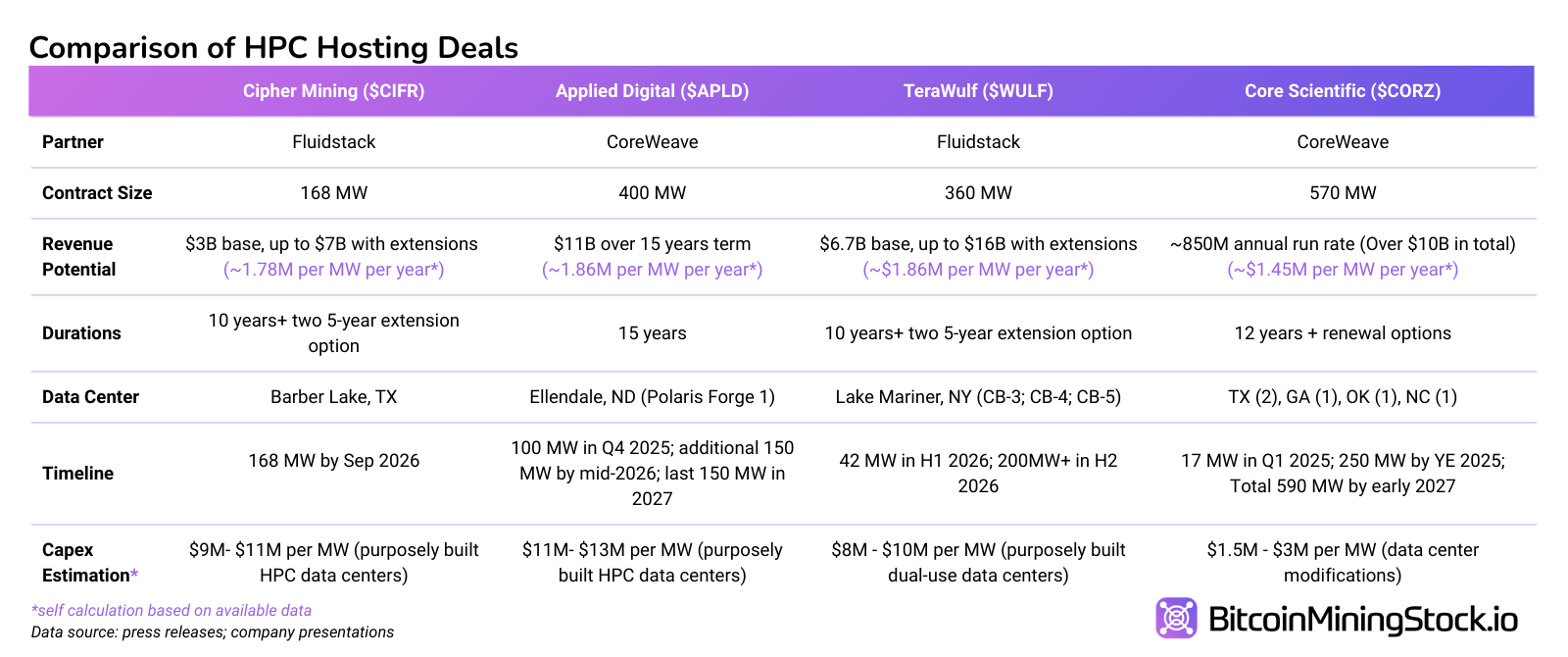

Recent Crypto Mining announcement The first hyperscale trading revealed Fluidstack as an HPC client. This marks the fourth major HPC hosting agreement among public miners and enhances the sector’s pivot to HPC as a complement to Bitcoin mining.

