Bitcoin Price It’s slightly above 109,000, but the pressure is increasing. As the Fed is once again climbing inflation behind Trump’s updated tariffs, investors ask: Can Bitcoin prices be slid all the way up to 81,000? Let’s break it down.

Bitcoin News: Inflation, tariffs, market psychology

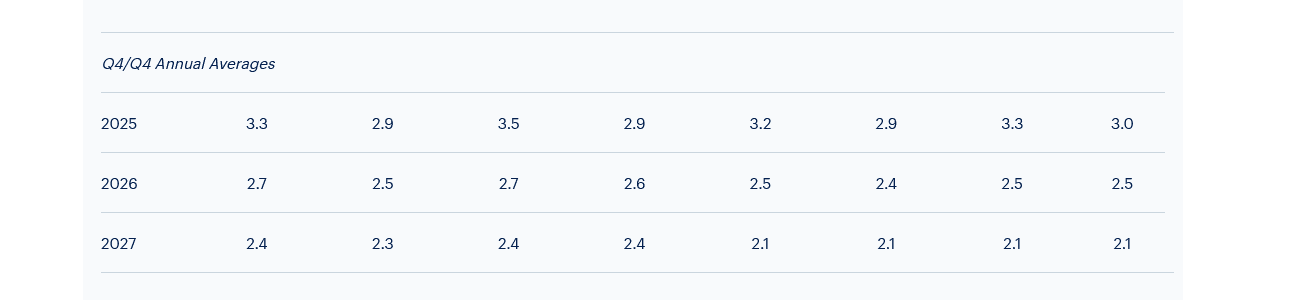

A survey from the Federal Reserve Bank of Philadelphia points out that inflation had risen to 3% by the end of the year, a notch higher than the current 2.9%. Core PCE remains stubborn at 2.9%, with Goldman expecting it to rise to 3.2% by December. It’s not runaway inflation, but it’s high enough to keep the Fed careful.

Here’s the problem. The market was betting on faster and deeper rate cuts after the Fed first cut in 2025. If the Fed is slowed, risky assets such as BTC prices could be damaged. Traders tend to spin out of crypto if rates remain limited as the opportunity cost of holding immense assets increases.

Tariff Inflation: Temporary but sticky threat

Tariffs act as artificial inflation drivers. Research suggests that companies have passed around 70% of their costs so far, but the fourth quarter saw an increase in pass-throughs. In other words, even when the fundamental demand is soft, inflation may look hot at the end of the year.

In Bitcoin news, tariff-driven inflation cuts two ways. On the one hand, sustained inflation keeps actual yields high and damages the code. Meanwhile, long-term tariff pressures weaken consumer trust and stir up demand for hedged assets. Historically, Bitcoin prices thrive when investors view them as violating their Fiat policy. But at this point, traders are concerned that mitigation delays will be eased than on the long-term hedging debate.

