It’s been a busy week, with Ethereum (ETH) near $4,470 per coin after a 5.3% slip every week, but leverage and hedges are humming.

Ethereum’s Week: Price drop, stable leverage, dealerships busy

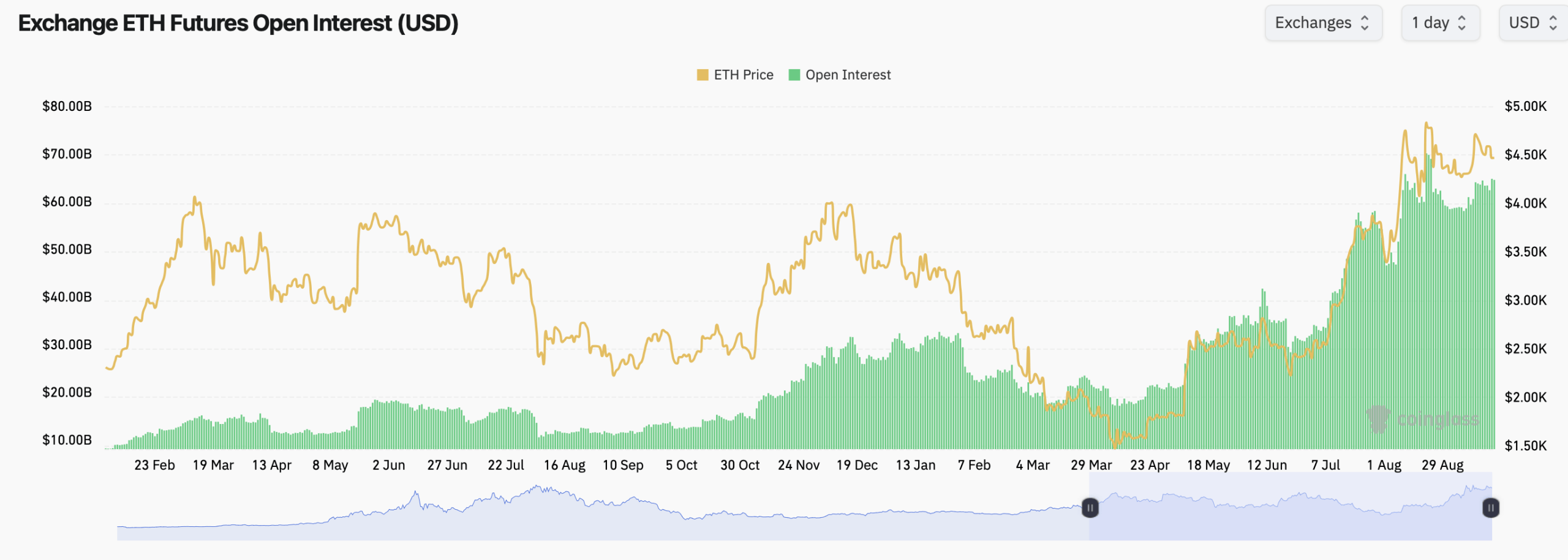

Open interest (OI) on Exchange-Tracked Ethereum (ETH) futures will reach approximately $64.57 billion (ETH14.43 million) per Coinglass, with prices chopped up until September. Binance leads in OI by around $12.26 billion (18.98%), while CME has $9.63 billion (14.91%). OKX is approaching $4.12 billion (6.37%), with both Bybit and Gate in the mid-term range of $5 billion.

The momentum was not uniform. Bibit’s OI popped 6.28% in 24 hours, even if Binance slipped 0.33% and CME rose 0.23%. Kucoin and Bitget added about 2.7% to 4.6% per day, while Bingx showed double digit intrinsic contraction. Weekend translation: Hedger shuffles chairs and not exits.

On the options side, crowds are bullish by position, but not so much. The open interest on the option is 61.11% calls against 38.89% puts (approximately 2.25 million ETH calls to 1.43 million ETH puts). The past 24 hours were similarly well balanced. 54.53% of the volume of calls, 45.47% of PUTS, about 118,475 ETH to 98,789 ETH. It’s optimism with a put spread umbrella.

The Open Interest rank shows thick floors centered around a $4,000 strike. The single biggest line is DERIBIT 26SEP25 $4,000 PUT (120,550 ETH), followed by December calls at $6,000 (92,667 ETH) and $4,000 (74,481 ETH). There were meaningful benefits at $7,000 and $5,000 in December, and the September call was raised between $3,600 and $4,700. Dealers can sense those magnets.

The biggest pain leaps towards the mid-$4,000 from late September to late September, and will be soaking in $3,600 at the end of the ~3,600 quarter and rebounding to Q4 in the week of September 26th. Additionally, the December curve falls below wobble, entertaining the late-year Ethereum bears. If the price approaches a roll between $4,450 and close to $4,550, the seller will maintain confetti.

Open interest in futures has risen from early summer with a choppy price recovery, with the green bar pushing towards the cycle highs as the spot stalled. Usually, that setup means that base traders are busy and Perps’ funds are doing dirty work, but the direction is waiting for the next catalyst. In close conditions, the dealer can fade impulsive movements.

Conclusion: Ethereum’s drawdown did not scare leverage. It reshaped it. There are heavy OIs in Binance and CME, the options are slightly heavy on the call, distorting the gravity of the largest pain for up to $4,000, and the most inconvenient path is a ferocious range with quick traps in both ways. It exchanges levels, not dramas.