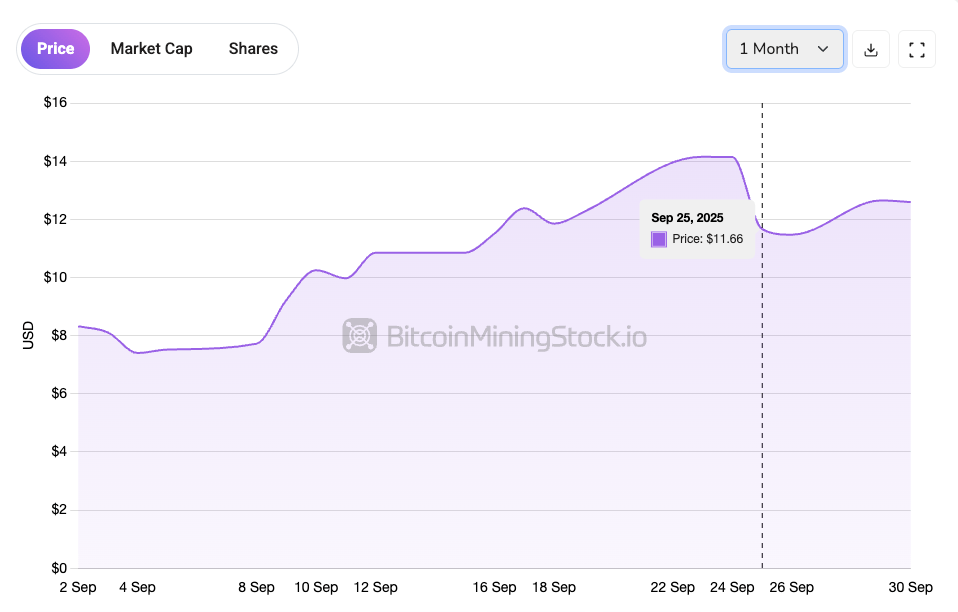

Such announcements usually cause sustained gatherings. This time, Cipher’s stock was first checked, but quickly fell after announcing a massive private finance. Within 24 hours, $800 Million Private Convertible Note Offer Up size $1.1 billion On overwhelming institutional demand. On social media, investors have denounced the convertible for killing momentum. This perception is understandable, but it also reminds us that large upfront costs are required to make the benefits of HPC/AI a reality.

Let’s unlock this mechanism of funding contracts. Because the institution hastily finds why shareholders responded cautiously.

