Ethereum has earned over 68% in the last three months, with most recent holders steadily gaining profits. However, assets have been stagnant last week, losing 4.7% in the last 24 hours and trading.

This integration pushed Ethereum prices up within the indecisive pattern of indecisiveness, where the Bulls and Bears fight for control. Such a setup can be resolved in either direction, but two chainmetrics suggest that the next move may support the upside.

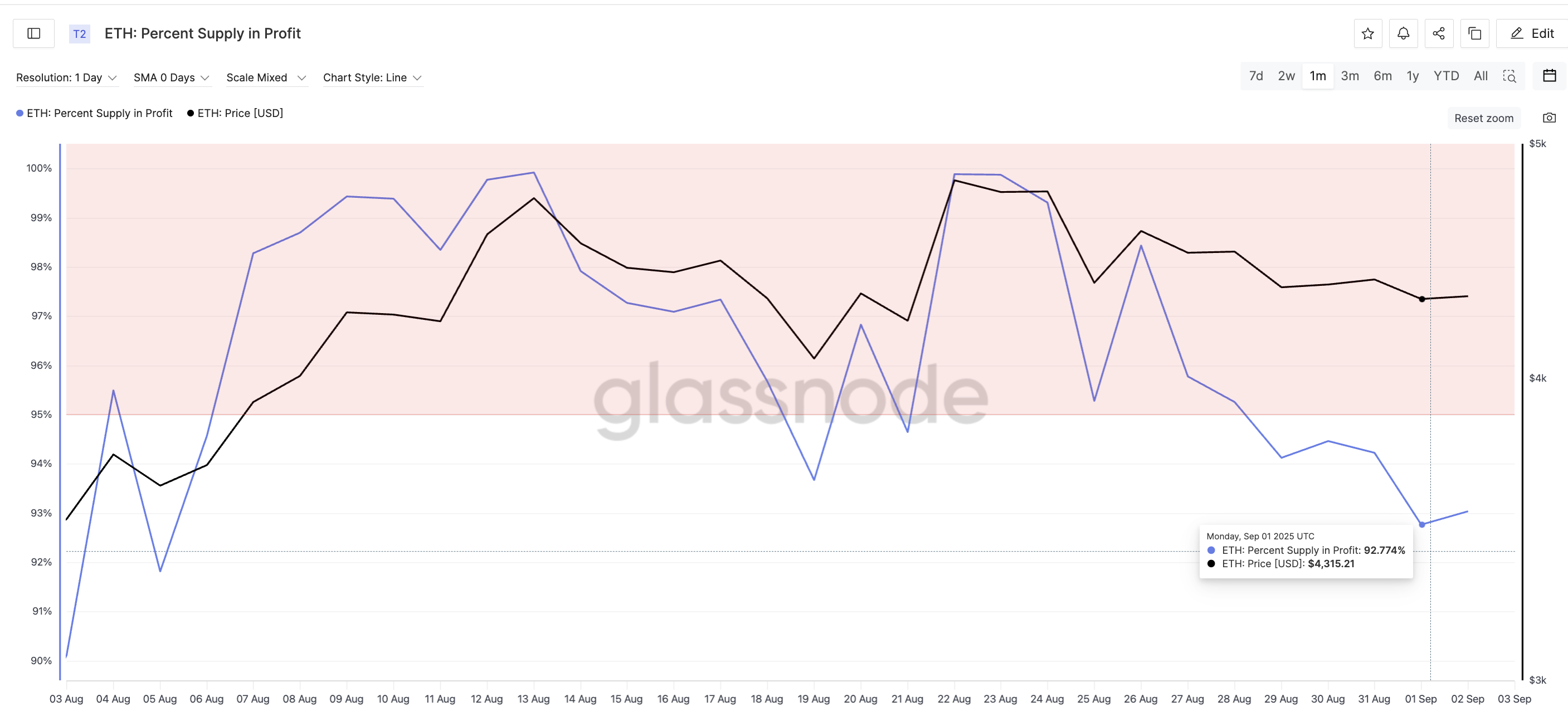

Metric 1: Profit Supply reduces seller fatigue

The share of profit ETH supply fell from 98.4% on August 26 to a local bottom of 92.7% on September 1. Such a decline usually reflects a severe profit. However, when profit supply hit the bottom of the local area, ETH has historically gathered. For example, when the ratio fell to 91.8% early in August, ETH surged from $3,612 to $4,748 (over 31%) in just eight days.

