According to a Friday research report from Broker Canaccord Genuity, Iren (Iren) reported fourth quarter results highlighting rapid progress in both Bitcoin mining and the artificial intelligence infrastructure business.

The broker repeated the purchase ratings of the stock, increasing its price target from $24 to $37, to 60%.

In early trading, stocks rose 25% to $28.75.

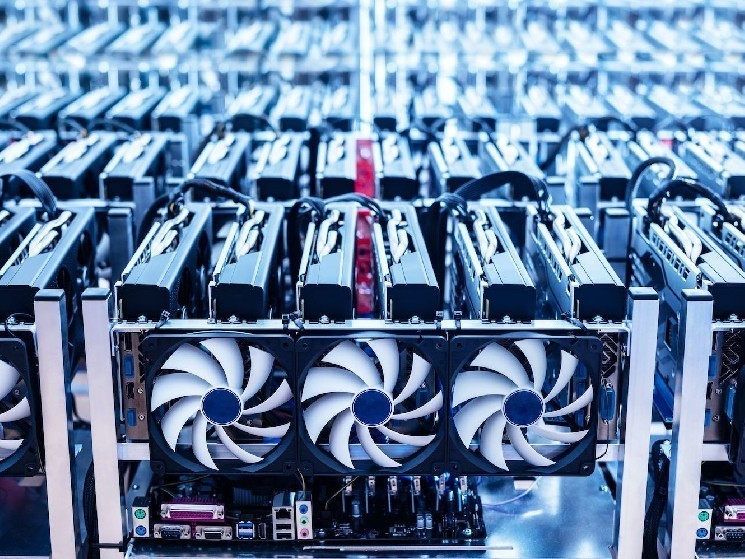

The company’s mining unit exceeds $1 billion in annual revenue occupancy, one of 50 capacity per second (EH/S) capacity, at 15 j/TH, is one of the most efficient fleets in the industry, operating at 3.5 cents/kWh of electricity, written by an analyst led by Joseph Vafi. This leads to a $36,000 cost of mining Bitcoin, which is well below market level.

Bitcoin mining revenues rose 33% in quarter to $187.3 million, while adjusted EBITDA rose 46% to $121.9 million.

On the AI side, Aylen is accelerating expansion, the report says. Bitcoin Miner has quadrupled its hashrate, with more growth expected in fiscal year 2025, adding another 3 MW of megawatt capacity.

Hashrate refers to the total computing power used to mine and process transactions on the Proof of Work Blockchain, a proxy for competition and mining difficulties in the industry.

Canaccord also pointed out Iren’s recent designation as Nvidia (NVDA) preferred partner.

With its protected power capacity of 2,910 MW and some of the industry’s lowest all-in-cash costs, Kanack Code claims that Aylen will become one of the largest and most efficient publicly listed miners with key options in high-performance computing.

read more: Aylen posts his first annual profits on AI cloud growth, expanding mining. Stocks are rising