Today, Ethereum prices are trading nearly $4,148, extending the decline after falling below the support zone of $4,250-$4,300. The desisting trendline and rejection in clusters of EMAs above $4,350 have strengthened bearish pressure, with traders looking at the $4,100 and $4,000 levels as the next critical defense.

Ethereum prices slide towards key support

ETH Key Technical Level (Source: TradingView)

On the four-hour chart, Ethereum is trapped within the downward channel, with a mid-September peak of nearly $4,750, and a recurring lower high confirming seller control. The $4,255 breakdown along the 20 and 50 EMA caused a critical character change, leaving $4,100 as an immediate line of defense.

The $4,367 100 Emma and $4,411 200-EMA continue to decline, indicating trend fatigue. Unless Ethereum Price regains $4,300 in the short term, the negative side’s momentum could deepen towards the $4,000 liquidity pocket.

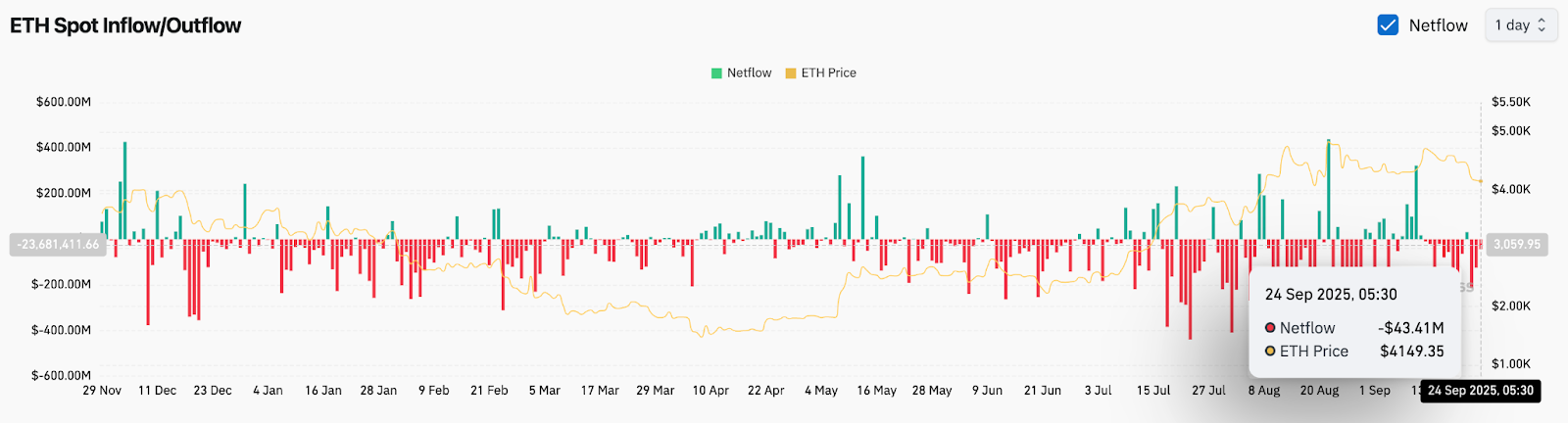

On-chain flow highlights weak demand

ETH chain flow rate (source: Coinglass)

Exchange flow data for September 24th showed a net outflow of $43.4 million, suggesting mild accumulation. However, the September trend has leaned towards a permanent influx, highlighting the vulnerable beliefs among buyers. Ethereum price action is struggling to find sustainable support as it cannot absorb consistent sales pressure.

Also, open interest has been flattened across the futures market, reflecting careful positioning rather than aggressive long exposure. Without a stronger inflow, Ethereum price volatility is likely to last, distorting risk into shortcomings.

Changes to SEC rules boost the ETF story

Beyond short-term weaknesses, Ethereum received a major structural catalyst from the U.S. Securities and Exchange Commission. On September 19, the SEC approved changes to the rules, allowing Grayscale’s Ethereum ETF to trade under a streamlined, general purpose standard.

This shift eliminates the need for individual case-by-case approval and ensures a faster list of Ethereum-based funds and clearer monitoring. Analysts note that this could match ETH ETFs with commodity trust stocks and pave the way for wider institutional adoption. Although immediate price responses have been suppressed due to technical weakness, the clarity of the regulations provides a supportive background for long-term evaluations.

Technical outlook for Ethereum prices

- Upside Level: $4,255, $4,367, and $4,420 instant hurdles.

- Disadvantage levels: $4,100 and $4,000 as important defenses, $3,850 is a deeper risk zone.

- Trend Marker: 200 Emma, close to $4,411 as a cycling direction pivot.

Outlook: Will Ethereum rise?

Ethereum’s short-term outlook is under pressure after breakdowns of under $4,250. If buyers are able to defend a support band of between $4,100 and $4,000, they could rebound to $4,367 and $4,420, with the breakout exceeding the $4,450 needed to revive bullish momentum.

However, failing to hold $4,100 will expose Ethereum to $3,850, slowing recovery despite the ETF headlines backing. For now, Ethereum price forecasts have generated profits from neutrality in the near term, along with long-term optimism linked to ETF adoption and chain growth.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.