1. The rise of DAT: Symptoms of shallow understanding

As public companies accelerate adoption of Bitcoin, copycats are inevitable. Latest trends? Data – “Digital Assets Treasury” – seeks to replicate the success of Bitcoin finance companies by assigning reservations to altcoins such as Ethereum and Dogecoin.

From the outside, the surface level pitch may appear similar: to acquire digital assets, move early and build financial strategies, try to challenge in the long term with stocks or dehttps://bitcoin-for-corporations/how-bitcoin-counterparty-in-corporate-corporate-strategybt. But beneath the surface, the comparison collapses.

Over the past few months, several companies have created headlines to pivot into the DAT model.

- CleanCore Solutions It slashed 60% after announcing its $175 million Dogecoin Treasury plan.

- Bit Digital (BTBT) Defeating Bitcoin Mining Operations, it became an Ethereum-only staking and finance company.

- Spirit Blockchain Capital and Dogecoin Cash Inc. We launched a Doge-centric financial strategy and lost over 70% of YTD.

These movements are not just dangerous. It uncovers fundamental misconceptions of what Bitcoin is uniquely suited to serve as a reserve asset for the Ministry of Finance.

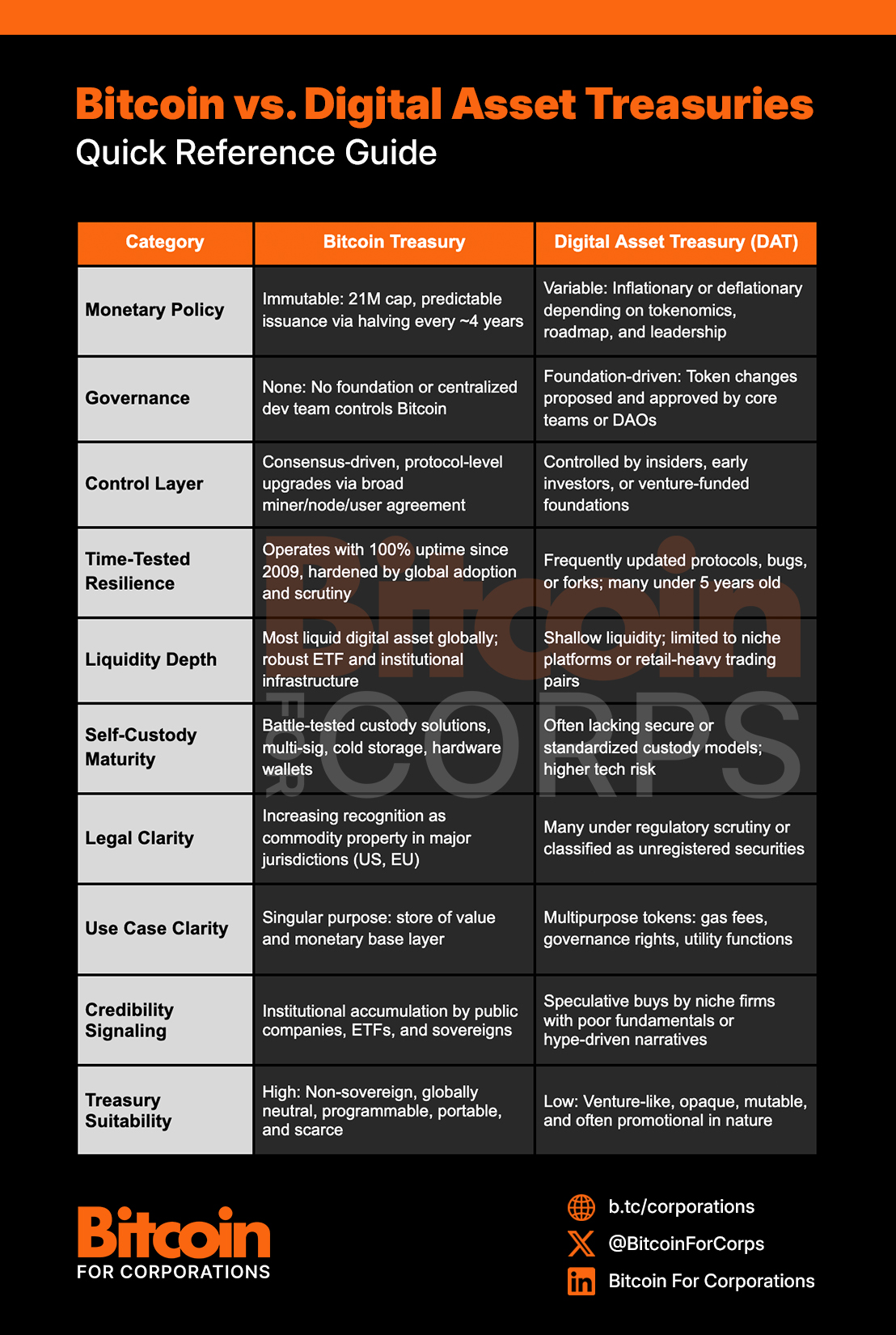

2. Bitcoin is money. The token is a venture bet.

Bitcoin is neither a tech platform nor a product roadmap. It’s money – dedicated, neutral, leaderless and maximally conservative in its evolution. That rule is set on stone, issue schedules are improperly locked, and designs are highly resistant to change.

