Solana Sol$240.96 It reached its strongest price since January as it ripped higher on Friday and could shape the Treasury demand for digital assets.

The token has been 5% over the past 24 hours, reaching just $240. We have extended weekly profits to 18%, significantly outpacing Bitcoin BTC$115,283.91 Ether (ETH) advanced only 4%-5% over the same period.

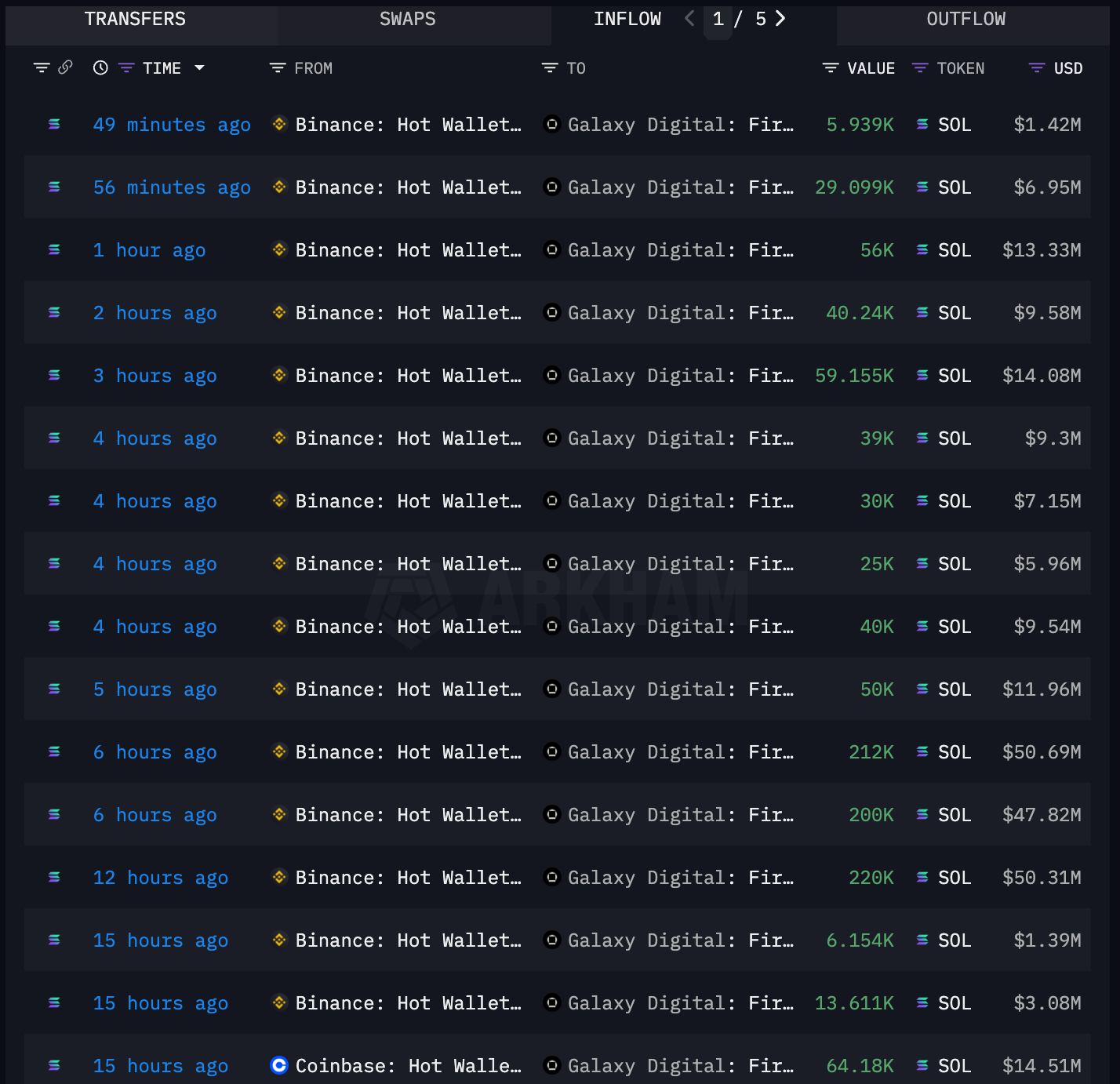

Blockchain data from Arkham Intelligence was profitable as digital asset manager Galaxy Digital retracted around 3.1 million Sol Tokens from exchanges worth a total of $724 million from Binance and Coinbase.

Galaxy withdraws Sol from exchange (Arkham Intelligence)

The deal could be linked to Forward Industries (FORD), a digital asset strategy company with a $1.65 billion cash pile to build the Solana Department of Treasury. According to a press release, Galaxy was a major investor in the funding round, but the asset management department was tasked with “actively managing” the forward War Chest.

Solana season

Solana’s outperformance could continue, with CIO Matt Hougan forecast earlier this week. Demand from the forecasts of finance companies and Spot ETFs is likely to have a significant impact and SOL given the lower market capitalization compared to Bitcoin. BTC$115,283.91 and ether (ETH).

Galaxy CEO Mike Novogratz reflected his views in a CNBC interview on Thursday, saying the market could enter “Sol season.” He brought fresh money to the crypto investment company Pantera’s future Solana Finance Company company and Sol ETF’s potential approvals.

His company also opted for the Solana blockchain to tokenize the stocks in a superstate earlier this month.

Read more: “All the ingredients are there”: Solana may skyrocket, says Bitise