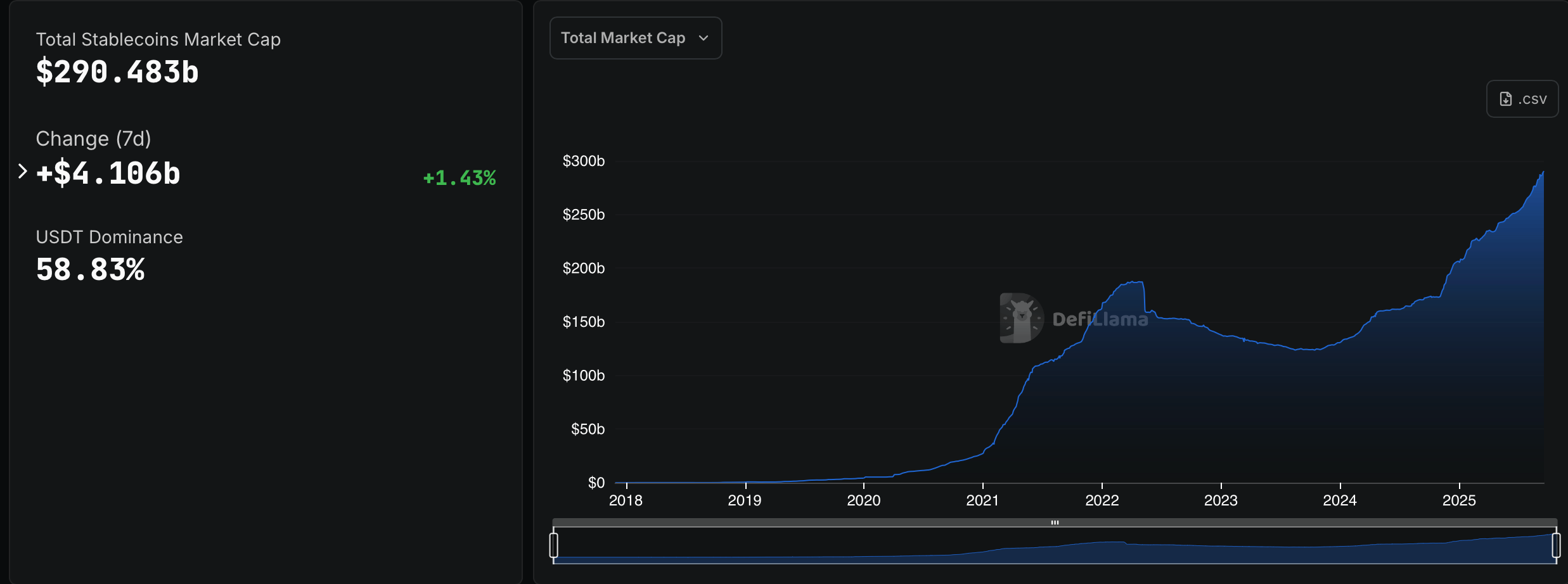

On Wednesday, the Stablecoin market cracked into unknown territory, piling up above the $290 billion mark for the first time after padding funding with more than $4 billion in fresh capital over the past week.

From USDT to RLUSD, all Fiat Page Tokens join the $29 billion Stablecoin Party

Stablecoins steal the full spotlight with high prices and hiccups. The cast is Tether (USDT), which is surrounded by a market capitalization of $1700.9 billion and a bump of 2.33% this month, based on data from Defillama.com. With the Stablecoin market sitting at $29.0483 billion, Tether will lead 58.83% of Pie overall and will do its best governance.

Circle’s USDC is also not shy, earning 7.74% per month and retaining an impact of $73.1 billion. This week, Stablecoin by market capitalization, the second largest by market capitalization, accumulated an additional $879 million in supply in just seven days. Ecena’s USDE has recently been a rising star, from 20.46% to $13.6 billion. The USDE stash has swelled around $2.31 billion over the past month, and has stylishly packed its financial resources.

Source: September 17, 2025, Defilama.com.

Meanwhile, Sky’s Dai got an 8.65% lift for a month. At the same time, Sky’s Sky Dollar (USDS) pulled out a flashy 2.48% pop in one day, but still limped that month with a -6.24% slide. World Liberty Finance token, USD1, is a stealth climber, posting 20.54% lifts per month without fanfare.

Dai’s market capitalization has risen to over $5 billion, with USDS steady at $4.65 billion, and USD1 is closed at around $2.666 billion. BlackRock Buidl has been humbled and sunk nearly 10% this month, proving that Wall Street gloss doesn’t guarantee blockchain glory. Currently, Buidl holds a market valuation of $2.146 billion.

Ethena’s USDTB is still bent and boasts a gain of 24.92%, bringing it to $1.817 billion. To avoid losing, Falcon’s USDF pulled out 41.48% of the climb each month, swinging well beyond the $1.75 billion weight class. PayPal’s PYUSD provided a respectable 7.87% gain, while First Digital’s FDUSD stumbled violently on a face plant of -13.02%.

Ripple’s RLUSD, now the 12th largest stub coin, closed things down with a 9.46% lift, securing a spot in the lineup. Translation: Tether is still wearing the crown, Ecena and Falcon are wildcards, Blackrock slides the notch and the rest hustling to keep the grooves on the dance floor. $290 billion won’t sneeze. For just $10 billion, the $300 billion milestone is virtually within arm range.