In contrast, Altcoins like Ethereum and Dogecoin are better understood as venture stage software projects pose as money. they are:

- Managed by a core developer foundation or small group

- Frequently, sometimes conditional on fundamental protocol changes

- We were able to actively optimize for adoption of new features rather than financial stability.

- It is closely linked to the charismatic founder and foundation’s capital structure

From a capital management perspective, this is the following difference:

- Assigning spares to sovereign, non-political monetary equipment

- Guessing the long-term success of a VC-style technology platform

One is dedicated to preserving value. The other is proxy for early stage risk.

3. Time Horizon Inversion: Bitcoin Align, Altcoin Mism

The role of the Ministry of Corporate Finance is not to chase yields, but to maintain and grow shareholder value over the long term. Public companies are rewarded with the resilience, discipline and a clear capital framework that is held throughout the cycle.

The Bitcoin design matches this. The property rewards convictions over time:

- Supply is fixed: 21 million people, issuance is halved every four years

- Market access is constant globally: no exchange times or gatekeepers

- As adoption grows, fluidity deepens over time

- Volatility is compressed over a longer field of view

Altcoins inverts this logic. They are:

- Inflate supply through unlock schedules and protocol changes

- Everyday shifting consensus models (e.g., transitioning to proof of ETH)

- Rely on speculative growth stories to maintain interest

- No predictable issuance and upgrade path

This discrepancy creates tensions for the Ministry of Finance. The longer you hold the token, the more governance, enforcement, and regulatory risks. It becomes difficult to adhere to assignments – not easy.

Bitcoin, by contrast, becomes easier to justify over time. It is the only digital asset that deeper retention is reduced, and it does not increase – the risk of the tail.

4. What’s not working: risks to build in Altcoin’s Treasury

For public companies, capital strategies should prioritize durability, auditability and market trust. Assigning them to Altcoins introduces risks that are in conflict with these goals.

- Protocol uncertainty: Tokens like Ethereum undergo frequent technical upgrades that can introduce bugs, change the economy, and expose the Validator to new forms of thrashing or MEV risk. Corporate finance requires stability, not ongoing protocol experiments.

- Governance and Capture Risks: Many altcoins are managed by foundations or small teams. The decisions on key protocols may reflect the benefits of insiders or early investors rather than long-term holders. Companies are at risk of being exposed to governance forks, roadmap pivots and consensus drama.

- Regulation uncertainty: Bitcoin is widely recognized as a product by US regulators. Most Altcoins occupy more intense legal territory. Many are actively investigating or pending lawsuits. A sudden classification as security can cause forced sales, legal penalties, or reputational damage.

- Duty and infrastructure restrictions: Bitcoin benefits from mature facility custody solutions, but many altcoins do not. Contracts, wrapped tokens, and definition-based management layers add smart contract risk and reduce auditability. This weakens the balance sheet rather than strengthening it.

- The vulnerability of the story: When price viewing is slow or reversed, the underlying papers of the Altcoin Ministry of Finance often collapse. Without the financial fundamentals set back, the “strategic” story is left to the speculative narrative, and boards, auditors and shareholders begin to ask harsh questions.

Building a Corporate Treasury on tokens with flexible rules, weak settlement guarantees and governance opacity is not bold. That’s reckless. Bitcoin is an exception not only because it came first, but because it is the only one that lasts for a long time.

5. Bitcoin is rock

Public companies employing Bitcoin do not bet on crypto. They upgrade the foundations of their capital structure with assets.

- Non-sovereign: Immunity of political interference or financial decline

- Limited: 21 million won without centralized authority to inflate supply

- Verification possible: All auditable units, all transactions are immutable

- Accessible: Liquid and tradeable in all major jurisdictions

- Battle Test: Operate perfectly for over 15 years without any relief or downtime

Bitcoin’s uniqueness is not ideological, it is structural. And its structure allows it to act as an anchor for modern balance sheets in an age of currency volatility, debt saturation, and institutional mistrust.

Disclaimer: This content was written on behalf of Bitcoin for businesses. This article is for informational purposes only and should not be construed as an invitation or solicitation to acquire, purchase, or subscribe to a security.

This post Dat Delusion: Why Bitcoin only belongs to the corporate balance sheet first appeared in Bitcoin Magazine and is written by Nick Ward.