Dennis Potter argues that Bitcoin fees are low, especially in developing countries, and that network security is strong against record hashrates and miner rewards.

He believes Bitcoin does not require premature code changes as it can resolve potential issues if they arise.

As Bitcoin adoption spreads worldwide, discussions on transaction fees and network security continue to grow. Lower prices make Bitcoin more accessible, especially in developing countries, but some argue that cheaper transactions can ultimately undermine the long-term security of your network.

Dennis Potter: Low prices are positive power

Bitcoin advocate Dennis Potter believes low prices are opportunities rather than weaknesses.

“The low fees for Bitcoin allow people in developing countries to continue to be mounted on Bitcoin’s base chain.

Potter pointed to a strong foundation for the network, highlighting that miners are now well compensated.

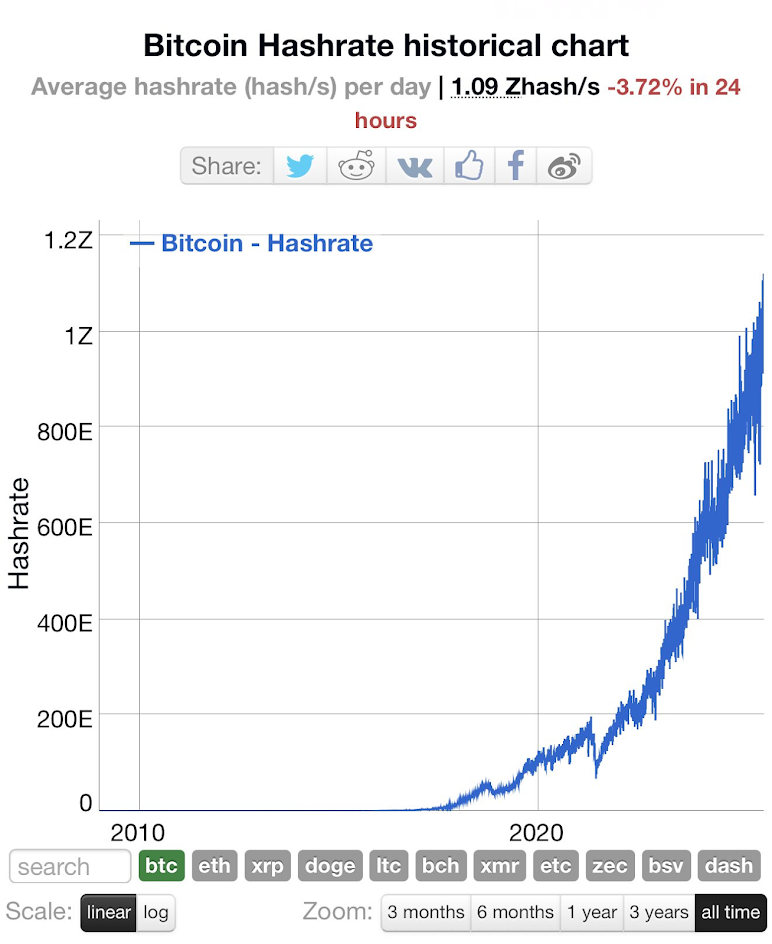

“Hashrate ath. Average reward near ATH. It’s not a problem. Security is growing unharmed.”

He also rejected the call for an early change in the Bitcoin codebase.

“If there is a problem, you can solve the problem. That can be the problem. Adding code to solve problems that are more than a decade away is a short-term idea disguised as long-term thinking.”

J.Dog reply: future security budget issues

Responds to community member Potter J.DOG The issue may not be urgent today, but it warned that it could become more serious in the future.

“Short-term no, this is not a problem, but if the block remains empty in 15 years, this will be a real problem.”

He noted that Bitcoin cuts its rewards every four years and many transactions can shift off-chain, which could weaken miners’ incentives.

“If Bitcoin gets advanced security budget fees, you’ll need to watch full blocks. Miners aren’t working for free.”

According to J.Dog, Building a A robust on-chain economy Also, driving the demand for block space is key to ensuring long-term security.

Bitcoin hash rate reaches 1 Zetahash for the first time in history

Bitcoin recently reached a historic milestone. 1 mining power Zetahash It’s the first time in history. One observer explained:

“What this means is that there is more easy-to-use power than mining Bitcoin, because otherwise the owner of that power would do something else instead.”

A massive surge in hashrate signals:

- Security resilience – 51% attacks are already very expensive. With each watt that adds hash power, such attacks are even more unrealistic.

- Minor efficiency – A higher hashrate squeezes out the most efficient miners and forces them to surrender or sell BTC, but more efficient miners can afford to hold.

- Transition to strands and dual purpose energy – Increased share in mining will otherwise go to waste (such as oil rig flare gas) or use energy that doubles as a heating system. These miners have lower costs and low pressure on BTC sales, which reduces overall selling pressure on the market.

This dynamic creates a healthier ecosystem dominated by efficient and sustainable miners, and Bitcoin’s price stability benefits from reduced forced sales.

The road beyond Bitcoin

The discussion highlights the central questions of Bitcoin’s future. Should developers take action now to prepare for the decline in rewards, or should they wait for signs of tension to appear?

For Potter, the answer is clear. Bitcoin is stronger than it is today, with record hash rates and miner revenues. For critics like J.Dog, ignoring security budgets could put a rift in the foundation years later.