Despite growing expectations for US interest rate cuts, Bitcoin has not achieved a meaningful price rise. Instead, the volume of futures trading in Binance futures has dropped significantly, and analysts see it as a potential “red flag.”

In a report released Monday, Cryptoquant Analyst Mignolet argued that a significant drop in futures volumes was a sign of concern..

Changes in market behavior

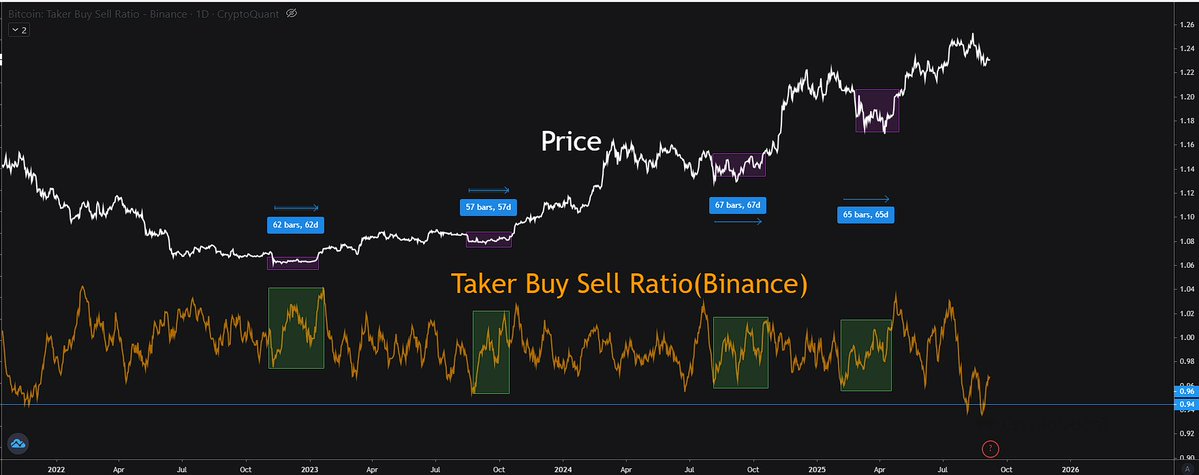

He explained that through the current Bull Run, bullish divergence in the buy/sell ratio in the futures market often indicates that prices are bottom-out or integrated.

Taker buying and selling ratio (Binance). Source: Cryptoquant

A large number of market purchases in the futures market means that many investors and many capital are betting on price increases. He noted that historical trends in the vinance futures market usually point to an upward trajectory.

However, my mood has changed recently. Mignolett believes the current situation is similar to when the market peaked in 2021. He suggests that traders should focus on actual trading volumes beyond a simple bull/bearish ratio, as prices have risen significantly.

Binance futures volume needs to be restored

Analyzing the charts, the rise in Bitcoin prices since 2020 is roughly consistent with an increase in the volume of purchases of vinance futures. However, this time the situation is different. Bitcoin prices are at their highest ever high, but futures purchases have not kept pace. Mignolet pointed out that this divergence is very similar to the top of the market in 2021.

Taker purchase volume (Binance). Source: Cryptoquant

He argued that the futures market is still concentrated on binance while ETFs and MicroStrategy (MSTR) promote liquidity in the spot market. According to Mignolet, Bitcoin’s strong upward movement is difficult without rebounding in the futures market.

Mignolet has stopped declaring the end of the current Bull Run. “The problem is that liquidity is overall declining,” he says, “If trading volumes recover, we can assume that the market is not finished yet.”

Post-Binance Futures Volume Drop: Bitcoin Red Flag? It first appeared in Beincrypto.