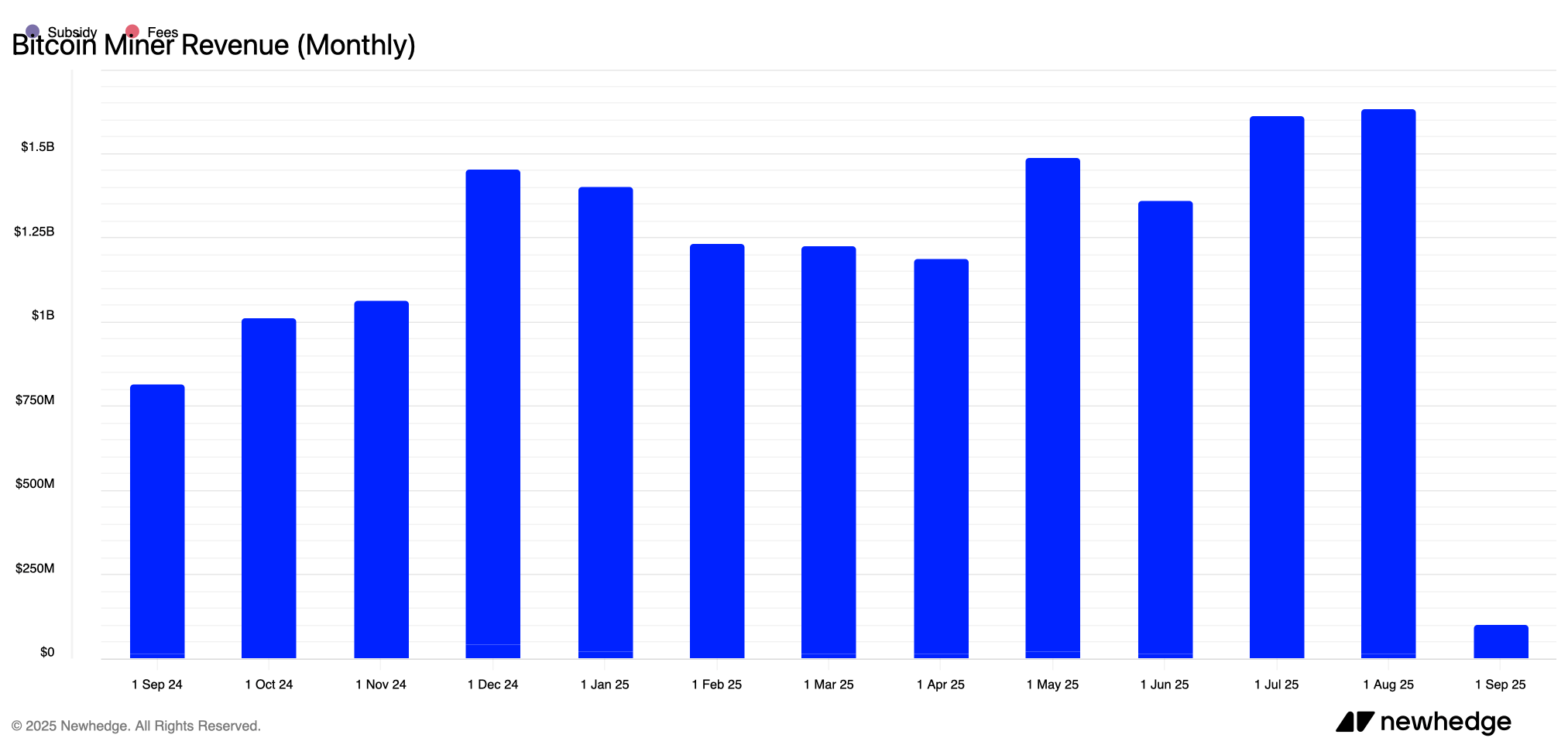

According to recent metrics, Bitcoin Miners maintained solid revenues in August, earning nearly equal numbers in the July tally or slightly above revenues in the range of $1.633 million to $1.66 billion.

