Bitcoin Price has recently faced sharp losses, reflecting the pressures of a bear market environment.

Crypto King has fallen below the critical threshold, causing fear of potential bear market structure. Investors are closely watching the signs of a reversal, but the outlook remains uncertain.

Bitcoin has a pain threshold

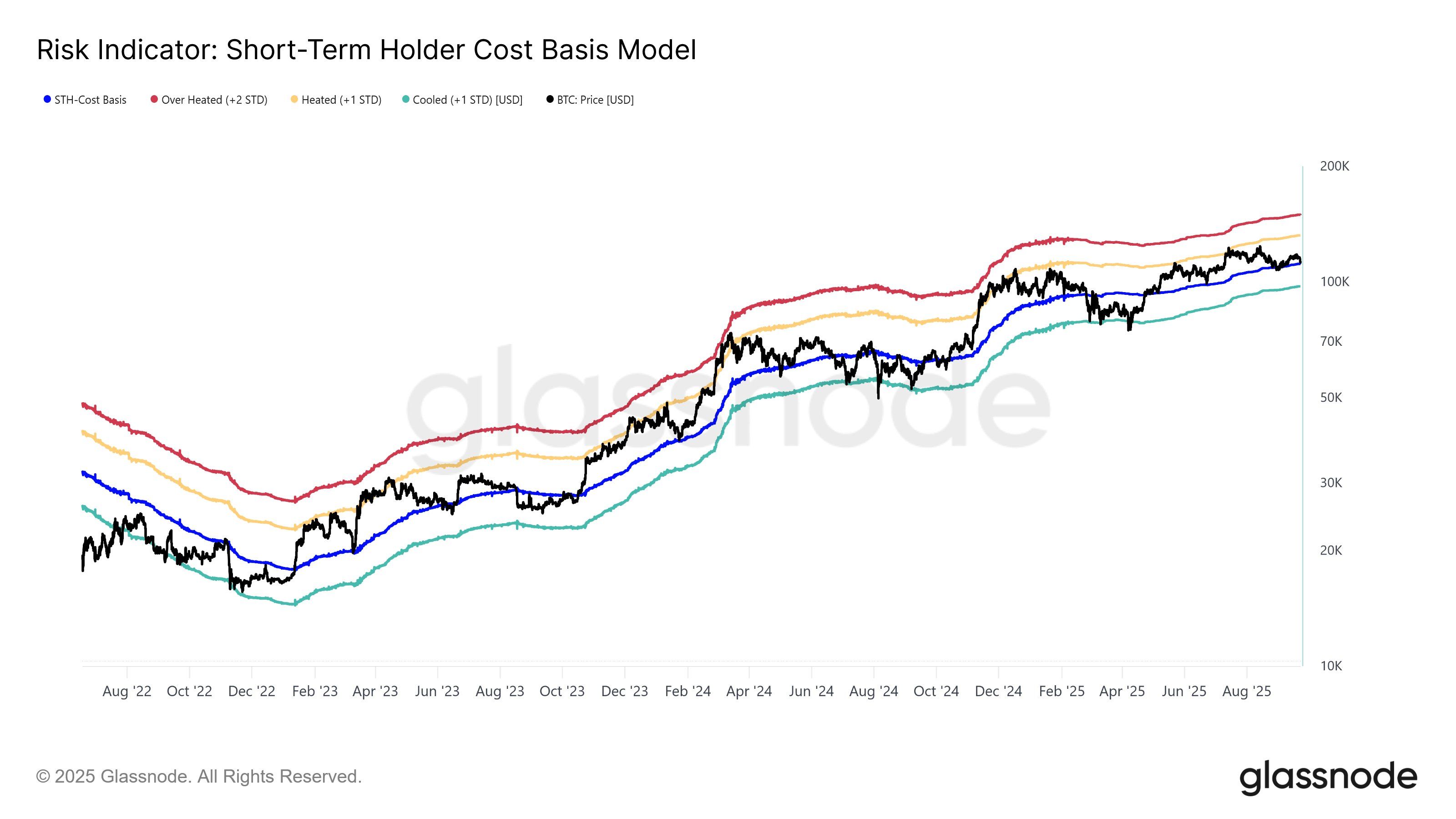

The Short-Term Holder (STH) cost-based model currently highlights the vulnerability of Bitcoin. Currently, the STH cost base is at $111,400. This means that sustained trading below this level can cause deeper downward pressure. Crossing this threshold is important to avoid further structural weaknesses.

A critical break below the cost base probably confirms bearish momentum, leading to a bigger drawdown in Bitcoin. Such a move could slow recovery across the crypto market and extend losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Bitcoin STH cost-based model. Source: GlassNode

The social sentiment surrounding Bitcoin shows a surge in “purchasing DIP” on major platforms. This indicator records the highest level of activity in 25 days and reflects the growth of optimism among retailers. Although it is positive on the surface, this trend often shows opposite price results.

Historically, Bitcoin has tended to go against crowd expectations when retail traders predict a quick rebound. If optimism remains at around $112,200, the market could still face more shortcomings. As sentiment cools and panic sales occur, opportunities for deeper accumulation can manifest.

Bitcoin’s social volume and control. Source: Santiment

BTC prices may bounce back

At the time of writing, Bitcoin traded at $112,960, slightly above the $112,500 support level. Within the last 24 hours, BTC has slipped from $115,100, touching $111,478 at its low in the day. This volatile action underscores the importance of maintaining current levels.

Crypto King has so far managed to surpass its STH cost basis of $111,400. By securing $112,500 in support, Bitcoin could return to $115,000, which will help prevent the structure of the bear market from being formed.

Bitcoin price analysis. Source: TradingView

However, updated sales pressure could drag Bitcoin towards $112,500 and $110,000 in support. If that happens, bullish papers will be invalidated and BTC may slide further and officially mark the onset of bearish momentum.

Post Bitcoin Breakdown Point: BTC below this price will signal the first bare market to appear in Beincrypto.