The Ethereum (ETH) Exchange-Traded Funds (ETF) saw another day of the $108.31 million withdrawal on Tuesday, September 23rd, with a $108.31 million withdrawal reported.

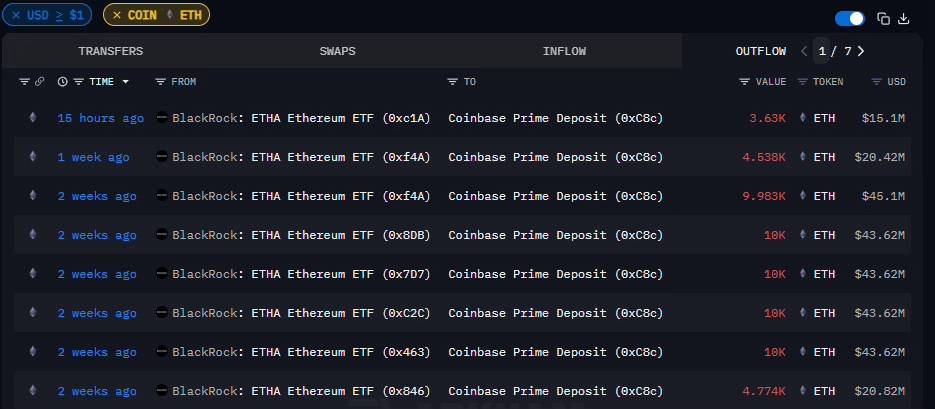

Surprisingly, BlackRockDid did not report the biggest losses, losing only 3,630 ETH, and sales worth around $15.1 million remain notable. The fund has sold $45 million from Arkham since September 17th, after selling more than $45 million from Arkham for more than $45 million since dumping $20 million worth of cryptocurrency.

It is also worth noting that the Ethereum Fund did not see an influx yesterday.

Ethereum is still struggling

In terms of prices, Ethereum traded at $4,180 at press, down more than 7% on the weekly chart. The market capitalization was $5045.2 billion, but daily trading volume fell by more than 12% to $33.45 billion.

The pressure is naturally amplified by large institutional withdrawals, but major technical obstacles and broader macros also weigh heavily on their performance.

For example, on the day of September 22, Crypto’s total market capitalization would be reduced by $150 billion, while Ethereum would fall due to an increase in correlation with Bitcoin (BTC). Similarly, Fed Chairman Jerome Powell’s announcement of a future speech on September 26 has led traders to spin into cash, bringing ETH down almost 14%.

Additionally, the day on September 23rd saw a long position of around $1.8 billion clearing, kicking over 370,000 traders out of the market. Ethereum accounted for more than $500 million of these losses.

As a result, the assets slipped through 78.6% Fibonacci support at $4,243, and are currently testing a 200-day moving average of nearly $3,411.

Furthermore, the seven-day relative strength index (RSI) fell to 24, and the moving average convergence divergence (MACD) fell to -46.42, resulting in a solid negative momentum.

Featured Images via ShutterStock