HPC Economics and Funding Links

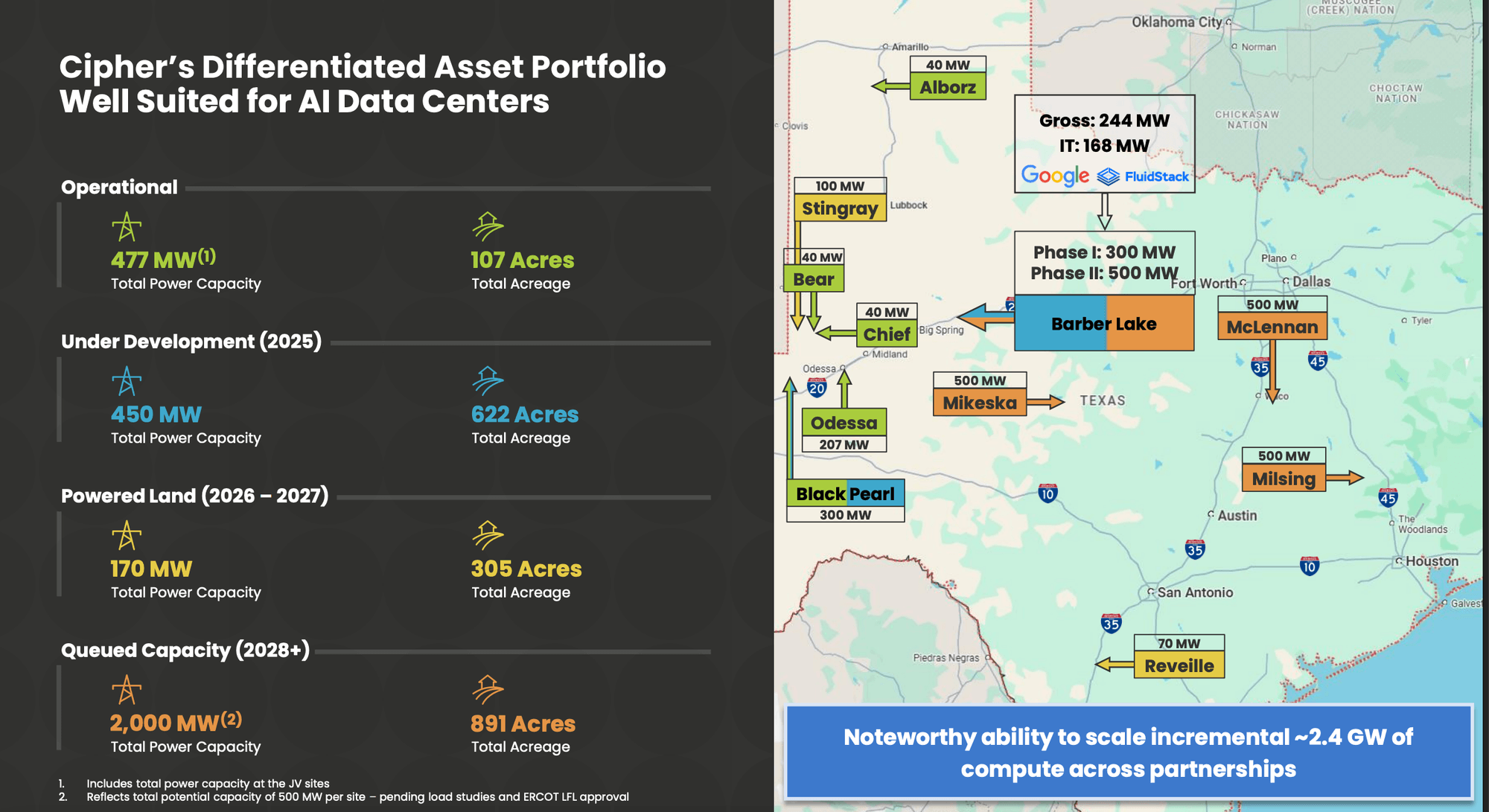

The Barber Lake site and Cipher’s wider 2.4 GW pipeline are the backbone of HPC strategies. You need Hyperscalers Large prepaid spending Land, power interconnections, and data center build-outs. Fluidstack examined demand, but capital was a bottleneck.

*Barber Lake’s 168MW build alone is expected to require a capital investment of around $1.5 billion to $1.8 billion, even before taking into account the additional costs required to fully utilize Cipher’s wider energy pipeline.

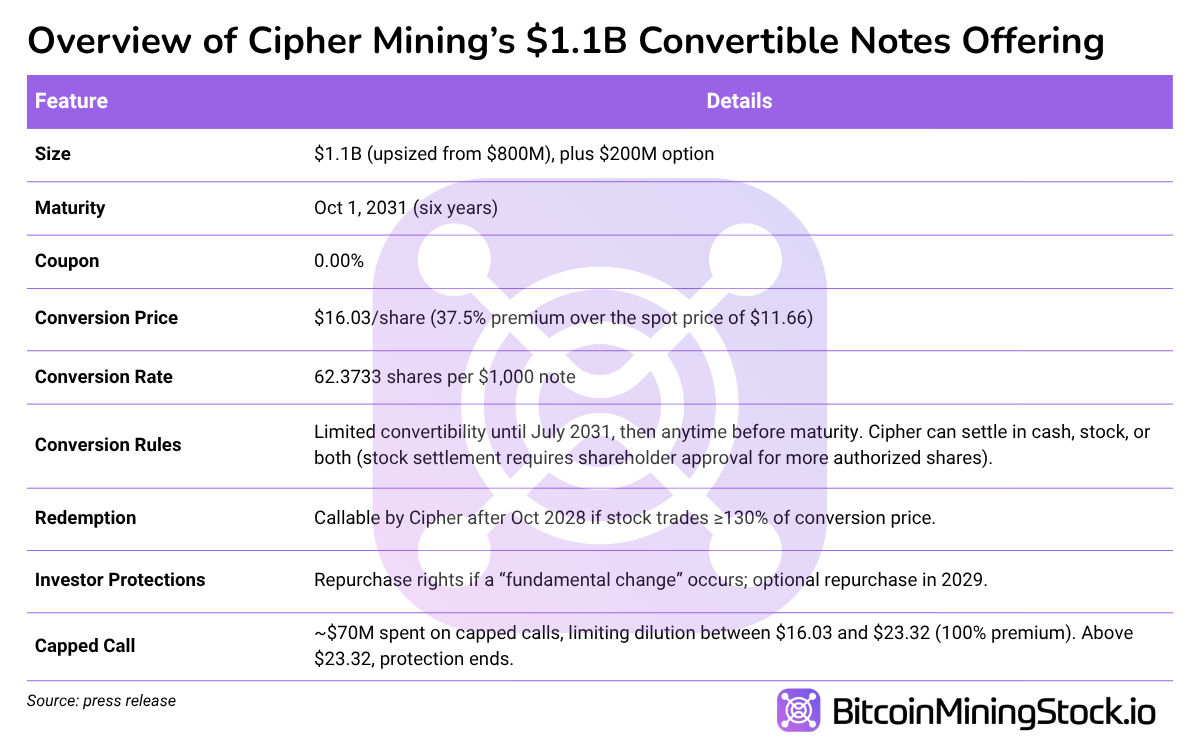

That’s where the convertible comes in. A $1.1 billion salary increase is not an afterthought to HPC stories, but a necessary step. By securing years of capital with zero interest, Cipher purchased the time and resources to run. But in doing so, management shifted risk from management to equity structure.

