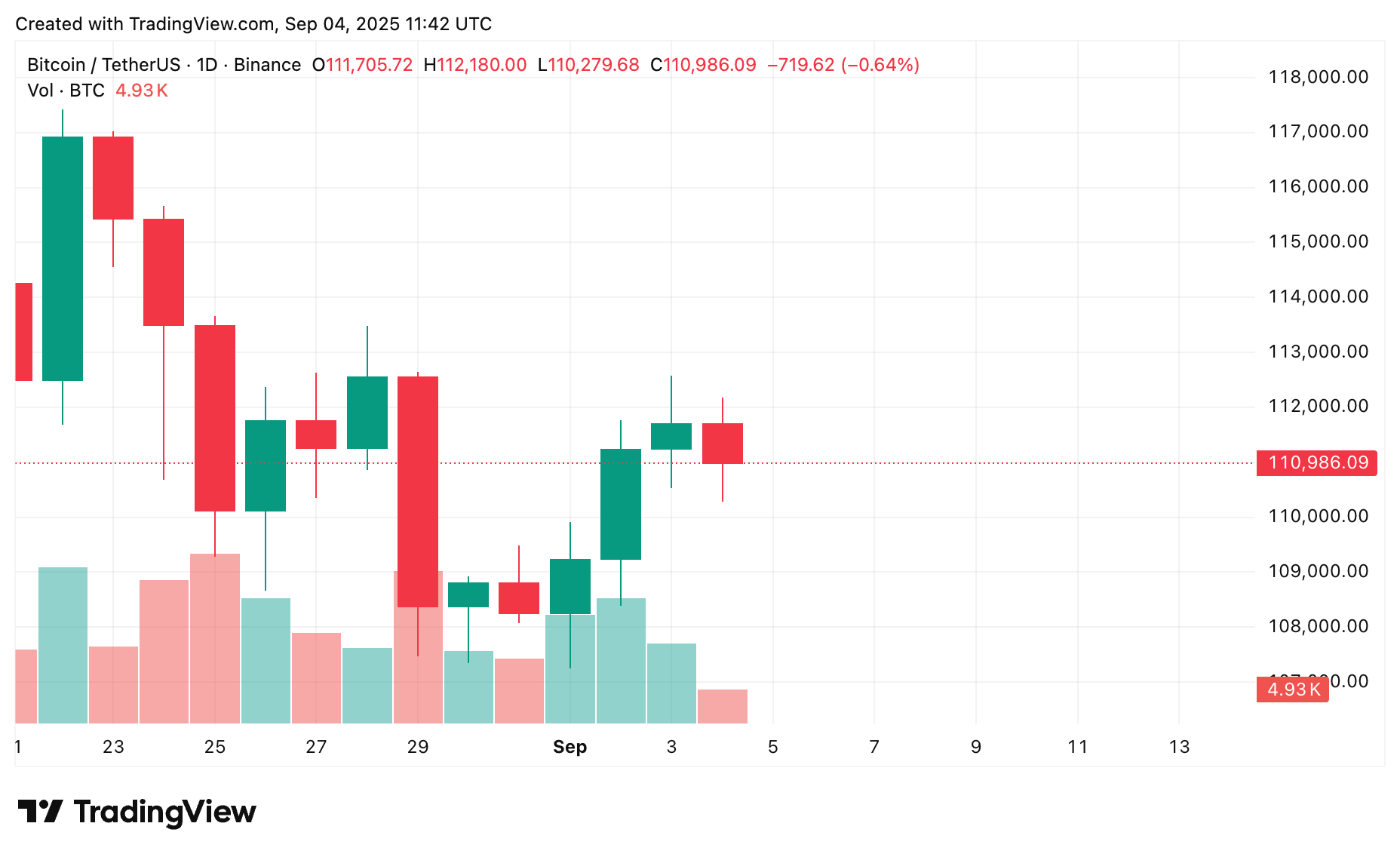

Bitcoin is stabilizing around $110,900 today after a choppy August filled with price shaking and macroeconomic unrest, affecting current Bitcoin price forecasts.

Things seem to be calm, with emotions improving behind the ETF influx, with more optimistic macro images, and an increase in action in the derivatives market. Traders are monitoring $112K as the main resistance level and $100,000 for nearby support as Bitcoin trades within the toughest range.

So, what is your future outlook for Bitcoin?

table of contents

summary

- BTC has stabilized around $110,900 after a volatile August, with resistance focusing on $112,000 and $108,000 in support.

- ETF influx and stubcoin liquidity support price stability and emotional improvements.

- A break above $112K could trigger a rally from $116,000 to $118,000, particularly using bullish macro data.

- As volatility is built, drops below $108K are at risk to $104,000 or even $100,000 on the minus side.

- Bitcoin price forecasts remain cautiously bullish, with institutional flows and macro signals keying in the next move.

Current BTC price scenario

At this point, Bitcoin is trading in a tough range between 110.3k and 112,000, supported by increasing stability liquidity and optimism surrounding Bitcoin ETFs.

There’s a lot going on in the derivatives field as well. Open interest sits at around $114 billion. Traders are marking important pressure points, notably looking at the $110,000 and $112.2,000 levels that the liquidation cluster has accumulated.

BTC 1-Day Chart, September 2025 | Source: crypto.news

Normally September doesn’t have much for Bitcoin (and therefore called “Red September”), but this year it’s possible that it’s not following the usual script. More institutions are taking part through ETFs, which could change the way the moon unfolds.

Positive impact on Bitcoin prices

If Bitcoin (BTC) is decisively damaged $112K, we may see a strong rally that will boost prices from up to $116,000 to $118,000, which is likely to be driven into more speculative influx, especially from agencies associated with ETF products.

The inflow of Bitcoin ETFs is currently pretty much in line with the influx of big gold ETFs, indicating a major change in how institutional investors play the game. These stable influxes can maintain price increases, especially when the macro image is positive.

And the US employment report, which exceeds expectations, could raise expectations for a Fed rate cut and add additional fuel to Bitcoin rallies. It drives risk appetite and allows you to bring more money into the code in the short term.

Negative impact

If Bitcoin does not violate the $112,000 level, the risk of pullbacks increases. A setback to $108,000 support is a concern for the time being, and if bearish sentiment is reinforced, further declines from $104,000 to the $100,000 range cannot be ruled out.

You might like it too: Corporate Bitcoin’s finances are a threat to market stability | Opinion

The historical risk of September weakness adds another layer of attention. Traders are increasingly hedged against volatility, as shown in the rising options market data and implicit volatility metrics. This suggests that the market is preparing for sharp movements in either direction.

Bitcoin is in a volatile place as the liquidation risk zone forms just above and below the current price. Minor catalysts – positive or negative – can cause important price actions.

Bitcoin price forecast based on current levels

The key range to monitor in the short term is $108K-112K.

- If Bitcoin clears $112K, it could launch a strong rally heading towards $116K or $118K, especially if the ETF continues to raise funds and the market remains healthy.

- Conversely, if you fall below $108K, the door opens to go down to $10,000, with $100K as your next major support.

For now, Bitcoin price forecasts remain on the cautious side, but everyone is waiting for clearer indications from the economy and institutional flows. There’s one thing for sure. As Bitcoin approaches this important turning point, volatility can increase.

Essentially, BTC price forecasts depend on what happens next in this narrow range. Medium-term forecasts are bullish as institutions step up, but traders should expect some hiccups with seasonal and macro challenges in the mix.

read more: Analysts say asset managers will move from Bitcoin to Ethereum amid a volatile August

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.