Bitcoin fees remained at $16.3 billion last month, but

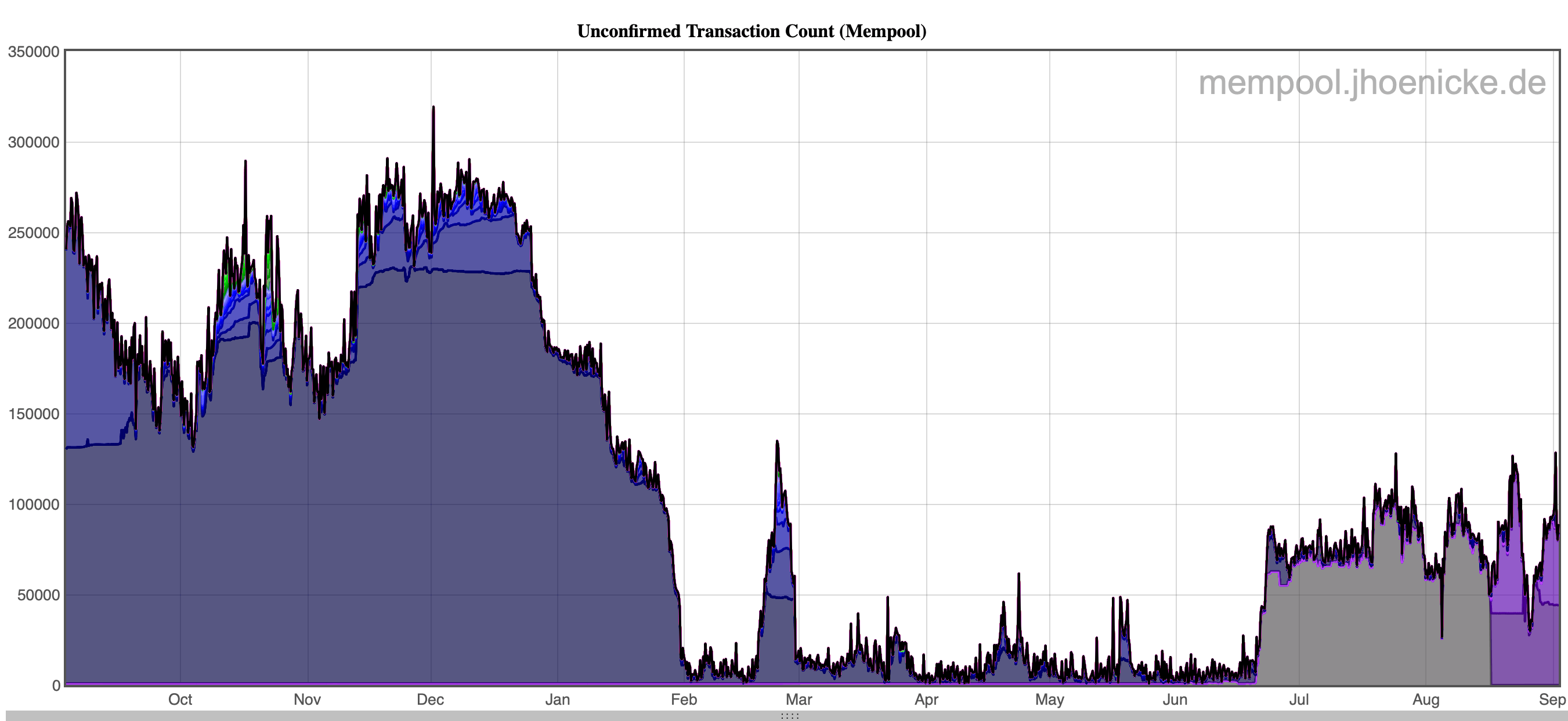

At the time of writing, the Mempool.space and Johoe’s Mempool tracker data show queues of approximately 85,000-93,000 unconfirmed transactions. This refers to an increase in on-chain activity as fees increase. On September 1st, the average cost of a BTC transaction reached 0.000016 BTC, or 8.7 Satoshis per byte, equivalent to $1.75 per $1.75.

Johoe’s Mempool tracker shows pending transfer conflicts since the end of June.

Until recently, trading fees accounted for less than 1% of the overall block’s compensation. Archives for September 2 show that on past days, fees represent 1.89% of total compensation. Since the end of June, a steady accumulation of unconfirmed transfers has continued, with daily backlogs ranging from 50,000 to 139,000. This contrasts with previous periods of record-breaking on-chain activities when blocks may be underutilized.

Despite steady mobile activity, fees are relatively stable, averageing between $1.30-$1.40 per transaction over the past three months. Most values average between $1.00 and $1.50, with only spikes in the $2.00-$3.00 range from $2.00. By late August, the average had approached $0.80-$1.00, followed by a slight increase in early September.

Miners went well in August, securing almost the same revenue as the previous month’s revenue, showing the strongest distance since half of April 2024. Theblock.co data rises to $1.66 billion when miners record compensation on subsidies alone, and $1.66 billion if fees are included. Same as July. The figures compiled by newhedge.io provide a more detailed view, with subsidies of $1.62 billion and totaling $1.633 billion, totaling more than the July $1.610 million.

Monthly revenue from Bitcoin Miners from newhedge.io.

Overall, stable cues, modestly stiff fees, and revenues that hold revenues near July levels suggest that miners will enter resilient cash flow in September. Subsidies continue to be the backbone, with Onchain Demand offering a small but growing tailwind. If the activity continues, revenue must continue to be supported. If congestion is alleviated, efficiency and energy costs determine margins until the next catalyst blocks economics again.