Disassemble the convertible note

Price of price 0.00% Convertible Senior Notes Until October 1, 2031It is scheduled to be resolved on September 30th, 2025. The deal quickly rose from $800 million to $1.11.1, with an additional $200 million option*, reflecting overwhelming institutional demand.

*$200 million purchase options exercised per cipher Form 8-Kbring in the total convertor bills issued to $1.3 billion.

Compared to peer miners, the transaction (6-year funds at 0% interest rate) appears to be cheaper. Some people either paid an interest rate of 10% or more on their debt or rely on issuing cereal equity. In addition, Cipher spent $700,000,000, Cap call transactionwhich helps reduce dilution when stock rises. In other words, shareholders are protected from dilutions of up to $23.32 per share (almost twice the selling price reported on September 25, 2025).

Why did the institution run in?

At first glance, this private product doesn’t pay interest until 2031 and doesn’t seem attractive to be locked. However, convertible notes are not simple bonds, but essentially Loan and Stock Call Options. Investors will receive compensation in 2031 if crypto is struggling, but if the stock exceeds $16.03, they can convert fairly and capture it upside down.

For hedge funds, appeal goes beyond simple long-term exposure. Many runs Transformable arbitrage strategiesthey buy notebooks and shorten the stock proportionally to conversion rate. After that, the short hedge is like that It’s dynamically adjusted As stock prices move. The goal is not to bet on the basics of a company, but to make profits from options-like structures and stock volatility.

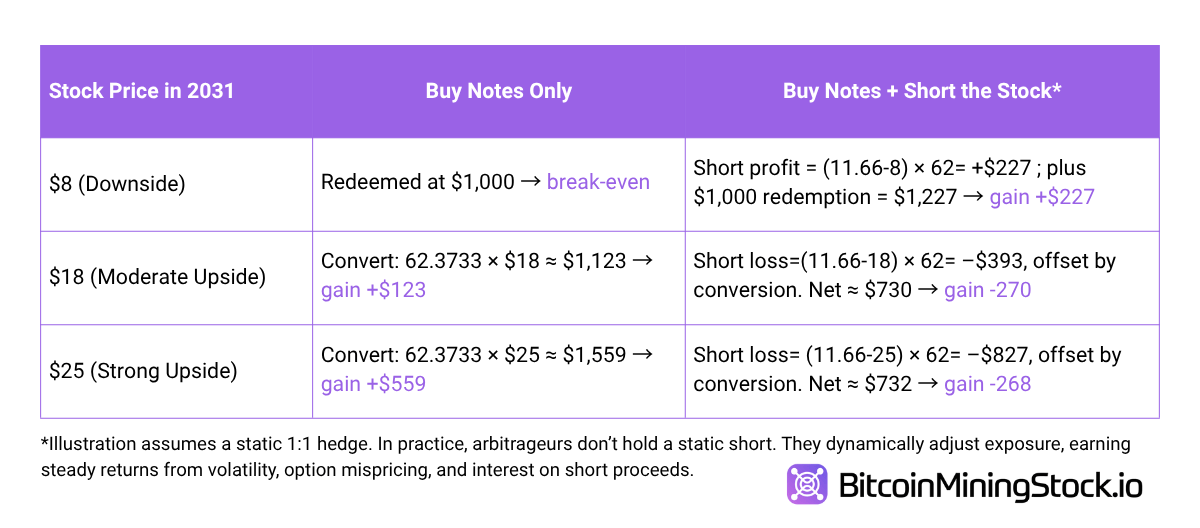

To explain, we assume that the investor will buy $1,000 face value Notes (62.3733 shares if converted). Cipher’s stock was $11.66. The conversion is $16.03.

in Static setupthe result is as follows:

So, what does this mean? Static mathematics may seem unattractive to arbitrators at higher prices, but dynamic hedging makes the strategy profitable across the outcome. That’s why the institutions stack up: they get the structure they provide Protection like upside down bond like options,On the other hand, ordinary shareholders only benefit if Cipher is successfully executed. This explains why this transaction took effect within hours.

