Ethereum-liquid’s Staking Protocol (LSP) welcomed the influx of 690,000 ETH over 14 weeks until the end of August, but the tide has since changed as LSP saw 60,000 ETH drop out in the past 27 days.

Billions of Movement: Ethereum Liquid Staking, currently worth $6.399 billion

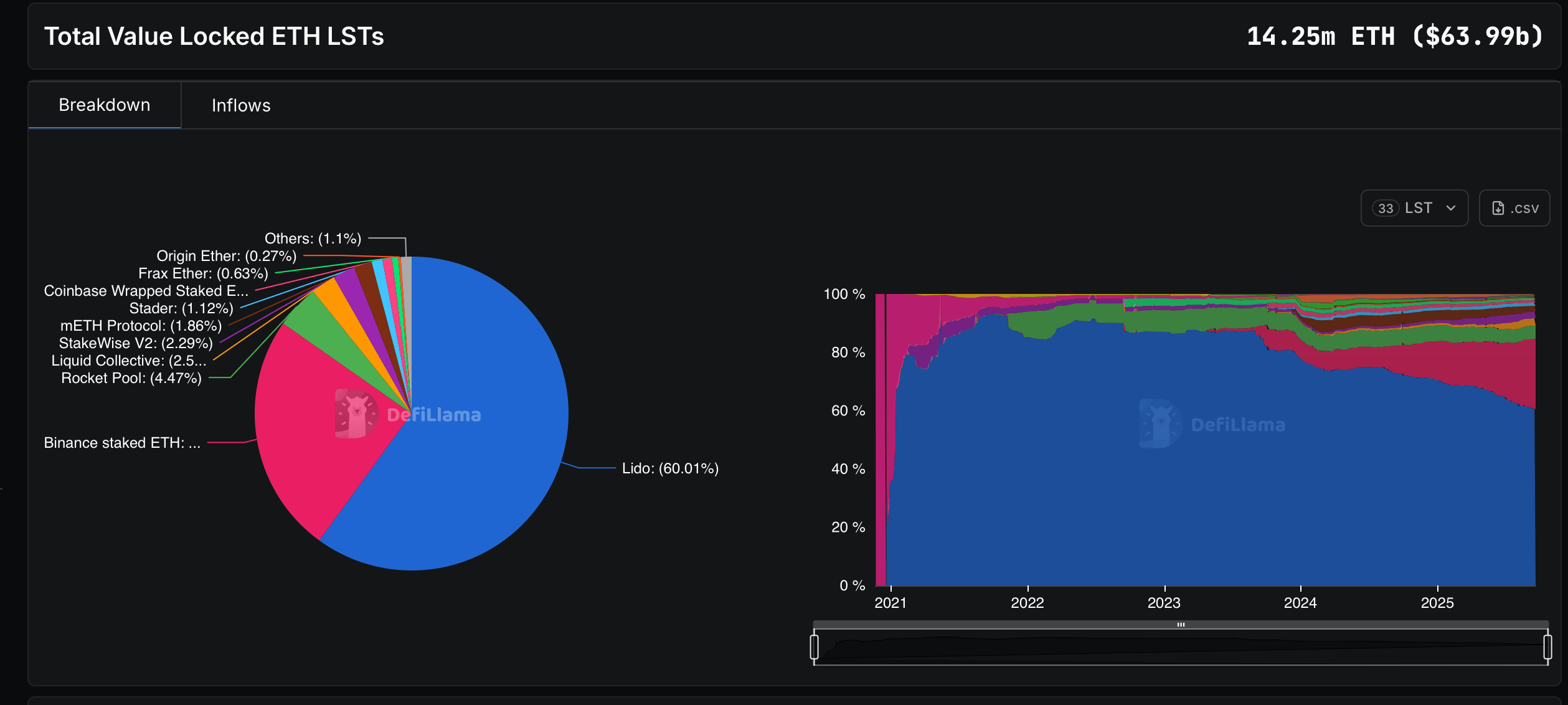

ETH LSP has acquired around 60,000 ether since August 24, 2025, after a heavy inflow over the 14 weeks of that date. Today, Ethereum-powered LSPs account for $639.9 billion out of the $8.7177 billion locked to all liquid staking protocols, giving the second crypto a 73.4% slice of the pie.

Despite a 60,000 ETH reduction, Ethereum’s Liquid Staking World offers some serious figures in many Sass. At the pinnacle of the food chain, Lido has bent over five unique chains with a $38.5524 billion TVL, stirring up a $21.68 million fee over the past week, earning $2.17 million.

Source: Defilama.com on September 20, 2025.

According to data from Defillama.com, Binance Staked Eth is locking $15.866.2 billion across two chains, so it’s not too late in size, but Binance Staked Eth has locked $15.866.2 billion. It pulled in $8.01 million in fees, but only earned $800,767. Binance’s liquid staking protocol has actually increased its ranks over the past 12 months.

Rocket Pool ranks third with 636,780 ETH ($2.856 billion TVL), but has soaked 0.33% over the past week. Liquid mass stays are barely prolonged with a move of -0.08% over seven days at 363,138 ETH and a $1.629 billion TVL. However, Stakewise V2 lights up its weekly charts and accumulates 325,962 ETH, worth $1.462 billion on TVL, up 1.92% this week.

From there, middle class players continue to keep the drama alive. The LSP METH protocol owns 264,488 ETH ($1.186 billion TVL), but wears the week’s biggest scar with a drop of -8.06%. Stader will be able to watch at $721.88 million worth of ETH at 160,327 ETH, alleviating just 0.18% in seven days. Meanwhile, Coinbase’s wrapped Staked Eth stole the spotlight, jumping 10.27% this week to 139,426 ETH ($624.39 million TVL).

The Frax Ether appears on 90,468 ETH and $458.82 million TVL, clocking at -0.12% for a week, almost flat. The Origin Ether solidifies at 38,039 ETH ($17,063 million TVL) and slips in a small -0.29%. Meanwhile, Crypto.com’s liquid staking was bent at +5.68% lift up to 36,376 ETH ($162.9 million). To close the top 12, Swell Liquid Staking manages 25,327 ETH ($113.6 million TVL), but has contracted -3.52% since September 13th.

Ethereum’s Liquid Staking Arena may be bent billions, but it’s not a cold weekend picnic. This is a slow motion gladiator pit. The crew of Lido Towers, Binance Moves and Mid-Tier keep things tough. If the inflow is reversed to the outflow, the only bet is that next week’s statistics don’t look the same.