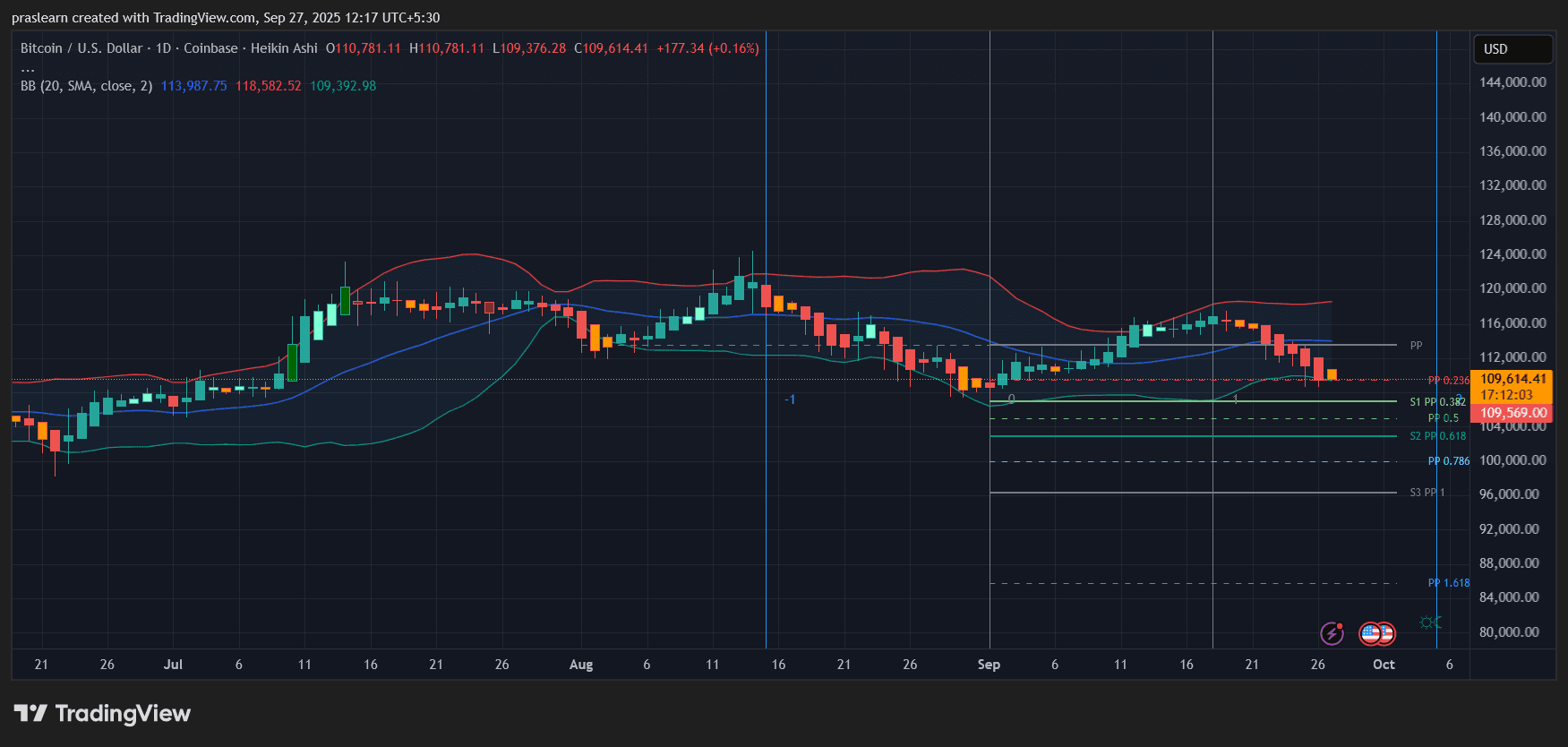

Bitcoin Price Prediction: BTC Daily Chart

BTC/USD Daily Chart – TradingView

The daily chart of BTC prices shows that it has consolidated prices of nearly 109,600 after a sharp drop from 116,000. The Bollinger band is expanding, with candles hugging the band below. Pivot Level tells the real story:

- Immediate support is around 109,500 BTC prices currently being tested.

- The next important Fibonacci levels are lined up at 104,000 (0.618) and 100,000 (0.786).

- Under that, S3 support is aligned with 96,000 and the extended pivot projection point is 81,000.

If $BTC loses 104,000-100,000 zones, the technology opens the door to a deeper flash. The 81,000 mark is not a prediction. If panic sales coincides with worsening macroemotion, it is a tail risk.

Macros meet Bitcoin News: 81,000 Risks

The chart setup and inflation outlook means that the market will be cornered between two forces.

- If the Fed ignores increasing inflation and continues to mitigate, the BTC could find support and rebound from the 100,000 level.

- If inflation stands by the Fed, the BTC may look lower on another leg, with 96,000 being seen as the next logical stop.

To truly test Bitcoin Price at 81,000, it requires a combination of stubborn inflation, delayed Fed mitigation, and perhaps the stock’s liquidity shock. Without that trilogy, the odds favor bounce back before such extremes.

Bitcoin price forecast: crash or fix?

So will the BTC price crash to 81,000? Probabilities exist, but they are not the basic case. The technical roadmap suggests that 104,000 and 100,000 are important battlefields. If they make way under heavy sales and macro headwinds, 81,000 will be possible targets. However, as expected, when inflation cools in early 2026 and the Fed resumes cuts, Bitcoin prices could instead reestablish the 115,000-120,000 range.

For now, traders need to treat 81,000 as an extreme negative side scenario, rather than as a central forecast. The real fight is whether the $BTC price can defend 100,000 in the coming weeks.