Dilution mechanism for shareholders

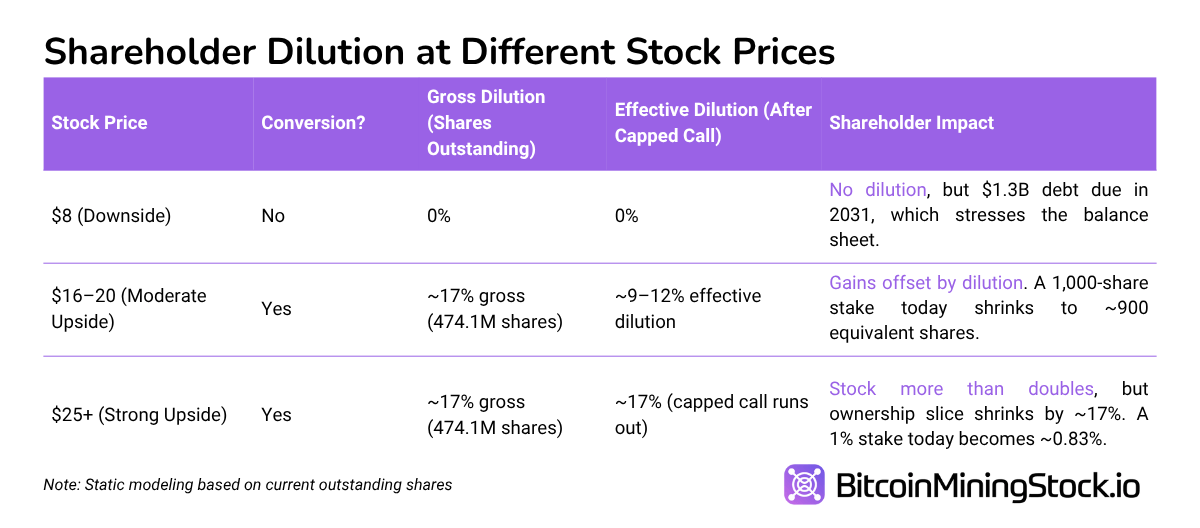

For a common stockholder, the impact is simple and it is much less flexible than an institution. Cipher currently has ~393m stocks are unpaid. If all notes are converted, a new stock of ~81.1m will be issued and the total will be lifted to ~474.1m. Capped calls trim this 9-12% If the shares land between $16.03 and $23.32, but exceed that (>$23.32), there is no protection and the shareholders will absorb the full dilution.

Asymmetry Here: Institutions can fine-tune risks through hedging and lock in to return, but shareholders cannot. Stock investors have binary results. The code is running and the stock has been valued well enough to exceed a 9-17% dilution, or not, with the company being liable for shares and $1.3 billion in debt.

Final Thoughts

Cipher’s Fluidstack contract I’ll verify it A strategic shift towards HPC and AI hosting. Like Core Scientific, Applied Digital, and Terawulf, the company is leveraging energy and infrastructure to attract hyperscale clients, aiming for a much more predictable revenue stream than pure Bitcoin mining.

But muted stock reactions show how Funding Even the most positive headlines can be cast a shadow. The $1.3 billion convertible note has smartly structured, capped call protection without immediate cash drainage, and still represents a substantial future claim for fairness. Shareholders face a dilution of 9-17% when the cipher is executed, but that’s true Dilution only causes a significantly higher stock price.

This tension explains the divergence HPC trading is a clear strategic victoryhowever, fundraising restructuring investors focus on risk. Cipher is the front-load capital to build Barber Lake and activate the 2.4 GW pipeline. This is a necessary step if you want to monetize HPC demand at a large scale. If the execution takes place within the deadline and Barber Lake’s 168 MW comes online by September 2026 as planned, the resulting revenue could exceed the dilution.

For now, convertibles give institutions an entry point like low-risk options, with shareholders taking execution risk. The HPC storyline remains engaging, but until concrete revenues come true, the market will have fewer cryptos due to its Fluidstack deals, and the $1.3 billion funding it has been used to fund it.