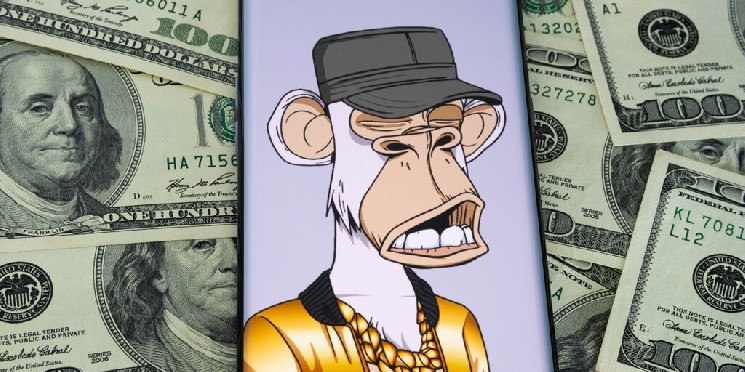

A federal judge in California has cast a class action lawsuit against Yuga Labs, the creator of the once dominant, boring APE Yacht Club NFT collection.

Los Angeles-based judge Fernando M. Olguin, who was appointed to the bench in 2013 by former President Barack Obama, introduced Thursday that he failed to meet some of the criteria for the tests used to determine the security status of financial transactions.

Orgin ruled Boring monkey It should be considered different from previously plausible securities, especially other NFT collections that have been previously discovered to be Dapper Labs. NBA Top Shot nfts and DraftKings NFTS-GIVEN Plaintiffs purchased boring apes in third-party markets such as Opensea and Coinbase, not in markets managed by NFT publishers.

The boring APE NFT cannot trigger the “common business” prongs that are required for testing by the court to determine whether an asset is security or not.

In short, the plaintiffs do not properly assert horizontal commonality because they did not assert the type of “interaction” between the claimed securities and their own “ecosystem,” as they underpinned the logic of Dapper Labs and Draftkings,” he wrote.

The judge also has a collection of Yuga Labs. Creator royalty fees All boring ape sales suggest that “removing coupling of (plaintiff’s) property from the defendant who had made a profit even if the plaintiff sold his NFT to the loss.” NFT publishers rely on creator loyalty as a form of revenue, collecting baked-in fees of 10% or more.

The court’s logic is in stark contrast to the legal arguments that the SEC had during the Biden administration. In particular, its creator royalty is It is shown assets It was Security is what its creator encourages reselling.

For years, Yuga Labs has been Legal Standoffs With the federal government on the security status of NFT, given the company is becoming more prominent in the sector. Once red hot Status symbol That’s been since then Faded In terms of value-culture connections, bored apes have earned a trading volume worth $7.2 billion since its launch in 2021.

Earlier this year, Yuga Labs announced that the SEC had it Closed A long-standing investigation into the company as part of the Trump administration’s offensive Procrypt Reorganization. The SEC also concluded a similar investigation of the NFT Marketplace opensea.

But one of the SEC’s refusal to pursue a particular case against the NFT project, and as with Yuga this week, federal courts clearly control the issue.

Despite the importance of the arbitration, bored apes seem to be barely affected. Collection floor prices (the cheapest NFT price in the collection) have fallen by 2% over the past 24 hours. $37,337 At the time of writing. This is a 90% drop from the ever-high $369,900 for the project reached in April 2022.

Yuga’s representatives did not respond immediately. DecryptionRequest for comment on this story.