Spot Bitcoin and Ether ETFs are seeing new influx as their institutional appetite for crypto exposure continues to increase.

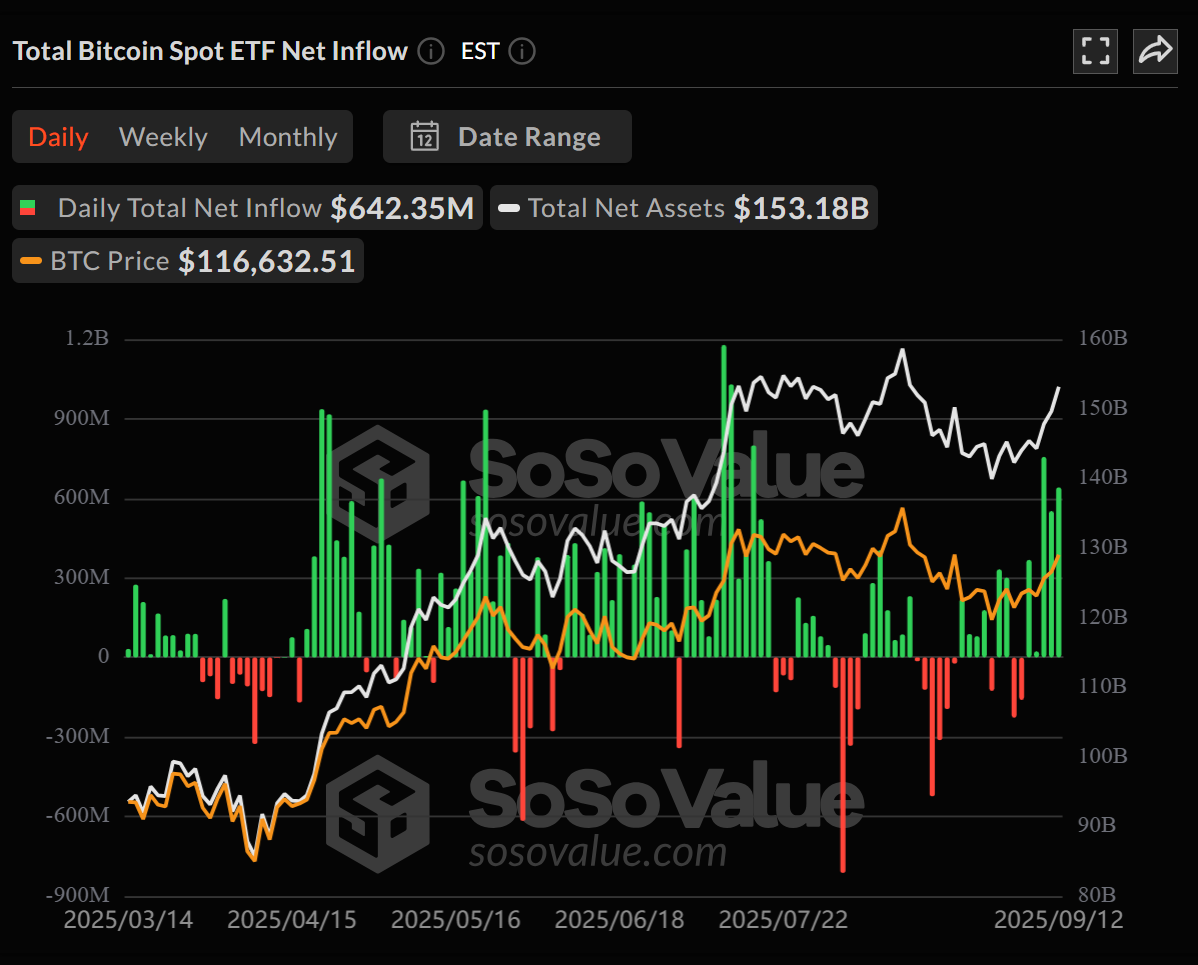

On Friday, Spot Bitcoin (BTC) ETFS recorded a net inflow of $642.35 million, marking its fifth consecutive gain profit, according to data from SosoValue. This brings the cumulative net inflow to $56.83 billion, with total net worth currently at $1531.8 billion, approximately 6.62% of Bitcoin’s total market capitalization.

Fidelity’s FBTC led the day in a fresh capital of $315.18 million, with BlackRock’s IBIT continuing at $264.71 million. All Spot Bitcoin ETFs trade volumes exceeded $3.89 billion, informing robust activity and expanding positioning within the facility. Market leaders such as IBIT and FBTC recorded daily profits of over 2%.

The rise comes after a quiet start of the moon, suggesting a change in emotions as macroeconomic conditions are stable and the crypto market shows signs of strength.

Spot Bitcoin ETFs see inflows. Source: SosoValue

Related: Ether ETF inflow, description: what does it mean for traders?

Ether ETF attracts $405 million

Spot Ether (ETH) ETF reflects bullish momentum, drawing in net inflows of $455,550,000 on the same day for the fourth consecutive day of profit. The total inflow of Ether ETFs currently reaches $13.36 billion, with a net worth of $30.35 billion.

On Friday, BlackRock’s Eta brought in $16,556 million, while Fidelity’s festival approached $16,823 million. Ether alone was worth $1.86 billion on the day, reflecting an increase in activity with Ethereum-based products.

“The Bitcoin and Ethereum spot ETFs continue to see strong influxes and show a growing institutional confidence,” Vincent Liu, chief investment officer at Taiwan-based company Kronos Research, told Cointelegraph.

“If macro conditions are true, this surge could enhance the liquidity of both assets and drive momentum,” added Liu.

Related: Spot Bitcoin ETFs see strong demand as crypto markets go above $4T again

BlackRock Eyes ETF tokenization

BlackRock is reportedly investigating the tokenization of ETFs on blockchain networks following the success of Spot Bitcoin ETFs. The asset management giant is particularly interested in tokenizing funds related to real world assets (RWAs), although regulatory challenges remain important hurdles.

Tokenized ETFs may offer new features such as 24/7 trading and integration into the Decentralized Financial (DEFI) ecosystem.

magazine: Can a tokenized inventory of Robinhood or Kraken really be decentralized?