Bitcoin prices have been sideways for several months, but liquidity data that tracks this cycle almost completely suggests that they will change soon. The correlations between Global M2, Stablecoin Supply, and Gold all suggest that BTC is putting pressure on the next breakout.

Global M2 and Bitcoin Prices

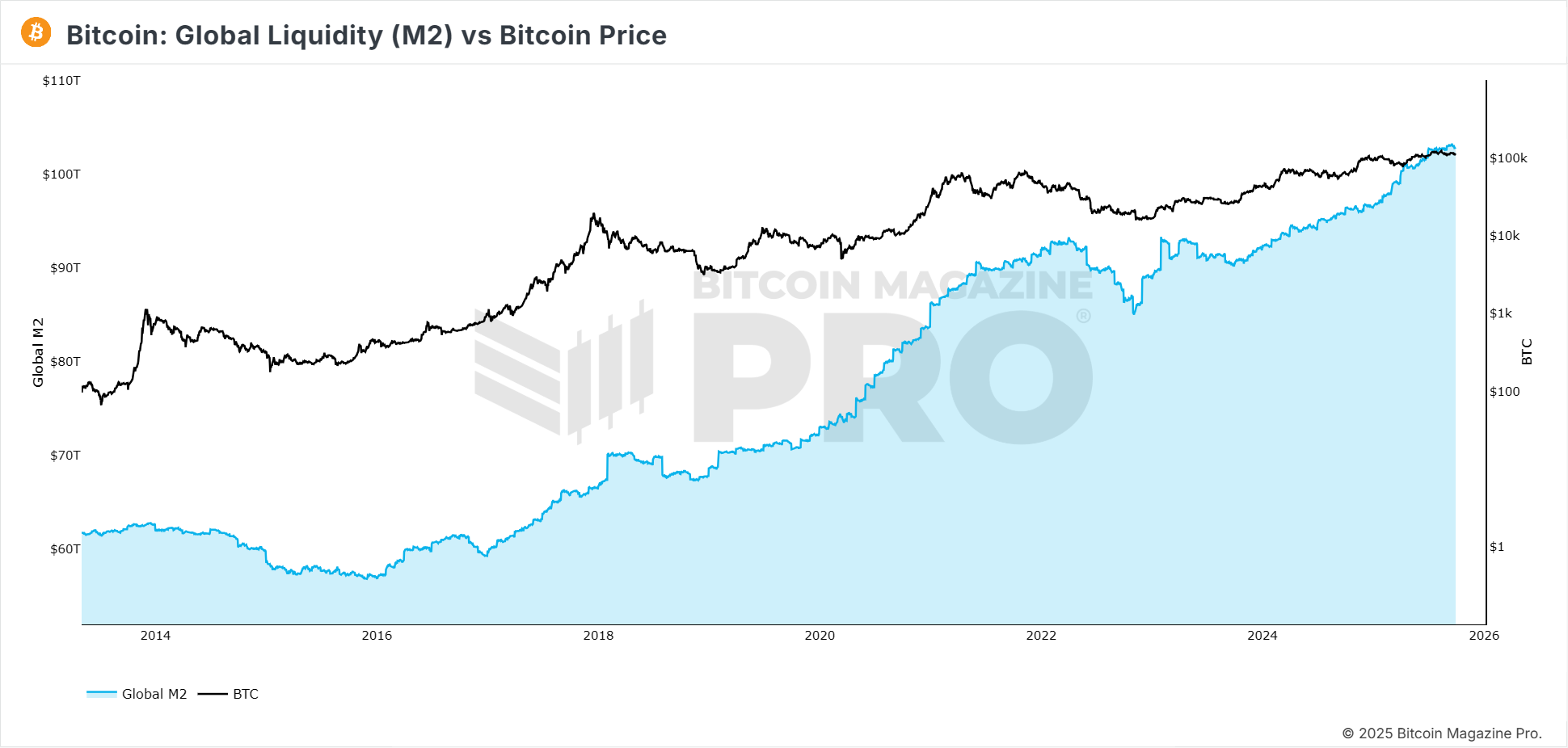

Global M2 Money Supply has historically shown a strong link to the Bitcoin Cycle. Expansion tends to coincide with bull markets, but contractions and stagnation line up in chop and negative periods. Over the past few months, global M2 growth has slowed, with BTC reflecting it with stagnant price action after hitting an all-time high of nearly $124,000. As the global M2 accelerates again, it consistently flows into speculative assets, with Bitcoin being one of the biggest beneficiaries.

Figure 1: Global liquidity (M2) vs. Bitcoin price. View live charts

Stablecoin supply and Bitcoin price trends

Stable supply within cryptographic ecosystems has proven to be an even stronger indicator than the global M2. The correlation with BTC is over 95%, with the alignment still being completely and almost completely year-on-year. When the rate of change in Stablecoin supply exceeds the 90-day moving average, it has historically marked an ideal period for Bitcoin to accumulate ahead of strong gatherings. The opposite is true, and contraction is alongside a period of weakness.

Gold correlation and Bitcoin prices

Throughout 2025, Bitcoin has been most closely tracked with a delay of around 40 days, showing a correlation of over 92%. This year’s Gold’s relentless push to the new all-time highs offered a tailwind for BTC. If this relationship was established, BTC could see a $150,000 breakout in early November.

US Dollar Strength and Bitcoin Price

The liquidity and gold correlation is bullish, but the US dollar’s strength index shows the opposite. Bitcoin usually trades inversely to the dollar, and DXY has bounced back in recent weeks. Compared to the previous year, the inverse correlation was around minus 40%. This suggests that some short-term chops or underside pressure can remain, even if a larger trend prefers a higher price.

The confluence of global M2, stablecoin supply, and gold correlations all indicate that BTC is on the crisis of a massive breakout. Still, the contradictory signals from the dollar remind us that lateral trading and false initiation are part of every cycle. Bitcoin prices have a long history of consolidation before explosive movements, and current data suggests that we may be on one end now.

To get a closer look at this topic, check out our latest YouTube videos.

Bitcoin follows this data point perfectly

For deeper data, charts, and expert insights into Bitcoin price trends, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.

This post first appeared on Bitcoin Magazine and is written by Matt Crosby, making it ready for a breakout as liquidity grows.