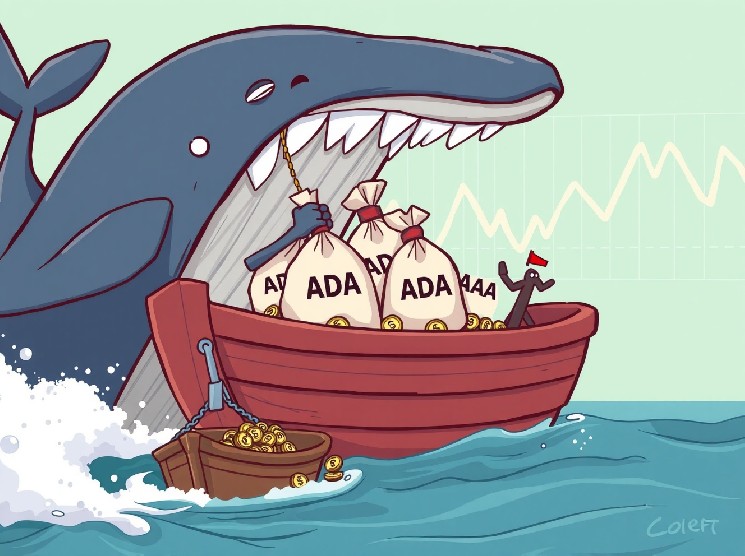

The cryptocurrency market has always been bustling with activities, and recently, all eyes have been present in Cardano (ADA). Important waves of Sale of slug whales It attracts attention from both investors and analysts, informing them of potential changes in market dynamics. Over the past two weeks, the powerful “whale” address has offloaded an astounding 140 million ADA tokens worth around $120 million. This substantial move, highlighted by renowned cryptography analyst Ali Martinez, raises important questions about the broader sentiment between Cardano’s near future and the larger owners.

What’s behind this surge Sale of slug whales?

It’s natural to wonder about the underlying cause, especially when such a large amount of digital assets change hands from key owners. This recent Sale of slug whales Events can come from a variety of factors, reflecting complex market strategies and responses to broader economic trends.

- Make a profit: By definition, whales hold a huge amount of cryptocurrency. They may be taking advantage of recent price increases or recalibrating their portfolios to lock in profits.

- Market Reassignment: In many cases, large investors move their funds between different assets. ADAs sold can be reassigned to other cryptocurrencies, stubcoins, or traditional investments.

- Expectations for volatility: Some whales will anticipate potential market corrections or increased volatility and encourage them to reduce exposure to ADA.

Understanding these motivations is key to interpreting the market pulse. However, it is important to remember that whales alone do not determine the overall market direction.

Important impact Sale of slug whales

The immediate effect of such a large-scale sale is noticeable. Typically, a significant increase in sales pressure can lead to a price decline, or at least to upward momentum. In the case of Cardano, this period Sale of slug whales In fact, it coincides with market adjustments.

However, the market is resilient. Large sales can create ripples, but they don’t always show long-term declines. Instead, they often present opportunities to other investors. Retail investors and small institutions may believe in Cardano’s long-term vision and technological advances and view it as an opportunity to win an ADA at a more advantageous price.

This is a dynamic interaction between supply and demand, and while the behavior of a few large players can affect the market trajectory, it cannot be determined simply. Therefore, it is essential to observe how the broader market responds to this supply inflow.

What does this mean in the future of Cardano? Sale of slug whales?

Cardano has a robust ecosystem and dedicated community. This project continues to develop smart contract capabilities, scalability solutions, and distributed applications. Despite recent Sale of slug whalesthe fundamental foundations of the Cardano Network are still strong.

Investors need to consider several aspects when assessing the impact of whale activity.

- Project Development: Does Cardano continue to collide with its development milestones? New features and upgrades can boost investor trust.

- Community Support: Strong and enthusiastic communities often act as buffers against important market shocks.

- Adoption rate: The increase in real-world utilities and adoption of Cardano blockchains could offset sales pressure from large owners.

While short-term price actions can be affected by large sales, the long-term health of cryptocurrency projects depends heavily on its usefulness, innovation and community support. Therefore, it is essential to pay attention to these core aspects.

Recent period of Sale of slug whalestotaling $120 million over two weeks, it is definitely a prominent event in the cryptocurrency space. It highlights the powerful impact that large holders can have on market sentiment and prices. However, it reminds us that the crypto market is complex and driven by many factors beyond the whale movement. It is important for investors to understand these dynamics, conduct in-depth research and maintain a long-term perspective. Cardano’s journey is far from the end, and how it navigates these important periods of capital movements will be evidence of its resilience and continued evolution.

By informing you about market trends and project development, you can make decisions more confident in this ever-changing landscape.

Frequently asked questions (FAQ)

What is a eddy whale?

An ADA whale is an individual or organization that holds a very large amount of cardano (ADA) cryptocurrency. Their important holdings mean that their buying and selling behaviors have a particular impact on market prices and emotions.

Why do whales sell a large amount of cryptocurrency?

Whales are being sold for a variety of reasons, including rebalancing their investment portfolios after price increases, diversifying into other assets, and forecasting future market volatility or price declines.

Does selling whales always mean prices drop significantly?

That’s not necessarily the case. Large sales can cause downward pressure, but the overall liquidity of the market, demand from other investors, and the basic strength of the project absorbs sales pressure and prevents a dramatic price drop.

How can I track ADA whale activity?

You can track whale activity using an on-chain analytics platform and cryptocurrency data aggregator. These tools monitor large transactions and provide insight into the movement of critical token holders.

What if I keep an ADA and see a whale sale?

It is important to avoid panic. Instead, conduct your own research on the reasons behind the sales, assess the cardano foundations, and consider your individual investment goals and risk tolerance. Long term holders often survive short-term fluctuations.

This analysis helped me understand what’s been going on recently. Sale of slug whales And what does that mean? Share this article on social media with friends and fellow cryptography enthusiasts to spread awareness and spark even more debate!

For more information on the latest crypto market trends, see our article on the major developments that shape Cardano price action.

Disclaimer: The information provided is not trading advice, bitcoinworld.co.in is not responsible for any investments made based on the information provided on this page. We strongly recommend independent research and consultation with qualified experts before making an investment decision.