ETH Profit Taker Falled: GlassNode

This drop means that a wave of sellers may already be out of the market, leaving fewer ETHs with potential profit-sensitive holders from Panic-Sell. In other words, sales strength can be weakened when Ethereum prices are already consolidated in the breakout zone. And that’s a bullish sign.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

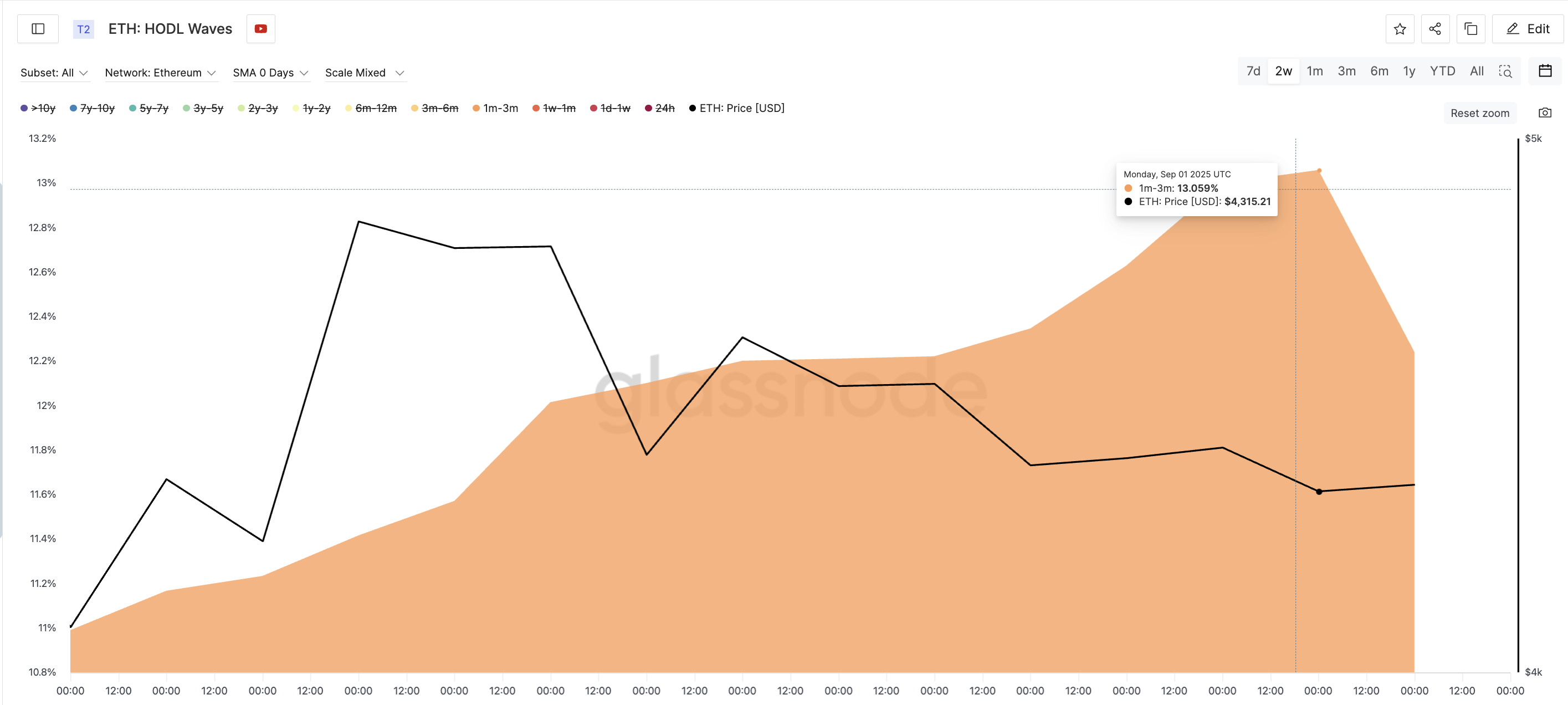

Metric 2: Short-term holders accumulate despite profits

A more surprising detail is that the groups that are most likely to make profits (owners for 1-3 months) are adding supply. ETH rose from 10.9% to 13% in just two weeks, despite earning more than 20% each month and bringing more than 68% in three months.

Continuing to purchase ETH: GlassNode

This shows that traders who flip positions quickly instead accumulate instead, signaling trust upside down. Combined with a low profit supply read, this HODL Waves paints a picture of the sales pressure and hidden demand behind ETH integration.

Hodl Waves measures the distribution of cryptocurrency supply by the age of coins held in wallets.

Ethereum price action and obv confirm accumulation

On the chart, ETH prices trade within a symmetrical triangle, with support at nearly $4,211 and resistance at $4,386. Prices achieved a lower lowest during this integration, but the balanced volume (OBV) produced a higher lower value. The OBV tracks whether transaction volume is controlled by buyers or sellers, and this difference suggests that accumulation continues beneath the surface.

The obv metric checks what you saw previously, while measuring Hodor waves.

ETH Price Analysis: TradingView

Ethereum price action and volume signal alignment enhance bullish breakout cases.

Approaching over $4,494 unlocks $4,669 as the next hurdle and $4,794 as the expansion target. A drop below $4,211 weakens the setup, but $4,058 is deeper support once the bear takes over.

Post Ethereum Price tested the breakout zone with two metrics pointing to the rise.