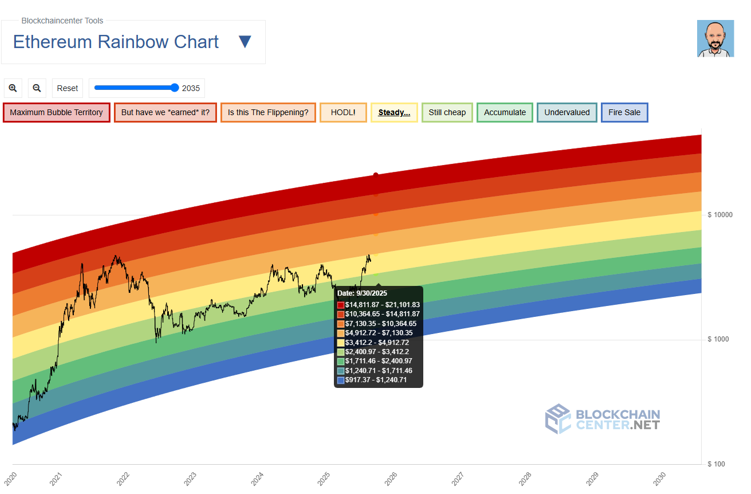

The Ethereum Rainbow Chart, a logarithmic regression model designed to track Ethereum (ETH)’s long-term growth trajectory, outlined the predicted price spectrum for September 30, 2025.

The outlook was attempted by Ethereum to regain its recent high, with the second-ranked cryptocurrency by market capitalization reaching a record price of nearly $5,000.

According to the charts, Ethereum would either make a low deal as $1,947 if it falls into the “fire” zone, or reach $21,101 if it enters the “maximum bubble territory.”

During these extremes, the band defines different stages of emotion. It’s $2,401 in the “undervalued” zone, $2,849 in the “accumulation” zone, $3,402 in the “still cheap” zone, and $4,117 in the “stable” band. On the scale increase, Ethereum is valued at $4,912 in the “HODL” zone and $5,913 in the “Is this flipping?” Band, and “But did we win that?” level.

ETH Price Analysis

Currently, Ethereum is trading at $4,380 and is located in the “stable” band on the Rainbow chart. This suggests that cryptocurrencies may remain stable or within HODL by the end of September 2025 if they maintain their current positioning with the model.

But stronger bullish momentum could drive it towards elastic or speculative bubble levels, while downside pressure could push it back into a build-up or underestimated zone.

Though not a short-term forecasting tool, Rainbow Chart provides a long-term framework for investors to assess Ethereum’s growth path. Ethereum’s price trajectory is closely linked to wider market movements, as it tends to correlate with other digital assets.

At the same time, for ETH to target higher value, it requires significant capital inflows, particularly through exchange trade funds (ETFs).

In this regard, the asset has attracted a growing interest from major companies such as BlackRock, which has accelerated the purchase of Ethereum in 2025, outperforming Bitcoin acquisitions.

Featured Images via ShutterStock