Ethereum continues its trade sideways with little or no price action reflecting the critical lack of demand or supply. Neither buyers nor sellers are controlled, and the market stagnates within well-defined ranges, waiting for a catalyst that breaks the equilibrium.

ETH Technical Analysis

By Shayan

Daily Charts

In the daily time frame, ETH remains confined to ascending channels, but the momentum is decreasing in the upper half of the structure. After failing to scale high towards the $5K resistance zone, the assets settled into a narrow integration over $4.2,000 midrange support.

The zone serves as a retention site, but the lack of fresh purchasing pressure underscores the lack of bullish convictions. At the same time, sellers failed to gain meaningful downside pressure, leaving the market at the waiting stage. A critical movement can only emerge if a new order flow shifts the balance of power.

4-hour chart

The four-hour chart reveals even more indecisiveness. The ETH is compressed within a downward wedge and trades between $4.2,000 and $44,000. This strict integration reflects the calm state of a market where both supply and demand appear to be exhausted in the short term.

A breakout from this wedge determines the next price action: Overcoming resistance could drive momentum heading from 4.6k to 4.8k, but breakdowns risk retesting deeper fluidity pockets above $4K. Until such a breakout occurs, Ethereum remains trapped, with participants waiting for a catalyst to inject new orders into the market.

Emotional analysis

By Shayan

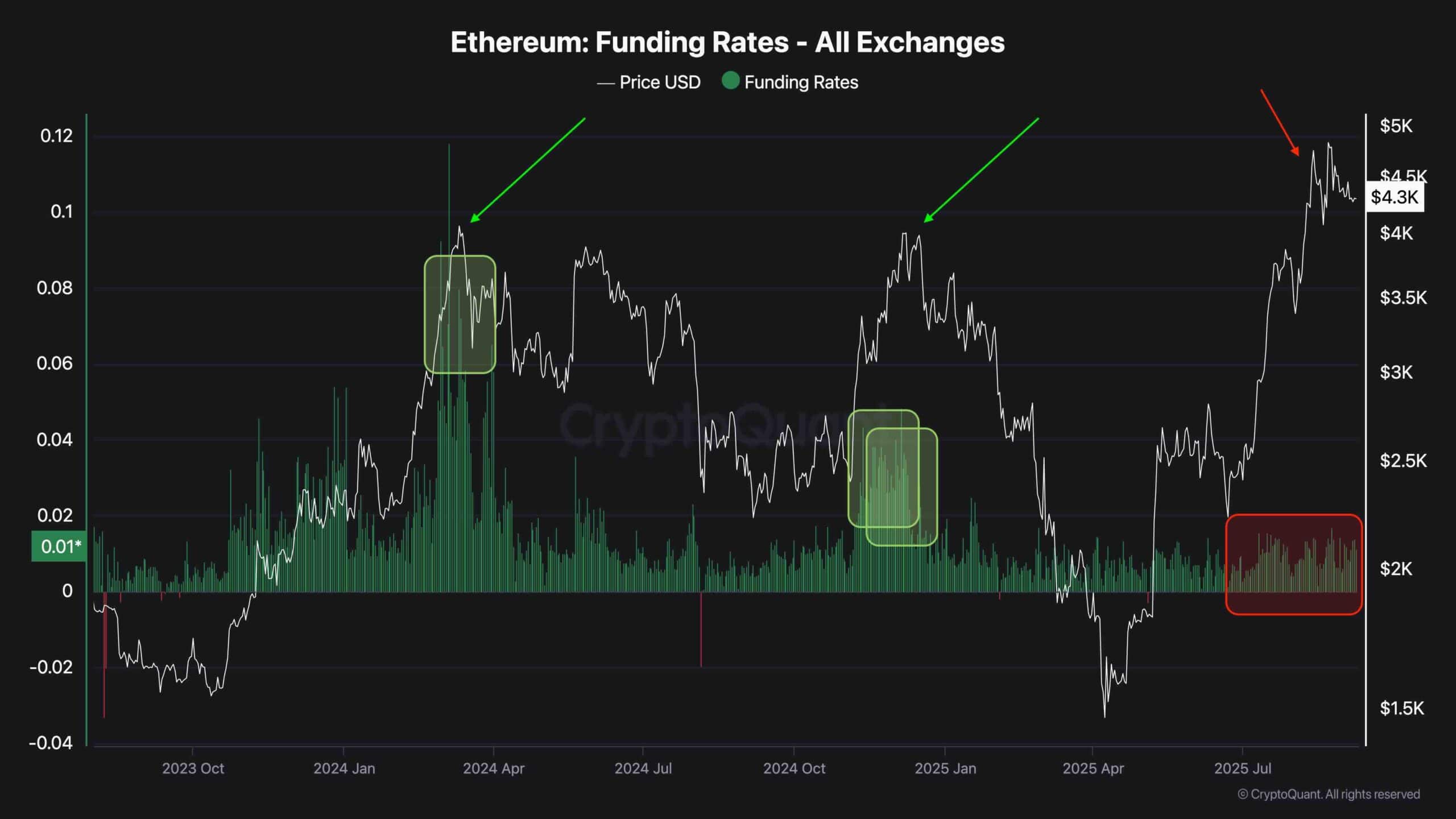

When comparing the last three major highs of Ethereum, the exchange-wide funding rate provides a significant context. At its initial peak in early 2024, funding rates surged above 0.08, reflecting excessively long positioning and speculative demand. The assets quickly reached the top as the overheated leverage was unlocked.

At its second peak in late 2024, ETH revisited similar price levels, but the funding rate was significantly lower. This indicates a decline in speculative participation, indicating a less overheated market, but lacking strong and sustained momentum.

Currently, at its latest peak in 2025, Ethereum hit a high of nearly $4.9,000, but its funding rate has been relatively restricted at a moderate level. This divergence emphasizes shifts. ETH is moving forward except for the aggressive long position that encouraged previous gatherings.

There are two takeaways. On the one hand, the market looks more spot-driven and structurally healthy, as prices are not pushed by excessive leverage. On the other hand, no aggressive demand limits breakout momentum, leaving ETH in a slow-moving environment where new order flows are essential for the continuation.

In short, the highs for Ethereum’s decline in funding rates suggest a market that is more stable and less vulnerable to a sudden liquidation cascade, but likewise suggests a market that requires stronger beliefs from buyers to keep the next leg higher.