The first Spot XRP Exchange-Traded Fund (ETF) in the US has been released in just under two weeks and has shown modest weakness since its debut.

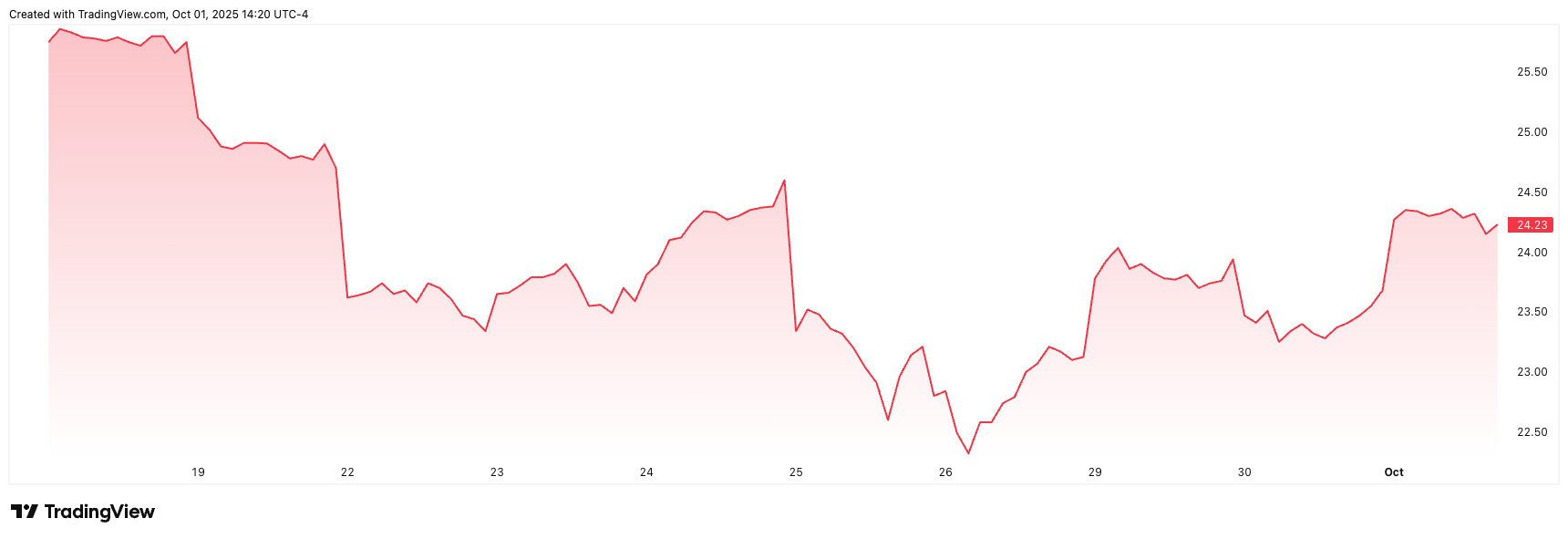

Specifically, the Rex-Soprey XRP ETF (XRPR) was released on September 18th for $25.83. By press time it was trading at $24.15. This has been a decrease of approximately 6.5% since its launch.

This pullback reflects the common trends seen in newly listed cryptographic ETFs. There, early liquidity, market establishment activities, and early trading flows often generate short-term volatility.

In particular, the Rex-Soprey XRP ETF received rapid approval due to its unique regulatory structure. Unlike traditional spot Crypto ETFs, which can take up to 240 days to SEC reviews under the Securities Act of 1933, Rex-Soprey was made up of under the Investment Companies Act of 1940, shortening the review to approximately 75 days.

The recent adoption of the general listing standards for goods-based ETFs in major exchanges such as NASDAQ, CBOE BZX, and NYSE ARCA has eliminated the need for individual applications under section 19(b) of the Stock Exchange Act of 1934.

Despite the slow start, XRPR’s list marks a milestone in the US market and provides mainstream access to XRP through traditional securities accounts.

Before the US launch, both Brazil and Canada had already introduced Spot XRP ETFs in 2025. Brazil’s Hashdex Nasdaq XRP Fund began trading on B3 Exchange in April, becoming the world’s first regulated spot XRP ETF.

In June, Canadian issuers such as Purpose Investment and Evolve gave previous investors previous exposure through regulated products following their lawsuits following their launch on the Toronto Stock Exchange.

Spot XRP ETF pending

The Rex-Sosprey Fund is not just XRP ETFs. Several key asset managers have pending applications with the Securities and Exchange Commission (SEC), and decisions are expected in the coming weeks.

The broader approval could significantly increase institutional access to XRP, reflecting the effectiveness seen when Spot Bitcoin and Ethereum ETFs gain regulatory clearance.

If more US SPOT XRP ETFs are approved, analysts expect a stronger influx that can support long-term price growth, along with potential derivatives such as CME futures and options.

However, short-term performance may remain volatile, as shown by the initial 6.5% reduction in XRPR.

At the press conference, XRP is trading at $2.93, up about 3.5% over the past 24 hours, but down 0.68% over the week.